Introduction

One in ten UK homes slashed their asking price in July – way above the five-year average – as the tables have turned in favor of house hunters.

With house price growth cooling to just 1.3% year-on-year (down from 2.1% at the start of 2025), we’re seeing a proper buyers’ market emerge. Here’s what’s really happening and why it matters for your next move.

Property Price Reductions: Why UK Homeowners Are Cutting House Prices in 2025

The UK property market data hides no sins: homebuyers now have 10% more properties to choose from compared to July 2024. That’s transforming the UK housing landscape, especially across high-value areas in Southern England where housing stock was previously limited.

“There is plenty of demand for homes and more people are looking to move… [but] buyers also have much greater choice,” explains Richard Donnell, executive director at Zoopla’s House Price Index. Translation? UK property sellers can no longer dictate terms in today’s competitive housing market.

This market correction is creating a clear divide between realistic property sellers (who price homes competitively from day one) and those still using 2021-2022 pricing strategies. The data shows which approach actually sells properties in the current UK housing market.

Regional Housing Market Analysis: Northern vs Southern England Property Performance

Here’s where UK regional house price trends reveal stark differences: Northern England properties are selling in an average of 27 days, while Southern England homes take 39 days to find buyers.

Why the regional housing market divide? Property affordability remains challenging in the South, even with increased housing supply. Northern England homebuyers benefit from better mortgage-to-income ratios, while Southern England’s property prices still strain buyer budgets despite improved market conditions.

This North-South property divide demonstrates how location dramatically affects housing market performance – successful pricing strategies in Manchester’s market might fail completely in London’s competitive landscape.

UK Mortgage Market 2025: Interest Rates Impact on Property Buyers

Don’t expect UK mortgage rates to drop significantly anytime soon. “Since we have possibly seen the final Bank of England base rate cut of the year, buyers may need to get used to the new ‘norm’ for mortgage rates,” warns Tomer Aboody from specialist lender MT Finance.

This mortgage rate reality is reshaping both sides of the UK property equation. First-time buyers are becoming more selective, property sellers are adopting realistic pricing strategies, and everyone’s adapting to a market where 5%+ mortgage rates are the new normal through 2025.

For UK property investment and residential buyers, this means factoring higher borrowing costs into housing budgets from the outset – no more assuming rates will fall to rescue overpriced purchases.

UK Property Tax 2025: Potential Changes Affecting Housing Market Confidence

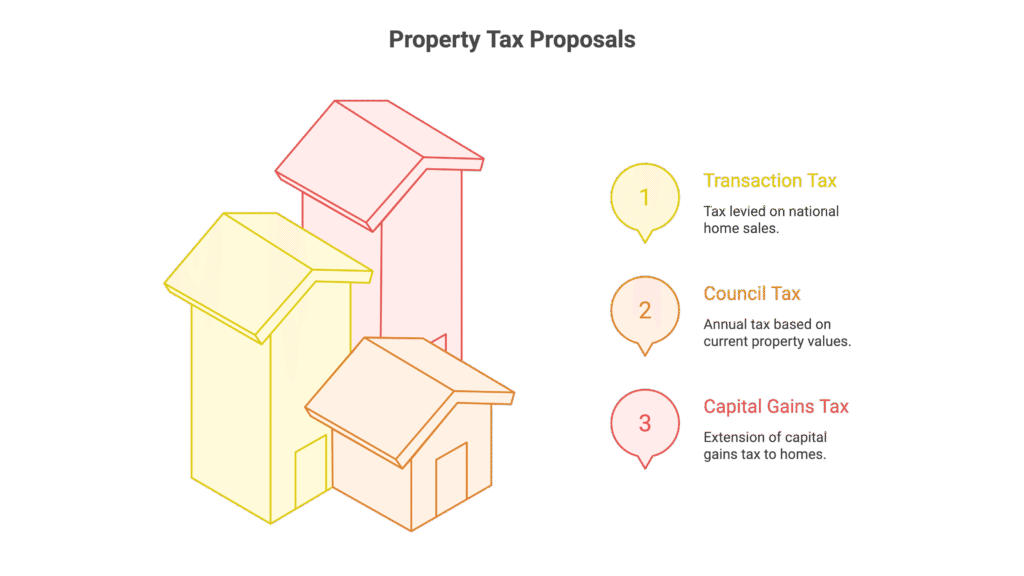

Just when the UK housing market was stabilising, Westminster discussions about new UK property taxes are creating uncertainty. Chancellor Rachel Reeves is reportedly considering multiple property tax reforms to address the £40bn budget shortfall:

- National property transaction tax on home sales

- Annual council tax replacement based on current property values

- Capital gains tax extension to UK homes over £1.5m

“Even rumours of a new property tax can have a detrimental impact on housing market confidence,” notes Jeremy Leaf, former RICS chairman. UK property markets thrive on certainty – and property tax speculation is currently undermining buyer and seller confidence across all UK housing sectors.

UK Housing Market Forecast 2025: Expert Predictions for Property Values

Zoopla’s House Price Index projects UK house price growth will remain between 1.5-2% annually through late 2025. This represents significantly slower growth compared to recent years, but signals housing market stability rather than the volatility seen in 2021-2023.

Southern England house prices show early signs of stabilisation, while Northern England property values are experiencing a cooling period. The UK’s regional housing market appears to be reaching equilibrium after years of unprecedented property price volatility.

For UK property investors and homebuyers planning purchases, this creates a more predictable market environment – particularly valuable for mortgage planning and property investment strategies extending into 2026.

UK Property Market Summary: Key Takeaways for 2025

We’re witnessing a fundamental shift from sellers’ market conditions to buyers’ market dynamics across the UK housing sector. If you’re selling UK property, implement realistic pricing from launch day. If you’re a house buyer, take advantage of increased choice and negotiating power.

The era of property bidding wars and gazumping isn’t completely finished, but it’s significantly diminished. Today’s UK property market rewards accurate pricing and informed buyers who understand current housing market conditions.

Ready to navigate the 2025 UK housing market? Secure expert mortgage advice and explore your property options in this shifting landscape – whether you’re buying, selling, or investing, housing market knowledge is essential for success in today’s UK property environment.

FAQ

Q1: Should I delay property purchases until UK house prices drop further in 2025?

A: With UK house price growth at just 1.3%, we’re already seeing significant housing market correction. Waiting for major property price drops is risky – you might miss quality UK properties while mortgage rates potentially increase further, affecting affordability calculations.

Q2: Will the rumoured UK property tax changes definitely be implemented?

A: No property tax reforms are confirmed yet, but the Treasury is exploring revenue-raising options. Any UK property tax changes would face substantial political resistance and require lengthy implementation periods, giving the housing market time to adapt.

Q3: Why do Northern England properties sell faster than Southern England homes?

A: Northern England housing markets benefit from superior affordability ratios, enabling quicker property transactions. Southern England still faces challenging house price-to-income ratios, despite improved housing supply and buyer choice in the market.

Q4: Is late 2025 optimal timing for selling UK property?

A: Yes, if you implement competitive property pricing from launch. The UK housing market remains active for realistic sellers, but overpriced properties experience extended marketing periods and often require subsequent price reductions to achieve sales.

Q5: Will UK mortgage rates decrease before 2026?

A: Most UK property experts and mortgage market analysts expect interest rates to stabilise around current levels. Factor 5%+ mortgage rates into property purchase calculations rather than anticipating significant rate reductions affecting housing affordability.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.