Recall when the droves said crypto ETFs would flop? Yeah, about that. Bitcoin ETFs just racked up their eighth straight day of inflows with $297 million pouring in, whilst Ether funds are absolutely raking it in with $259 million in fresh dosh.

The institutional money machine is running hot, and BlackRock’s leading the charge. Obviously.

The Numbers That Matter

Bitcoin ETFs are presently on fire. We’re talking $297.40 million in net inflows on Tuesday alone – that’s mega Wall Street money betting on digital gold.

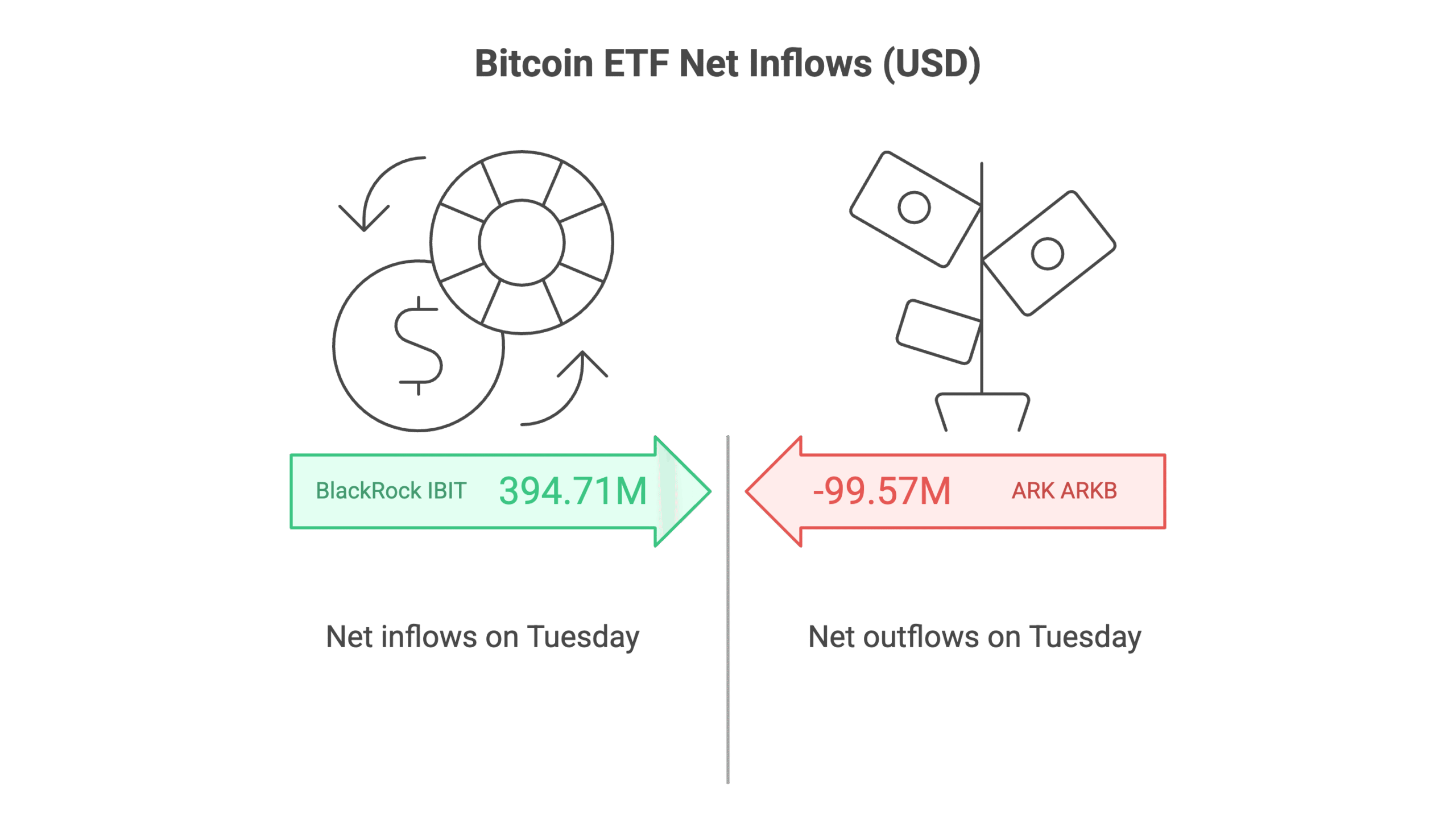

BlackRock’s IBIT absolutely dominated with $394.71 million flowing in. Sure, ARK’s ARKB saw some profit-taking with a $99.57 million outflow, but when you’re netting nearly $300 million in a day, who’s complaining?

Here’s what else moved:

- Grayscale’s Bitcoin Mini Trust: +$12.75 million

- VanEck’s HODL: +$8.47 million

- Fidelity’s FBTC: -$26.13 million (small pullback)

Trading volume? A whopping $5.95 billion. Total assets? We’re sitting pretty at $153.29 billion.

Ether ETFs Join the Party

Whilst Bitcoin’s getting headlines, Ether ETFs are quietly gearing up to steal the show. They pulled in $259.04 million – not too shabby for the “other” crypto ETF.

BlackRock’s ETHA led again (sensing a pattern?) with $151.45 million. Grayscale’s Ether Mini Trust grabbed $43.79 million, and Fidelity’s FETH added $31.43 million. Even the smaller players got their slice – everyone’s eating at this table.

Trading volume hit $1.26 billion with total assets at $13.77 billion. Not Bitcoin-level huge, but growing fast.

What This Actually Means

Eight days straight of inflows isn’t luck – it’s a trend. Institutional investors are treating crypto ETFs like legitimate portfolio assets now, not just speculative plays.

The concentration in BlackRock’s funds? That’s brand power meeting crypto demand. When the world’s largest asset manager backs something, money follows.

This mid-July momentum suggests we’re past the “wait and see” phase. The smart money’s already moving.

The Bottom Line

Half a billion dollars flowed into crypto ETFs in a single day. That’s not retail FOMO – that’s institutional allocation at work.

Whether you’re bullish or bearish on crypto prices, one thing’s clear: ETFs have made digital assets boring enough for Wall Street. And in finance, boring often means profitable.

Want to track these flows yourself? Most major financial platforms now offer real-time ETF data. The institutional crypto trade is happening in plain sight.

FAQ

Q1: Why are Bitcoin ETFs suddenly so popular?

A: They offer regulated exposure to Bitcoin without the hassle of wallets or exchanges. Plus, institutional investors can finally buy crypto through familiar channels.

Q2: Is BlackRock’s dominance concerning?

A: It shows market concentration, but also validates crypto as an asset class. When BlackRock moves, trillions in AUM pay attention.

Q3: Should I invest in crypto ETFs over actual crypto?

A: ETFs offer convenience and regulatory protection but charge fees. Direct crypto ownership gives you full control. It’s a personal choice based on your comfort level.

Q4: What’s driving the Ether ETF surge?

A: Ether’s seen as more than just “digital gold” – it powers DeFi and NFTs. Institutional interest suggests growing confidence in Ethereum’s long-term utility.

Q5: How long will this inflow streak last?

A: Nobody knows, but sustained inflows typically signal broader market confidence. Watch for any major outflows as potential trend reversals.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.