Nvidia earnings Q2 2025 just exceeded Wall Street expectations, yet NVDA stock dipped 3% in after-hours trading. The paradox? Record Nvidia revenue of $46.7bn wasn’t enough to offset fears about China semiconductor ban impact.

Jensen Huang’s company delivered a masterclass in AI chip dominance, with quarterly earnings surging 59% to $26.4bn. But Nvidia investors are fixated on one stark reality: China’s $50bn market remains off-limits, creating a massive revenue headwind for the world’s most valuable AI semiconductor company.

Here’s why NVDA earnings couldn’t prevent this tech stock selloff — and what it means for AI investment strategy going forward.

Nvidia Q2 2025 Earnings Results: Record Breaking Performance vs Wall Street Estimates

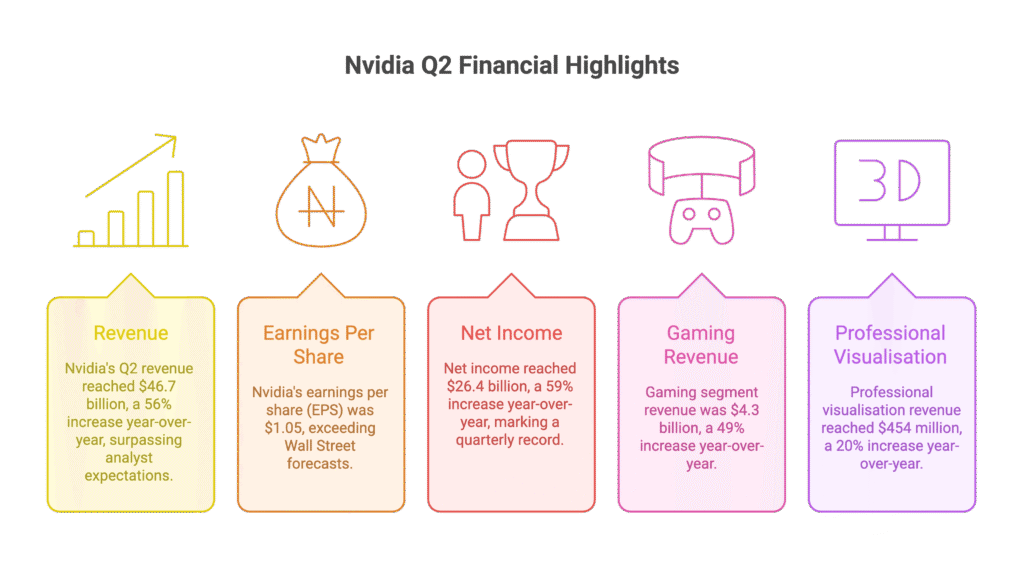

NVDA financial results delivered another knockout performance that should have sent Nvidia share price soaring:

- Nvidia Q2 revenue: $46.7bn (+56% YoY) — beat analyst estimates

- Nvidia EPS: $1.05 — exceeded Wall Street forecasts

- Net income: $26.4bn (+59% YoY) — quarterly record

- Gaming segment revenue: $4.3bn (+49% YoY)

- Professional visualisation: $454m (+20% YoY)

Nvidia Corporation also unveiled a colossal $60bn share buyback programme, adding to the $9.7bn already repurchased this quarter. These Nvidia fundamentals signal unprecedented AI market growth.

Yet NVDA after hours trading told a different story. Why did institutional investors react negatively to such stellar financial performance?

Data Center Revenue Miss: Why Nvidia Stock Dropped Despite AI Chip Demand Surge

The NVDA stock price decline centres on one critical metric: Nvidia data center revenue. Despite generating $41.1bn (+50% YoY), this fell short of analyst consensus at $41.3bn.

In today’s AI stock valuation environment, missing estimates by even 0.5% triggers algorithmic selling. When growth stocks trade at 70x earnings, quarterly guidance accuracy becomes paramount for stock market performance.

However, AI infrastructure demand remains robust. Nvidia Blackwell architecture drove 17% sequential growth, with hyperscale customers (AWS, Microsoft, Google) accounting for roughly 50% of data center sales. This AI server market expansion validates Nvidia’s competitive moat in machine learning accelerators.

