The OBR productivity downgrade just torpedoed Rachel Reeves’ Budget plans. The Office for Budget Responsibility is slashing UK productivity forecasts, blowing a massive hole in public finances that could cost tens of billions.

Remember that cozy £9.9bn budget headroom? It’s vanishing fast. With the November Budget looming, tax hikes are now practically inevitable. Here’s why this productivity downgrade spells trouble for your wallet and what Rachel Reeves’ tax strategy means for working families.

What’s Behind the OBR Productivity Downgrade?

The OBR has quietly briefed the Treasury that those March productivity forecasts were way too optimistic. We’re talking about a potential fiscal black hole running into “tens of billions” of pounds.

Here’s the math that’ll make your head spin: every 0.1 percentage point cut to productivity forecasts costs the government around £9bn. With Reeves’ budget headroom already squeezed by previous U-turns on welfare reforms (there goes £6bn), she’s rapidly running out of wiggle room.

A Treasury source told the Financial Times: “The OBR productivity downgrade could amount to half or three-quarters of the fiscal hole.” That’s not pocket change.

Rachel Reeves’ Tax Dilemma: Who’s Getting Hit?

Labour’s playing the blame game hard, pointing fingers at the Conservative government’s “poor productivity record.” But regardless of who’s at fault, someone has to pay the bill.

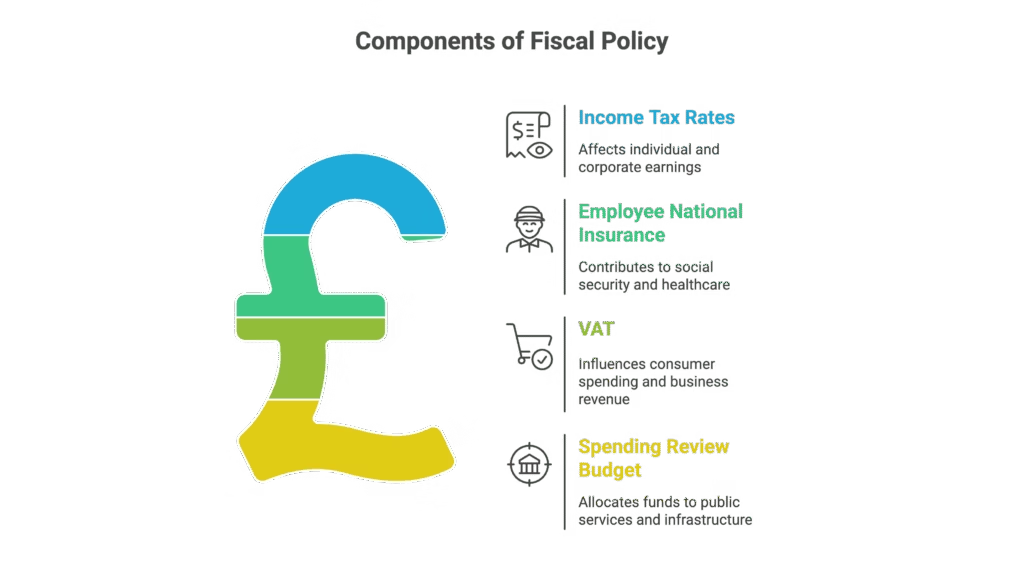

The Chancellor faces some tough choices. She’s promised to protect:

- Income tax rates

- Employee national insurance

- VAT

- The £190bn Spending Review budget

So where’s the money coming from? Pension pots and property owners are squarely in the crosshairs. Even “working people” aren’t safe – expect that income tax band freeze to stick around longer than anyone wanted.

The Numbers Game: How Bad Could It Get?

City forecasters are split on just how brutal this Budget will be:

The Pessimists:

- NIESR estimates Reeves needs £50bn in extra taxes or savings

- Capital Economics suggests a £30bn shortfall

The (Slightly) Optimists:

- Deutsche Bank and JP Morgan offer more moderate estimates

Reeves has dismissed NIESR’s forecasts, saying she doesn’t “recognise” their numbers. But with the OBR’s productivity downgrade looming, those figures might start looking uncomfortably accurate.

What This Means for Your Money

Keir Starmer’s reportedly scrambling to revive welfare reforms, with working-age benefits set to rise by £25bn over five years. But that’s not enough to plug the gap.

