Ever wonder what happens when Trump tariffs meet your favourite car brands? Just ask Stellantis shareholders – they’re getting a masterclass in pain right now.

The European automaker behind Vauxhall, Fiat, Alfa Romeo, and a dozen other marques just confirmed Trump’s car tariffs will cost them €1.5bn ($1.4bn) this year, even after the EU-US trade deal cut tariff rates. The Stellantis tariff impact represents one of the largest confirmed hits by a major European car manufacturer since Trump’s trade war escalated.

That’s billion with a ‘b’ – enough to fund several new electric vehicle plants or, you know, keep shareholders from jumping ship. Speaking of which, Stellantis stock tumbled nearly 5% when this tariff news hit the wires.

Stellantis Financial Results: Tariff Damage Report

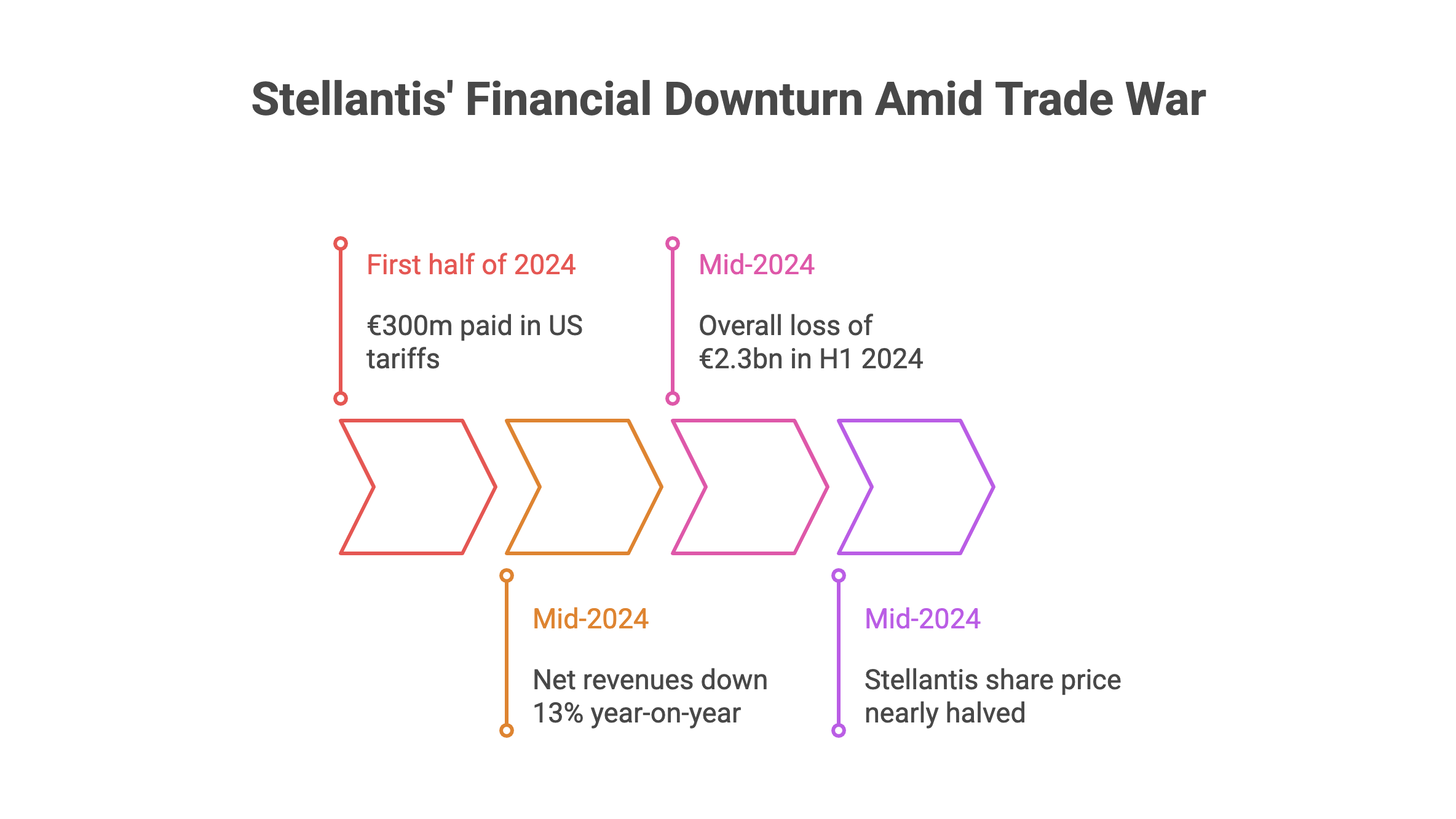

Here’s where the Trump tariffs impact gets ugly fast. Stellantis already paid €300m in US tariffs during the first half of 2024 – and that was before the trade war really escalated.