Cloud service providers continue expanding GPU clusters for large language model training, suggesting long-term AI adoption remains intact despite short-term earnings volatility.

China Export Controls: $50B Market Loss Weighs on Nvidia Stock Outlook

The China semiconductor export ban represents NVDA’s biggest headwind. CEO Jensen Huang quantified the impact: “The $50bn China market is effectively closed to us.”

US export restrictions completely eliminated H20 chip sales to Chinese customers this quarter. While Nvidia managed $650m in H20 revenue from non-Chinese buyers, this pales compared to pre-ban China sales of $10bn+ annually.

Nvidia Q3 guidance of $52.9bn-$55.1bn explicitly excludes China revenue, disappointing buy-side analysts who projected $58bn-$60bn including potential trade resolution. This guidance shortfall explains NVDA’s after-hours weakness.

CFO Colette Kress suggested $2bn-$5bn upside if US-China trade tensions ease, but current Trump administration export policy shows no signs of reversal. Nvidia China exposure remains a binary catalyst for stock volatility.

The broader implications? Chinese AI companies like Baidu, Alibaba, and ByteDance are accelerating domestic chip development, potentially creating long-term competitive threats to Nvidia’s AI monopoly.

Wall Street Analysis: Nvidia Stock Rating Remains Strong Despite Earnings Reaction

Nvidia stock analysis from institutional research suggests the post-earnings selloff represents a buying opportunity rather than fundamental weakness.

Hargreaves Lansdown’s Matt Britzman maintains bullish Nvidia stock forecast: “Smart long-term investors will look through the noise. Nvidia’s technological leadership in AI infrastructure remains unmatched.”

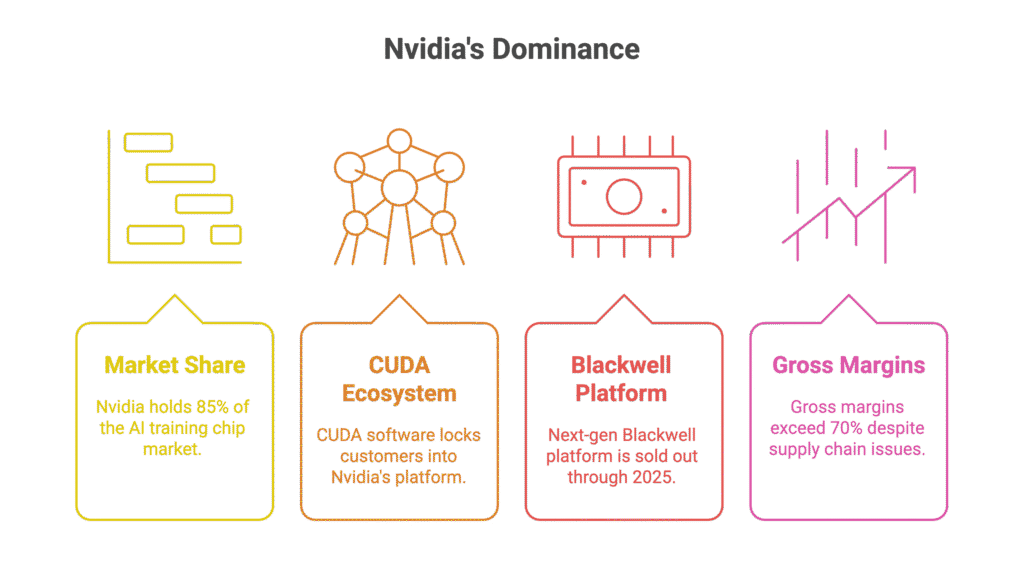

Morgan Stanley, Goldman Sachs, and Bank of America maintain Buy ratings on NVDA stock, citing several competitive advantages:

- 85% market share in AI training chips

- CUDA software ecosystem creating customer lock-in

- Next-gen Blackwell platform sold out through 2025

- Gross margins exceeding 70% despite supply chain pressures

Jensen Huang emphasised record Blackwell demand: “Production is ramping at full speed with extraordinary customer interest.” This suggests AI capex spending from Big Tech remains robust despite macroeconomic headwinds.

Nvidia stock price target consensus sits at $150-$180, implying 25-40% upside from current levels.

