Not so long ago, many were calling Solana finished. Well, those days now feel like distant memories. While Bitcoin’s cooling off, SOL just bulldozed through the $100 billion market capitalisation milestone—and left a wake of crushed shorts behind.

Solana’s climbed 15.5% last week and tacked on another 5.5% on Monday. At $192.71 per coin, it’s cruising with a $103.71 billion market capitalisation. The twist—short sellers just got completely wrecked, bleeding $11.6 million out of $16.5 million in total liquidations.

SOL’s Price Surge Triggers Massive Liquidation Wave

Short sellers thought they had Solana pegged. They were mistaken—catastrophically mistaken.

Out of $16.5 million in total liquidations, shorts absorbed a crushing $11.6 million blow. That’s what happens when you oppose momentum in crypto—the market shows no compassion.

SOL’s surge isn’t just punishing bears; it’s drawing fresh capital like a beacon. Trading at $192.71, the token’s now approaching its all-time peaks. And with this kind of velocity? Don’t be shocked if it continues ascending.

Futures Market Goes Wild: $11 Billion in Open Interest

Solana futures open interest just rocketed past $11 billion—heights we haven’t witnessed since the 2021 crypto boom.

Traders are flooding in with substantial leverage, and the figures confirm it:

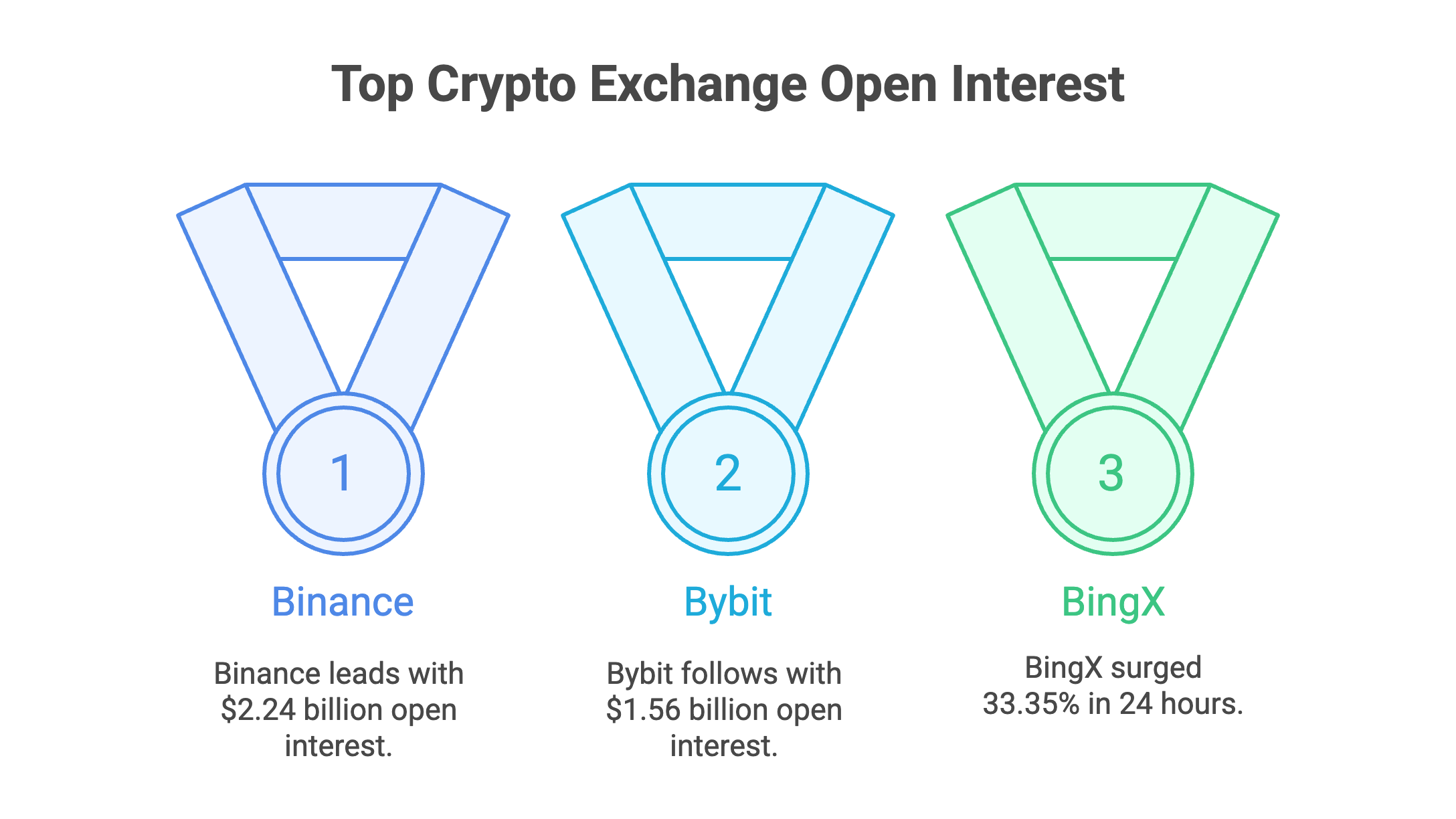

Exchange Breakdown:

- Binance leads with $2.24 billion in open interest

- Bybit follows at $1.56 billion

- BingX jumped 33.35% in just 24 hours

- Overall open interest surged 13.74% in a single day

CME’s carved out a solid 4.36% share, while Bybit saw a 24.24% spike despite some short-term volatility. Bottom line? The smart money’s betting big on SOL’s continued rise.

What’s Driving Solana’s Monster Rally?

This isn’t mere random crypto turbulence—there’s a solid foundation behind SOL’s explosion.

The derivatives frenzy shows institutional appetite is intensifying. When open interest reaches $11 billion and keeps expanding, that’s not retail euphoria. That’s substantial money making calculated wagers.

Plus, Solana’s ecosystem keeps flourishing. While other chains grapple with congestion and fees, SOL’s handling thousands of transactions per second without faltering. That functionality converts to price performance.

The Bottom Line

Solana just proved the sceptics wrong, again. Surpassing $100 billion in market capitalisation isn’t fortune; it’s confirmation of a blockchain that genuinely operates at scale.

For traders, the signal is evident: momentum’s favoring SOL’s direction, and the derivatives market’s supporting it with billions in open interest. Just remember—what climbs rapidly can plummet faster. Trade wisely.

Want to stay ahead of the next crypto surge? Keep watching those open interest numbers—they don’t lie.

FAQ

Q1: Is Solana’s $100B market capitalisation sustainable?

A: The $11 billion in futures open interest suggests serious institutional backing. However, crypto markets are volatile, so expect swings along the way.

Q2: Why did short sellers lose so much money?

A: They bet against SOL’s momentum and got caught off-guard by the 15.5% weekly surge. In crypto, timing is everything—and theirs was terrible.

Q3: Which exchange has the most Solana trading activity?

A: Binance dominates with $2.24 billion in open interest, followed by Bybit at $1.56 billion. BingX showed the biggest percentage growth at 33.35%.

Q4: Should I buy Solana at these levels?

A: That depends on your risk tolerance. The momentum’s strong, but crypto prices can reverse quickly. Do your own research and never invest more than you can afford to lose.

Q5: How does Solana compare to other altcoins right now?

A: SOL’s leading the altcoin charge while Bitcoin consolidates. Its 15.5% weekly gain outpaces most major cryptocurrencies, backed by real utility and growing adoption.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.