Norway’s record-breaking £10bn warship order from BAE Systems has triggered the biggest UK defence stock rally of 2025. The Norwegian government’s decision to purchase five Type 26 frigates represents Britain’s largest-ever warship export deal by value, sending defence companies like BAE Systems, Rolls-Royce, and Babcock surging on Monday’s trading session.

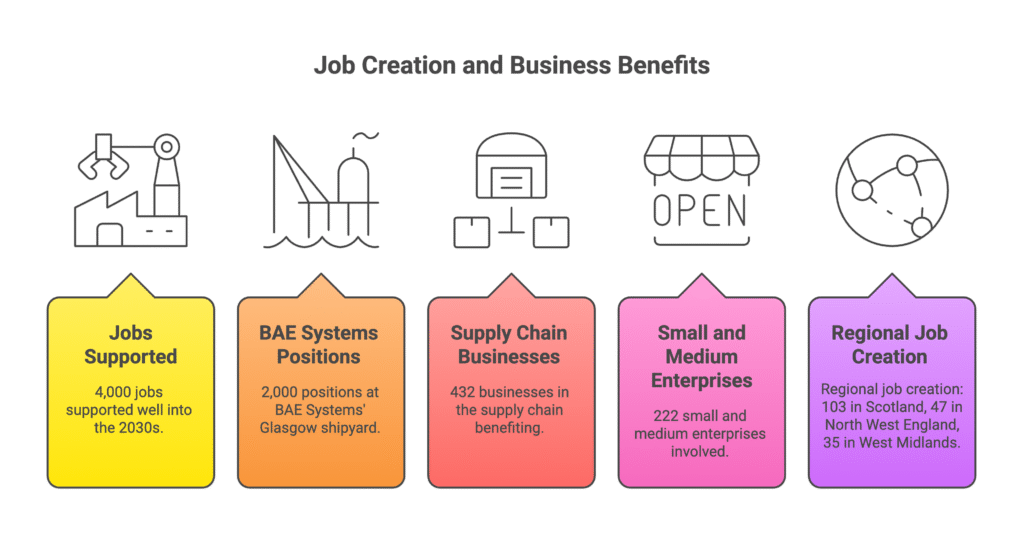

This massive defence contract will create 4,000 UK jobs well into the 2030s and highlights how European NATO members are ramping up military spending amid rising geopolitical tensions.

BAE Systems Leads UK Defence Stock Rally

BAE Systems shares jumped nearly 2% on Monday after Norway confirmed its commitment to the Type 26 Global Combat Ship programme. The £10bn warship deal will support 2,000 jobs at BAE’s Glasgow shipyard alone, where construction for eight other Royal Navy frigates is already underway.

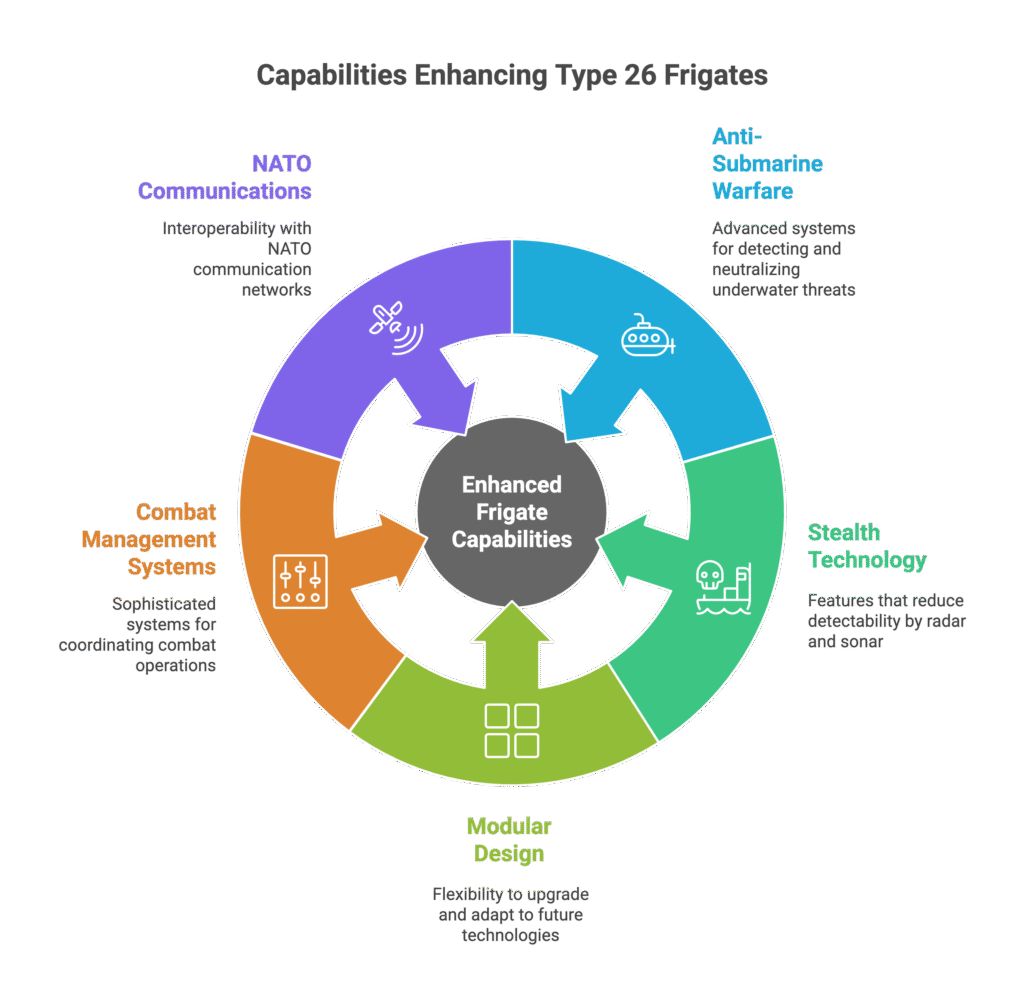

The Type 26 features sophisticated weapons, advanced sensors and cutting-edge communications, with a flexible design that enables future upgrades to counter emerging threats. Norway’s Prime Minister called the UK “our most strategic partner” for defence procurement, citing superior British warship technology.

