The SEC just pulled a classic bureaucratic move. On July 22nd, regulators approved a major multi-asset crypto ETF packed with Bitcoin, Ethereum, XRP, and seven other digital assets — then immediately froze.

We’re talking about the Bitwise 10 Crypto Index ETF, which would’ve been a game-changer for investors wanting diversified crypto exposure in a traditional wrapper. But now? It’s stuck in regulatory limbo while the full Commission decides whether the approval was actually a good idea.

Here’s what happened, why it matters, and what comes next for this crypto ETF rollercoaster.

What Exactly Got Approved (Then Frozen)?

The Bitwise 10 Crypto Index ETF isn’t your typical single-asset fund. This thing’s designed to track the 10 largest cryptocurrencies by market cap, giving investors a basket approach to digital assets.

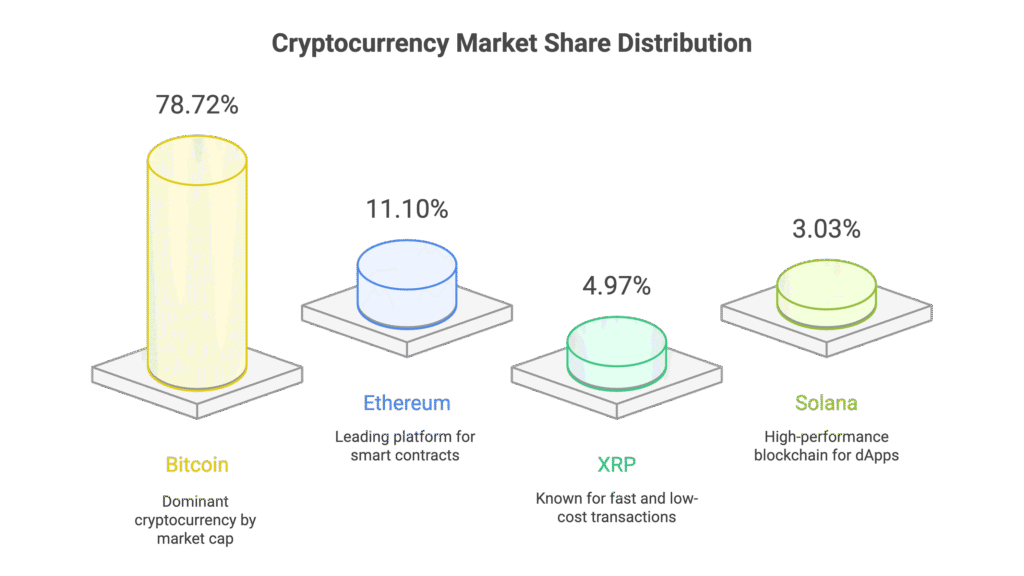

The current lineup reads like a crypto greatest hits album:

- Bitcoin dominates at 78.72%

- Ethereum grabs 11.10%

- XRP takes 4.97%

- Solana rounds out the top four at 3.03%

The remaining 2% gets spread across Cardano, SUI, Chainlink, Avalanche, Litecoin, and Polkadot. Not exactly equal weighting, but it mirrors how the actual crypto market works.

The fund has some smart guardrails too. At least 85% of holdings must be in SEC-approved crypto assets, whilst the remaining 15% can venture into newer territories. Coinbase Custody handles the crypto storage, and Bank of New York Mellon manages the boring administrative stuff.

The SEC’s Mixed Signals Problem

Here’s where things get ridiculous. The SEC’s Division of Trading and Markets gave the ETF accelerated approval under Rule 8.500-E. That’s bureaucrat-speak for “we’re fast-tracking this thing.”

But hours later, the SEC’s Office of the Secretary basically said “hold up” and froze the approval pending a full Commission review. They cited Rule 431, which lets them pump the brakes on staff decisions.

It’s like your manager approving your holiday request, then immediately calling to say HR needs to review it. Confusing? Absolutely.

Why This Matters for Crypto Investors

This approval-then-freeze dance isn’t just regulatory theater — it signals something bigger brewing at the SEC.

We’ve seen similar crypto ETF approvals over the past year, but most focussed on single assets like Bitcoin or Ethereum. A diversified crypto ETF represents the next evolution, potentially opening the floodgates for mainstream adoption.

The timing’s also interesting. With crypto markets showing renewed strength and institutional interest growing, the SEC’s cautious approach suggests they’re feeling pressure from multiple directions.

Investment expert Nate Geraci called the situation “bizarre,” noting that both this fund and a similar Grayscale product got the same approve-then-freeze treatment. That’s not coincidence — it’s policy uncertainty playing out in real time.

What Happens Next?

The full SEC Commission now gets to decide whether their staff made the right call. This could go several ways:

They might uphold the approval and let the ETF launch. Given the precedent set by other crypto ETFs, this seems possible.

Alternatively, they could reject the approval entirely, sending Bitwise back to the drawing board. Less likely, but stranger things have happened in crypto regulation.

Most probably? They’ll request modifications or additional safeguards before giving final approval. The SEC loves compromise solutions that let them say yes while adding extra protection layers.

The Bottom Line

The SEC’s approval-then-freeze move on the Bitwise crypto ETF perfectly captures where we are with digital asset regulation — caught between innovation and caution.

For investors, this represents both progress and frustration. We’re clearly moving toward more diverse crypto investment products, but the regulatory process remains maddeningly unpredictable.

Keep watching this space. When (not if) diversified crypto ETFs finally launch, they could reshape how mainstream investors access digital assets.

FAQ

Q1: What makes this crypto ETF different from existing ones?

A: Unlike single-asset Bitcoin or Ethereum ETFs, this fund holds 10 different cryptocurrencies weighted by market cap. It’s essentially a diversified crypto index fund in an ETF wrapper.

Q2: Why did the SEC approve then immediately freeze the ETF?

A: The SEC’s trading division approved it, but the full Commission invoked their right to review staff decisions. It’s a checks-and-balances mechanism that creates temporary uncertainty.

Q3: When might the ETF actually launch?

A: The Commission hasn’t set a timeline for their review. Based on similar cases, it could take weeks to months before we get a final decision.

Q4: What does this mean for other pending crypto ETFs?

A: It suggests the SEC is taking a more cautious approach to multi-asset crypto products, even after approving single-asset ETFs. Expect similar review processes for future diverse crypto funds.

Q5: Should investors wait for this ETF or buy crypto directly?

A: That depends on your preference for traditional investment vehicles versus direct crypto ownership. ETFs offer easier access and familiar tax treatment, whilst direct ownership provides more control and potential staking rewards.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.