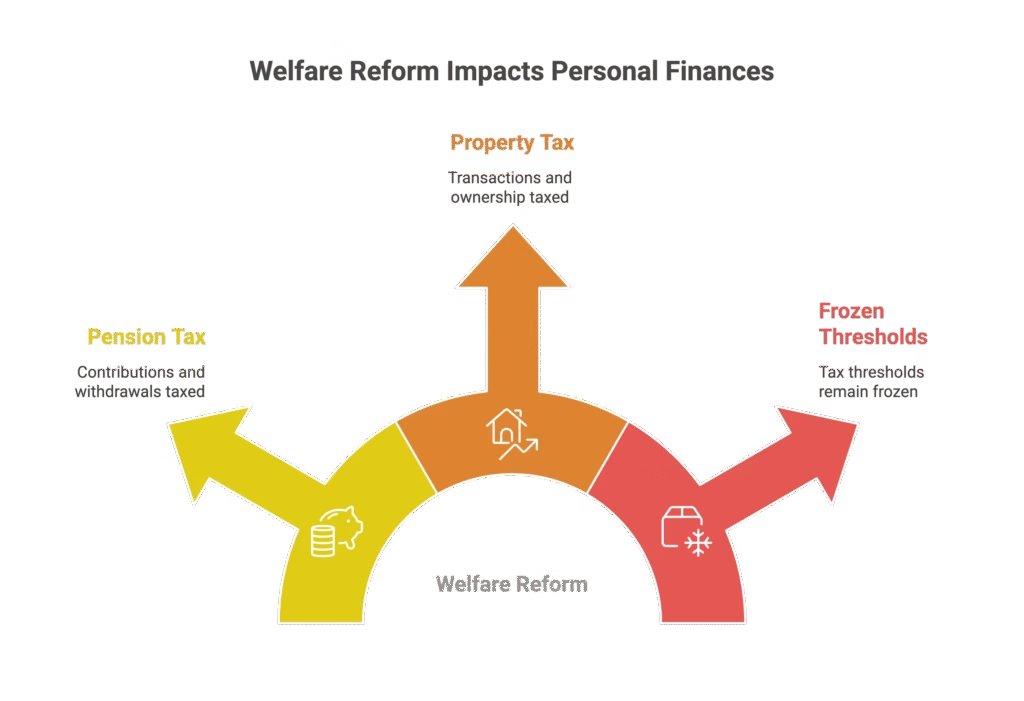

Expect targeted tax grabs on:

- Pension contributions and withdrawals

- Property transactions and ownership

- Frozen tax thresholds (the stealth tax that keeps on giving)

The opposition isn’t buying Labour’s blame game. Shadow Chancellor Mel Stride fired back: “Every time the numbers don’t add up, Rachel Reeves blames someone else.”

The Bottom Line

The OBR productivity downgrade isn’t just a technical adjustment – it’s a Budget bombshell that’ll reshape Labour’s spending plans. With fiscal headroom vanishing faster than free samples at Waitrose, November’s Budget is shaping up to be a tax-hiking extravaganza.

Ready or not, your wallet’s about to feel the squeeze. Stay informed about Rachel Reeves’ Budget announcements and consider reviewing your pension and property strategies before November hits. The productivity downgrade means higher taxes are coming – preparation is your best defense.

FAQ

Q1: What exactly is the OBR productivity downgrade?

A: The Office for Budget Responsibility is cutting forecasts for UK economic productivity. Lower productivity means less growth and smaller tax receipts, creating a budget shortfall.

Q2: How much could this productivity downgrade cost?

A: Estimates range from £30-50bn in lost fiscal headroom. Each 0.1 percentage point cut costs roughly £9bn.

Q3: Which taxes are most likely to rise?

A: Pension taxes, property levies, and extended income tax threshold freezes top the list. Labour ruled out raising income tax rates, VAT, and employee national insurance.

Q4: Is this really the Conservative government’s fault?

A: Labour claims the productivity issues stem from Conservative mismanagement, but the OBR makes independent forecasts. Regardless of blame, the current government has to fix the fiscal hole.

Q5: When will we know the full impact?

A: The November Budget will reveal exactly how the government plans to address the shortfall. Expect detailed tax changes and spending adjustments to be announced then.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.