Nvidia Investment Thesis: AI Stock Opportunity vs Geopolitical Risk Assessment

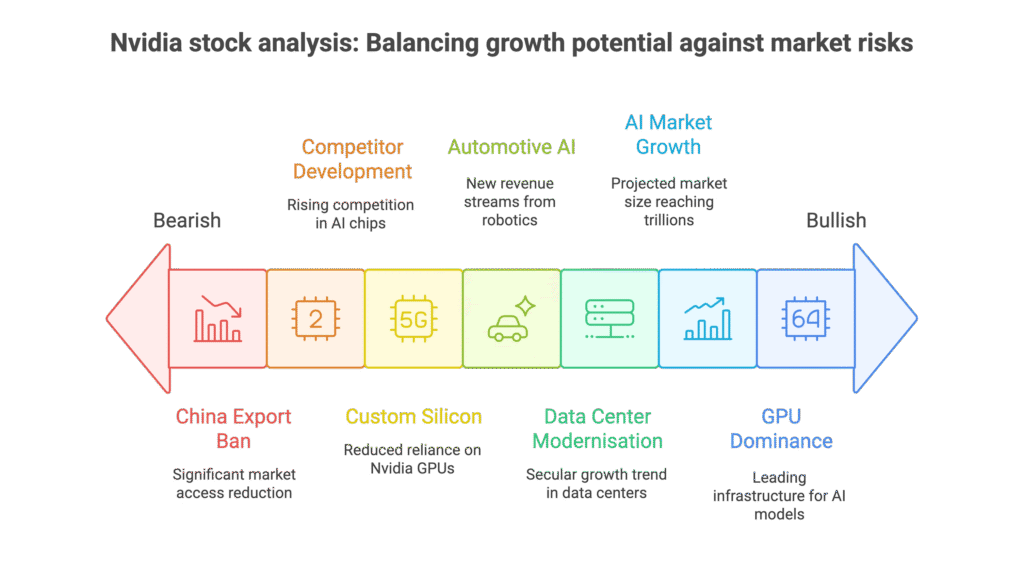

NVDA investment outlook presents a classic risk-reward scenario. Nvidia stock valuation reflects both massive AI opportunity and China regulatory overhang.

Bull case for Nvidia stock:

- AI market size projected to reach $1.8 trillion by 2030

- Nvidia GPU dominance in ChatGPT, Claude, and Gemini infrastructure

- Data center modernisation driving secular growth trend

- Automotive AI and robotics creating new revenue streams

Bear case considerations:

- China export ban removes 20% of addressable market

- AMD and Intel developing competitive AI chips

- Custom silicon from Google TPU, Amazon Trainium reducing Nvidia dependence

- AI bubble concerns among growth stock investors

For buy-and-hold investors, Nvidia’s technological moat and first-mover advantage in generative AI infrastructure remain compelling. However, position sizing should account for regulatory volatility until US-China relations stabilize.

NVDA stock recommendation: Strong Buy with 10-15% portfolio allocation maximum given concentration risk in single-stock exposure.

FAQ

Q1: Why did Nvidia stock fall despite beating earnings expectations?

A: Investors were spooked by the exclusion of China from future guidance and data center revenue barely missing estimates. At Nvidia’s high valuation, even small misses or uncertainties can trigger selloffs.

Q2: How much revenue is Nvidia losing from China restrictions?

A: CEO Jensen Huang pegged the China market at $50 billion, which is now “effectively closed” to Nvidia. They sold zero H20 chips to China this quarter due to US export curbs.

Q3: Are Nvidia’s AI chip sales still growing?

A: Absolutely. Data center revenue hit $41.1bn (up 50% year-over-year), and demand for their next-gen Blackwell chips remains “extraordinary” according to CEO Jensen Huang.

Q4: Should investors be worried about Nvidia’s long-term prospects?

A: The fundamentals remain strong with the AI boom continuing and Nvidia maintaining market dominance. However, geopolitical tensions create near-term uncertainty that could impact growth.

Q5: What’s Nvidia’s guidance for next quarter?

A: They’re forecasting $52.9bn–$55.1bn for Q3, but this excludes any potential China sales. Some analysts had expected closer to $60bn including resumed Chinese business.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.