Ever tried buying a house in the UK? If you have, you’ll know it feels like navigating a maze blindfolded while juggling flaming torches. Now Santander’s put a price on that pain – and it’s eye-watering.

The bank’s latest research reveals the UK’s antiquated house buying process is bleeding the economy dry to the tune of £1.5 billion every year. With over half a million failed housing transactions costing buyers £560m directly, it’s clear our century-old property system needs urgent surgery.

Here’s why this matters: you’re not just losing money on failed purchases, you’re funding a broken system that’s dragging down the entire UK economy. Let’s break down the real cost and what needs fixing.

The True Cost of Failed Property Dreams

Here’s the brutal reality: 85% of people who’ve experienced a collapsed house purchase lost money. The average hit? £1,240 per person. But one in five unlucky souls faced losses exceeding £2,000.

Nearly a quarter of would-be buyers watched their property dreams crumble, with 17% seeing deals collapse after just one month. Even worse, 45% of failures happened after the three-month mark – imagine being that close to the finish line only to trip at the final hurdle.

“Buying a home… for too many people, it’s an uncertain and exhausting process that drains their mental, emotional and physical health,” says David Morris, Santander UK’s head of homes.

Economic Productivity Takes a Hit

The ripple effects extend far beyond individual wallets. Failed transactions cost the wider economy £950m annually, with the average buyer spending 100 hours on doomed deals.

The kicker: nearly 60% of that time was during work hours, creating a productivity drain worth £380m yearly. That’s money disappearing from the economy while people chase paperwork instead of focusing on their jobs.

This broken system also puts a brake on labour mobility – people simply can’t move for better opportunities when buying a house feels like climbing Everest in flip-flops.

A System Stuck in the Past

Morris nails it: “The homebuying journey is still operating in the confines of a framework that was established a century ago. This antiquated system is an increasingly heavy anchor weighing on the economy.”

The good news? Industry players are finally waking up. Major banks including HSBC, Legal and General, and the Mortgage Advice Bureau have signed a charter promising to cut the buying process to 28 days. Ambitious? Absolutely. Necessary? Absolutely.

What Needs to Change

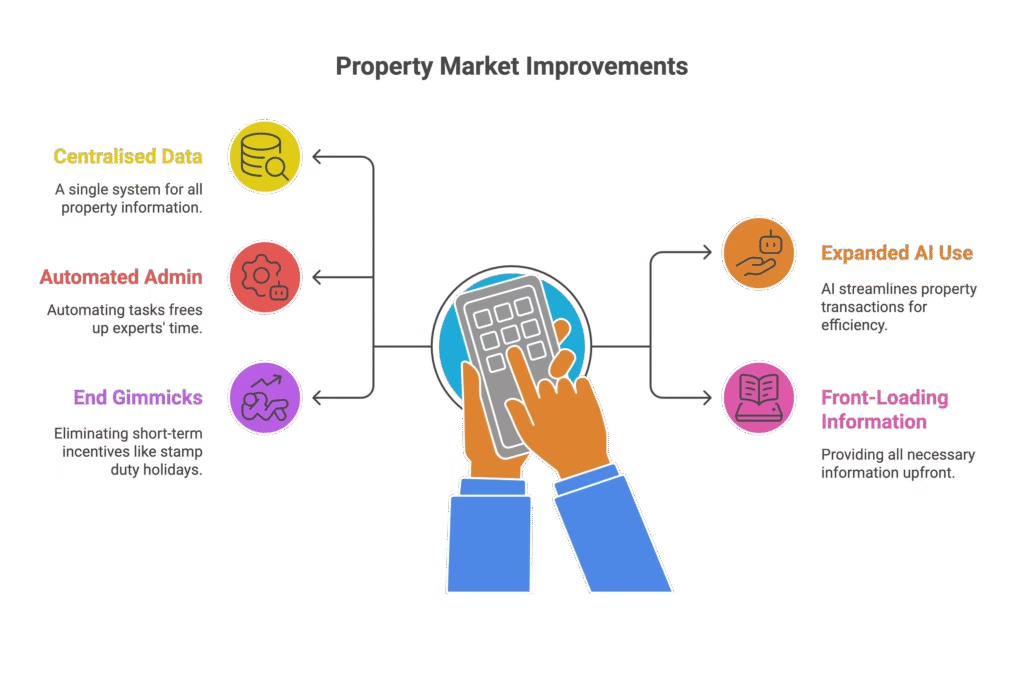

Santander’s calling for serious modernisation, including:

- A centralised property data system (imagine that!)

- Expanded AI use for seamless transactions

- Automated admin tasks to free up expert time

- Front-loading all necessary information

- Ending short-term gimmicks like stamp duty holidays

The government’s promised 1.5 million new homes, but without fixing the buying process, we’re just adding more properties to a broken system.

The Bottom Line

The UK’s house buying process isn’t just frustrating – it’s economically destructive. With £1.5bn vanishing annually and buyers facing a medieval system in a digital age, reform isn’t just overdue, it’s essential.

Key takeaways: failed transactions cost you an average £1,240, waste 100 hours of your time, and drag down the entire economy. The solution? Modernise the system with centralised data, AI automation, and industry-wide 28-day completion targets.

Ready to stay ahead of property market changes? Keep up with the latest housing reforms that could transform your next home purchase.

FAQ

Q1: How much does a failed house purchase typically cost buyers?

A: The average financial loss from a collapsed property transaction is £1,240. However, one in five buyers face losses exceeding £2,000, with costs including non-refundable mortgage and solicitor fees.

Q2: What percentage of house purchases actually fall through in the UK?

A: Nearly a quarter (around 25%) of people attempting to buy property experience transaction failures. Shockingly, 45% of these failures occur after the three-month mark in the process.

Q3: How much time do buyers waste on failed transactions?

A: The average buyer spends 100 hours on activities related to a failed house purchase. Nearly 60% of this time occurs during regular work hours, creating significant productivity losses.

Q4: What’s being done to fix the broken system?

A: Major financial institutions have signed a charter pledging to reduce the buying/selling process to 28 days. Santander is also calling for a centralised property data system and increased AI automation.

Q5: How does the broken system affect the wider economy?

A: Beyond the £560m direct cost to consumers, failed transactions cost the wider economy £950m annually through lost productivity and reduced labour market mobility.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.