Ever seen a mining stock surge while bitcoin stays flat? That’s exactly what happened on Tuesday when Microsoft’s massive AI deal sent crypto miners soaring, even as bitcoin itself stumbled.

The twist: Nebius Group’s $17.4 billion GPU supply agreement with Microsoft sparked a 22% rally in mining stocks like Bitfarms, while bitcoin dropped 1% to $111,100. The disconnect reveals something bigger—miners aren’t just bitcoin plays anymore.

Why Microsoft’s AI Deal Boosted Bitcoin Miners

Microsoft’s five-year GPU contract with Nebius Group lit up the mining sector because investors finally connected the dots. These companies don’t just mine crypto—they’ve got serious computing power that AI companies desperately need.

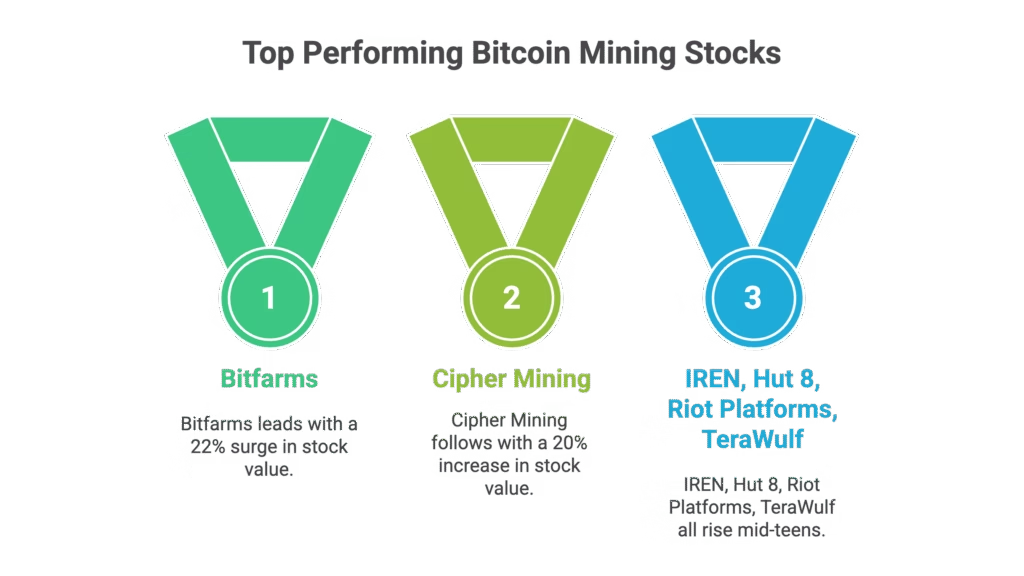

The winners were clear:

- Bitfarms (BITF): +22%

- Cipher Mining (CIFR): +20%

- IREN, Hut 8, Riot Platforms, TeraWulf: All up mid-teens

The outlier? MARA Holdings gained just 4%. Why? They’ve positioned themselves as a bitcoin treasury play rather than a high-performance computing company. Tuesday’s action shows which strategy investors prefer right now.

The Mining Industry’s New Reality Check

Bitcoin mining used to follow a simple playbook: halving cycles every four years cut block rewards in half, driving price and miner profitability. That predictable rhythm? It’s dead.

