Chancellor Rachel Reeves is targeting landlord tax increases for a quick £2bn revenue boost in 2025 – but property experts warn this national insurance on rental income could backfire spectacularly. Her “punitive” landlord tax plan might shrink UK rental supply and drive up rent prices by 15-20% across Britain’s housing market. So much for protecting working families from rising housing costs, right?

What Is Rachel Reeves’ 2025 Landlord Tax Plan?

The UK Chancellor’s playing tax Tetris with buy-to-let landlord taxation, trying to raise £2bn without breaking her “no tax hikes for working people” promise. Her controversial solution? Apply national insurance contributions to rental income from buy-to-let properties – a move that could cost landlords an extra 12% on their rental profits.

HM Treasury officials are frantically drafting new landlord tax legislation to squeeze property investors while technically keeping Labour’s election pledges intact. But will this Chancellor’s Budget 2025 move backfire on British renters?

Why UK Small Landlords Are Getting Hammered by Rising Tax Burden

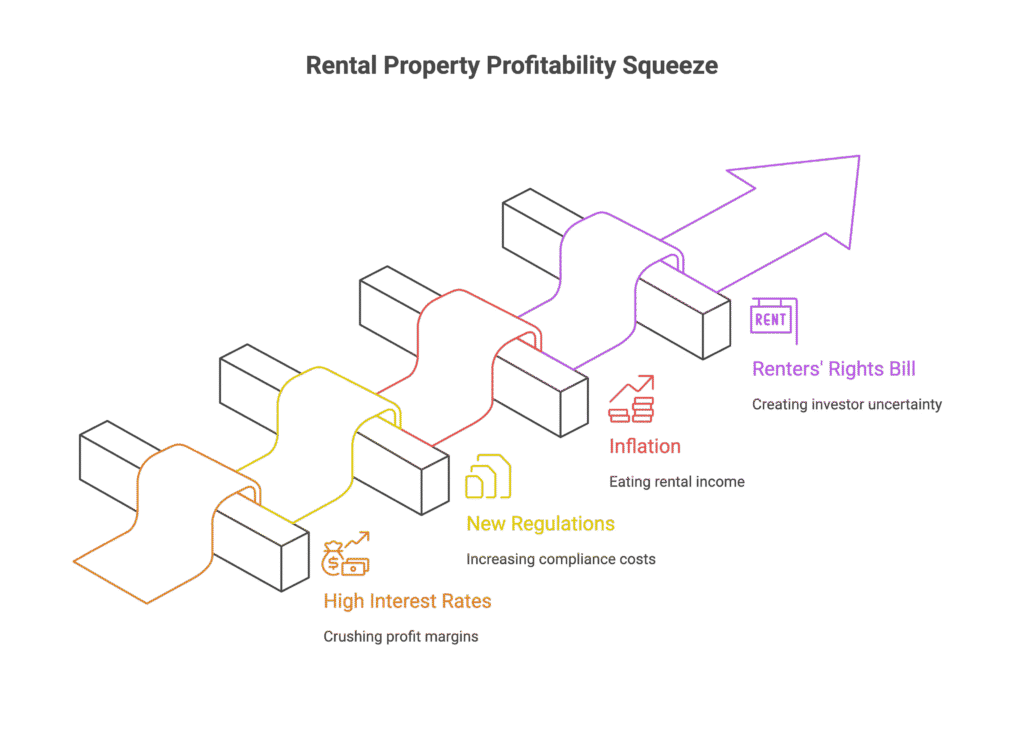

Private landlords – especially small buy-to-let investors, not corporate property giants – are already drowning in a storm of financial pressures:

The Storm Crushing Buy-to-Let Investors

- High interest rates crushing rental property profit margins

- New landlord regulations piling on compliance costs

- Inflation eating rental income alive

- Renters’ Rights Bill creating more uncertainty for property investors

Tom Bill from Knight Frank estate agents states: “When you tax an activity, you get less of it.” Add another tax burden to this list, and many landlords will just exit the rental market entirely.