The Stellantis half-year results read like a financial horror story:

- Net revenues down 13% year-on-year

- Overall loss of €2.3bn in H1 2024

- Stellantis share price nearly halved over the past year

These aren’t just accounting hiccups. This is what happens when Chinese EV competitors flood European markets whilst you’re still figuring out how to make electric cars people actually want to buy.

EU-US Trade Deal 2025: Limited Relief from Trump Tariffs

Sunday’s EU-US trade agreement was supposed to be the cavalry riding over the hill for European automakers. Instead, it feels more like negotiating down from a mugging to a pickpocketing.

The “victory”? EU car tariffs capped at 15% instead of the threatened 30% Trump tariff rates. The price? Europe promised billions in investments into US energy and defence sectors – basically paying protection money with extra steps.

French PM François Bayrou didn’t seem best pleased, calling the EU-US deal a “submission” and a “dark day” for European trade. German Chancellor Friedrich Merz was slightly more diplomatic but equally pessimistic, warning of “considerable damage” to Germany’s export-heavy automotive industry.

Stellantis CEO Strategy: Navigating Automotive Industry Challenges

New Stellantis CEO Antonio Filosa inherited this mess when he took over in May, after his predecessor Carlos Tavares abruptly resigned over “different views” with the board. (Translation: the board wanted results, Tavares couldn’t deliver the automotive turnaround.)

Filosa’s playing it straight: “Our new leadership team, while realistic about the challenges, will continue making the tough decisions needed to re-establish profitable growth.”

That’s CEO-speak for “buckle up, it’s going to get worse before it gets better.”

The European automaker expects revenue and cash flow to recover, but when you’re competing against cheap Chinese EVs whilst paying Trump tariffs, that’s quite the uphill battle for any automotive company.

Stellantis Stock Impact: What Investors Need to Know

If you’re eyeing a new Vauxhall or Alfa, expect car prices to climb. Automotive companies don’t eat billion-dollar tariff bills – they pass Trump tariff costs along to consumers.

For investors, Stellantis stock represents the broader challenge facing European automakers: caught between aggressive Chinese EV competition and protectionist American trade policies, whilst trying to navigate the electric vehicle transition without going broke.

The next few quarters will show whether Filosa’s automotive industry strategy can turn this ship around or if Stellantis becomes another casualty of the global trade war.

FAQ

Q1: Why is Stellantis being hit so hard by Trump tariffs?

A: The automaker exports significant volumes from European plants to the US car market. Trump’s automotive tariffs specifically target these imports, making Stellantis vehicles more expensive for American consumers and eating into profit margins.

Q2: Will the EU-US trade deal actually help Stellantis tariff costs?

A: Marginally. The 15% tariff rate is better than the threatened 30% Trump tariffs, but it’s still a massive cost burden. The €1.5bn Stellantis tariff hit shows even the “reduced” rates are devastating for European car manufacturers.

Q3: How does this Stellantis tariff impact compare to other automakers?

A: Stellantis is the first major European automotive company to provide specific Trump tariff guidance post-EU deal. Other car exporters are likely facing similar trade war pressures but haven’t disclosed exact financial figures yet.

Q4: What’s driving Stellantis’s broader struggles beyond tariff costs?

A: The automotive giant is getting squeezed by cheap Chinese EV competitors in key markets whilst struggling to update its own electric vehicle lineup fast enough. It’s a classic case of being caught in the middle during an industry transition.

Q5: Should investors buy the dip on Stellantis stock after tariff news?

A: That depends on your risk tolerance and belief in the new CEO’s automotive turnaround plan. The fundamentals are challenging, but Stellantis shares have already been hammered pretty hard. Do your own research and consider the broader car industry trends.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.