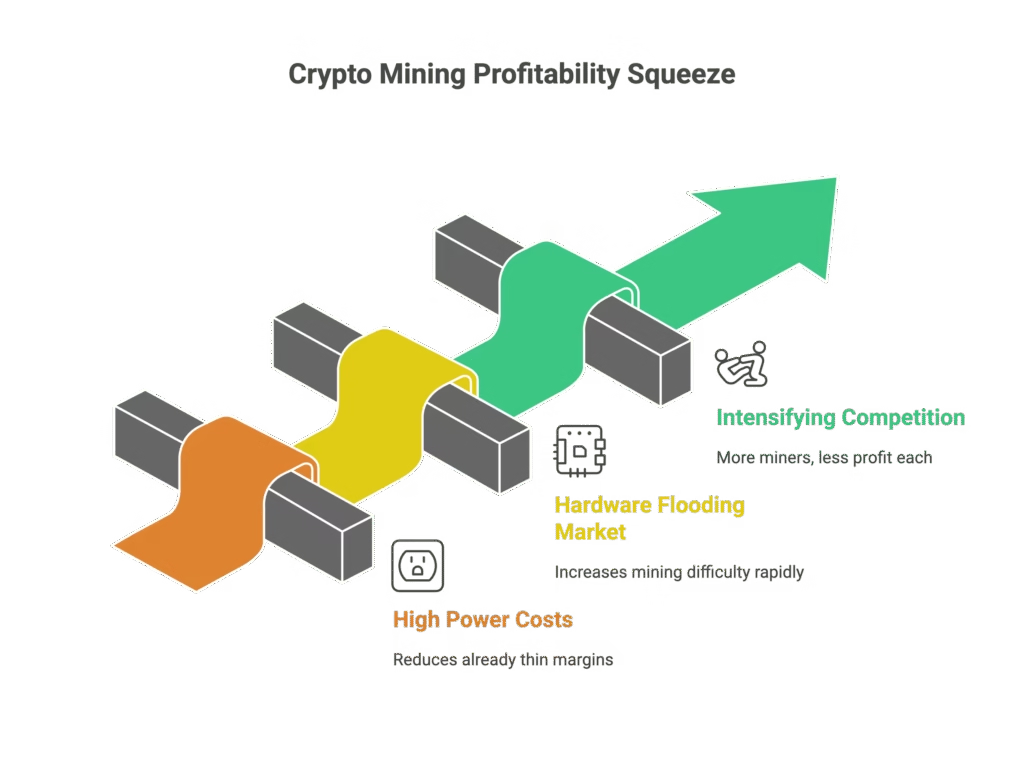

Now miners face a cluster of challenges:

- Soaring power costs eating into margins

- Hardware makers like Bitmain flooding the market with new equipment

- Intensifying competition from new players entering the space

The old bitcoin-price-equals-miner-success formula doesn’t work anymore. Smart miners are adapting fast.

AI Infrastructure: The New Gold Rush

Miners with massive energy footprints and advanced computing setups are pivoting toward AI and data center services. They’re leasing spare capacity to hyperscalers and tech giants hungry for GPU power.

The Nebius-Microsoft deal proves GPU access is liquid gold in today’s AI boom. Markets are rewarding miners who can scale beyond just bitcoin—and punishing those stuck in the old playbook.

What This Means for Crypto Investors

Tuesday’s action shows the mining sector is evolving beyond pure bitcoin exposure. Companies with scalable infrastructure and AI partnerships are commanding premium valuations, while traditional miners focused solely on bitcoin are getting left behind.

Smart money is betting on miners who can adapt to both crypto cycles and AI demand. If you’re investing in this space, look for companies building bridges between crypto mining and AI infrastructure.

FAQ

Q1: Why did mining stocks rise while bitcoin fell?

A: Investors are valuing miners’ AI and computing potential beyond just bitcoin mining. Microsoft’s massive GPU deal highlighted how valuable this infrastructure has become in the AI boom.

Q2: Which mining companies performed best?

A: Bitfarms led with 22% gains, followed by Cipher Mining at 20%. Companies focused on high-performance computing outperformed those positioning as bitcoin treasury plays.

Q3: Is bitcoin mining still profitable?

A: Traditional mining faces challenges from rising power costs and increased competition. The most successful miners are diversifying into AI infrastructure and data centre services.

Q4: What’s driving the shift toward AI infrastructure?

A: Miners have existing energy capacity and computing power that AI companies need. This creates new revenue streams beyond bitcoin mining rewards.

Q5: Should investors focus on bitcoin price or mining innovation?

A: Tuesday’s action suggests the market values mining companies’ ability to adapt and scale infrastructure for multiple use cases, not just bitcoin price correlation.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.