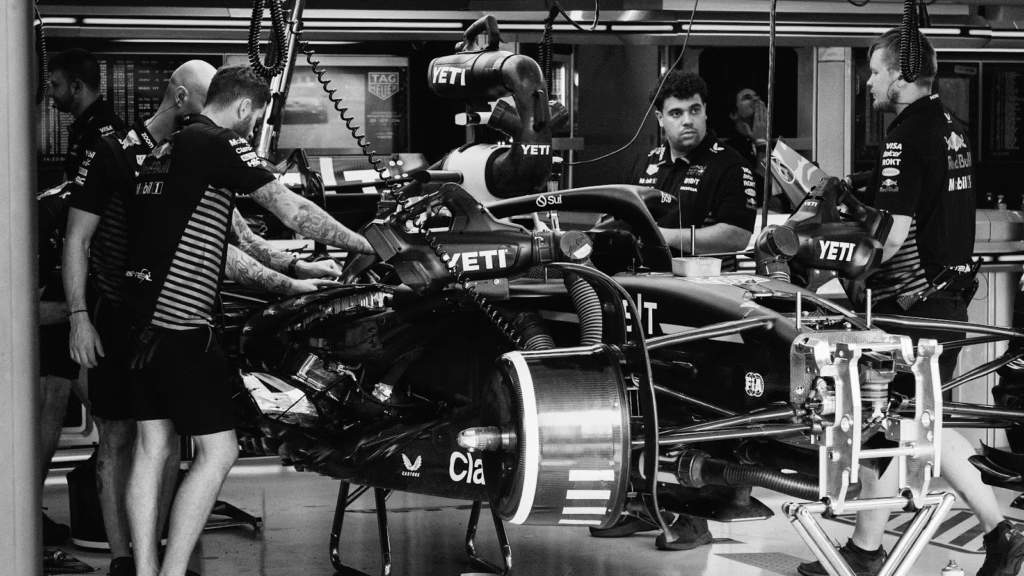

Carlyle Group just announced a multi-year strategic partnership with Red Bull Formula 1 team – and it’s the first deal of its kind in F1 history. This isn’t just about slapping logos on cars; it’s about opening new doors for global connectivity, technology, and serious money-making opportunities.

Why Wall Street’s Betting Big on F1 Right Now

F1 isn’t your grandfather’s racing series anymore. The sport’s exploding with cash injections from major brands who’ve finally figured out what racing fans have known forever – this stuff is addictive to watch.

Take McLaren’s recent Mastercard deal: a whopping $100 million per season. That’s not pocket change, even for a financial services giant. Meanwhile, betting companies, luxury brands, and manufacturers are fighting for space across the current 20-car grid.

The competition’s about to get even fiercer. Cadillac’s joining as the 11th team next season, bumping the grid to 22 cars and creating more premium real estate for partnerships.

What This Deal Actually Means for Both Parties

Carlyle CEO Harvey Schwartz isn’t just throwing money at shiny cars for fun. He’s betting on F1’s growth being “fueled by greater access to private markets and growing interest from a new generation of investors.”

Translation? Younger investors love F1, and Carlyle wants in on that action.

For Red Bull, this partnership comes at an interesting time. They’ve dominated F1 since 2021 but lost their team title to McLaren last year. Even Max Verstappen – their four-time champion – looks set to lose his individual crown for the first time in five years.

New team principal Laurent Mekies (who replaced Christian Horner earlier this year) sees the Carlyle partnership as bringing an “expansive network” from “an iconic firm in global finance.”

Carlyle’s Sports Investment Strategy

This isn’t Carlyle’s first rodeo in sports investing. They previously owned London’s Addison Lee (now exited) and dropped $58 million in 2024 to acquire women’s football team Seattle Reign alongside the Seattle Sounders ownership.

The pattern’s clear: Carlyle’s betting on premium sports properties that combine global reach with growing audiences.

What’s Next for F1’s Financial Future?

With the next race hitting Baku on September 21st, all eyes will be on how this partnership plays out. F1’s become a magnet for institutional money, and Carlyle’s move could trigger more private equity interest in the sport.

Ready to dive deeper into F1’s investment boom? Keep watching as more Wall Street giants discover what racing fans already know – this sport’s financial engine is just getting started.

FAQ

Q1: What makes the Carlyle-Red Bull deal different from other F1 partnerships?

A: This is the first strategic partnership of its kind between a major private equity firm and an F1 team. Unlike traditional sponsorship deals, it focuses on long-term value creation and global connectivity rather than just branding.

Q2: Why is F1 suddenly attracting so much investment money?

A: F1’s audience has exploded globally, especially among younger demographics who are also entering investment markets. The sport offers premium brand exposure and growing commercial opportunities that institutional investors find attractive.

Q3: How much is Carlyle worth compared to other F1 investors?

A: Carlyle’s $23 billion market cap puts it among the largest financial entities involved in F1. For context, McLaren’s Mastercard deal is worth $100 million annually, showing the scale of money flowing into the sport.

Q4: Is Red Bull still competitive in F1?

A: Red Bull dominated from 2021-2023 but lost their team championship to McLaren in 2024. Max Verstappen also looks set to lose his individual title after four consecutive wins, marking a shift in F1’s competitive landscape.

Q5: What other sports has Carlyle invested in?

A: Carlyle acquired Seattle Reign women’s football team and Seattle Sounders ownership for $58 million in 2024. They previously owned London transport company Addison Lee but have since exited that investment.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.