UK Rental Market Crisis 2025: Housing Shortage Getting Worse

Here’s the scary reality for British renters: the UK needs 1.2 million more rental homes by 2031 just to meet exploding housing demand, according to Savills property market research. We’re already facing a severe rental housing shortage of 400,000 properties, and this new landlord tax burden could worsen supply problems dramatically.

“We’re seeing acute supply pressures pushing rental costs onto tenants across London, Manchester, and Birmingham,” warns Marc von Grundherr from Benham & Reeves estate agents. Fewer rental properties = higher rent prices. It’s basic UK housing economics hitting working families hardest.

How Landlord Tax Changes Will Impact UK Rent Prices in 2025

Rental Price Increases as Buy-to-Let Investors Pass Tax Costs to Tenants

Think property investors will absorb these extra 12% tax costs? Not a chance. Shaun Moore from Quilter wealth management predicts the national insurance hit would “almost certainly increase rental prices by 10-15% across major UK cities within 12 months.”

Mass Landlord Exodus from UK Buy-to-Let Market Accelerating

Shocking stats: 35% of small landlords plan to exit buy-to-let investing by end-2025, with 88% lacking confidence in the private rental sector’s future. This tax increase could trigger a mass sell-off of rental properties.

Sam Humphreys from Dwelly property consultancy warns: “Once 200,000+ rental properties are lost to the market, it takes 5-10 years to rebuild that housing stock.” Lose landlords now, British renters face a decade of pain.

Limited Company Rush: How Landlords Will Dodge Rachel Reeves’ Tax

Plot twist: savvy property investors are already restructuring through limited companies to avoid national insurance entirely. Accountants report 300% increase in landlord incorporation enquiries since the tax announcement. The government’s £2bn revenue target could shrink to £500m overnight.

Rachel Reeves Housing Policy 2025: Political Theatre vs Smart Solutions

Ben Beadle, CEO of the National Residential Landlords Association (NRLA), slams the proposals: “Punitive landlord tax increases will drive rental prices up 15-20% in the next 18 months, hitting exactly the working families Rachel Reeves claims to protect.”

This isn’t effective UK housing policy for 2025 – it’s political point-scoring that’ll devastate the 4.5 million British households who rent privately.

Want genuine rental affordability for working families? Build 300,000+ new homes annually and reform planning laws, don’t destroy existing housing supply through punitive buy-to-let taxation.

Key Takeaway: Rachel Reeves’ landlord tax could reduce UK rental supply by 200,000 properties while increasing rents by £150-200 monthly for average tenants.

FAQ: Rachel Reeves Landlord Tax 2025 – Your Questions Answered

Q1: How much will Rachel Reeves’ landlord tax actually raise for UK Treasury?

A: Treasury officials project £2bn annually from applying 12% national insurance to rental income, but property tax experts predict just £500m-800m once landlords restructure through limited companies or exit buy-to-let investing entirely.

Q2: Will my rent increase due to the 2025 landlord tax changes?

A: Yes – rental price increases of 10-20% are virtually guaranteed across UK cities. Reduced rental supply plus landlords passing 12% tax costs to tenants equals higher monthly rents of £150-250 for typical British properties.

Q3: Why can’t small buy-to-let landlords absorb tax increases like property companies?

A: Small UK landlords average just 8-12% profit margins on rental properties and lack resources for complex corporate tax structures. Many operate single buy-to-let investments and face bankruptcy if profit margins disappear.

Q4: What happens to UK rental properties if landlords sell due to tax pressure?

A: They’re typically bought by owner-occupiers, permanently removing them from Britain’s rental market. Each lost rental property worsens the housing shortage for the 4.5 million UK households who rent.

Q5: How can UK renters prepare for higher rental costs in 2025?

A: Start budgeting for 15-20% rent increases, consider house-sharing to split costs, and explore government rental support schemes. Unfortunately, few alternatives exist in Britain’s constrained housing market.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.