This Norwegian contract proves how Europe’s military buildup directly benefits British defence companies. As defence spending across NATO allies increases, UK manufacturers are winning lucrative international contracts.

UK Defence Stocks Dominating 2025 Performance

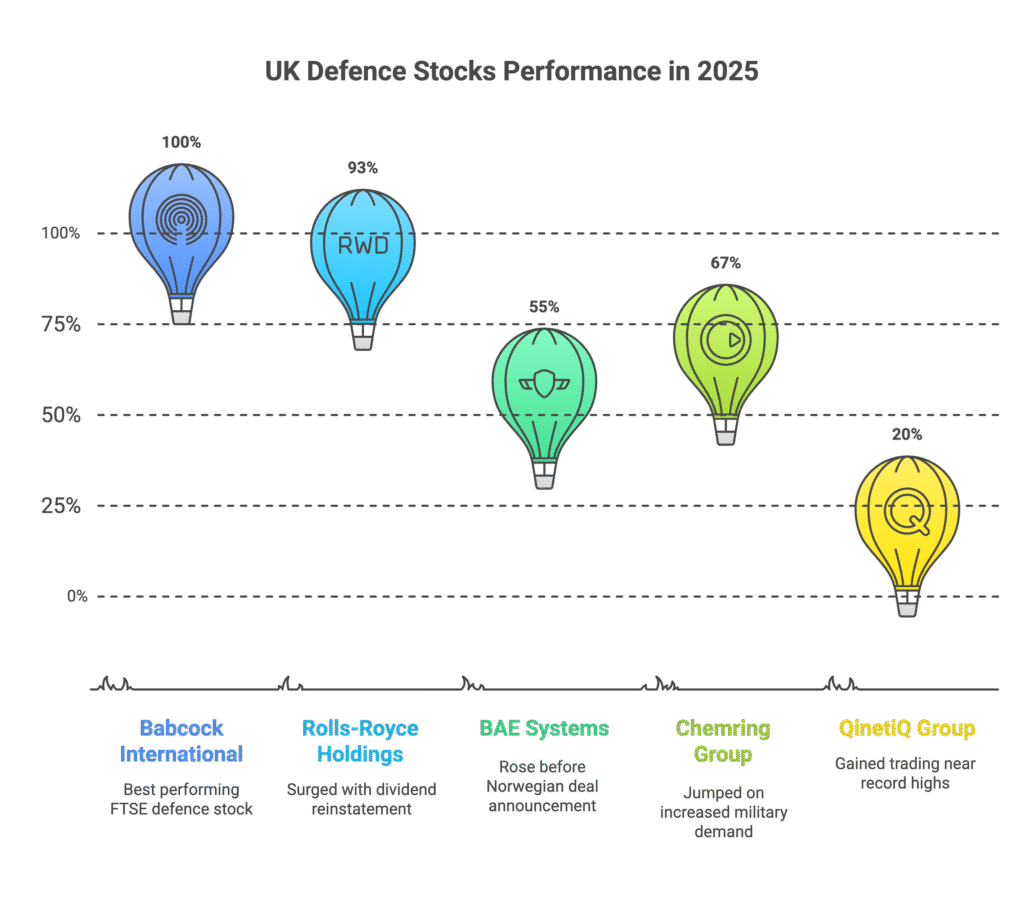

British defence stocks are posting exceptional gains in 2025:

- Babcock International: Up over 100% year-to-date (best performing FTSE defence stock)

- Rolls-Royce Holdings: Surged 93% with recent dividend reinstated

- BAE Systems: Rose 55% before Monday’s Norwegian deal announcement

- Chemring Group: Jumped 67% on increased military demand

- QinetiQ Group: Gained 20% trading near record highs

Defence stocks have outperformed broader markets as European NATO members rapidly increase military spending due to ongoing Russian threats and pressure from the US to contribute more to collective defence. Peel Hunt analysts upgraded Babcock’s target price from 828p to 1,119p, citing the transition “from decades of cost-down to output-based budgets.”

Why UK Defence Exports Are Booming in 2025

NATO spending commitments are driving unprecedented demand. Following pressure from the US in 2025, European nations are beginning to increase their annual defence spending, driving up near-term demand from leading defence businesses.

The UK government has committed to increasing defence spending to 2.5% of GDP by 2027, with plans to reach 3% in the next parliament. Chancellor Rachel Reeves announced a £2.2bn boost to the Ministry of Defence budget, targeting new technologies like drones and AI.

International warship export opportunities are expanding rapidly. The Norwegian deal follows successful Type 26 exports to Australia (£20bn deal) and Canada (15-ship programme), demonstrating global demand for British naval technology.

Type 26 Frigates: World-Class Anti-Submarine Warfare

The Type 26 Global Combat Ship represents cutting-edge naval technology designed for North Atlantic operations. Each Type 26 will have a design life of 30 years, weighing just shy of 8,000 tonnes when fully loaded.

Key Type 26 capabilities include:

- Advanced anti-submarine warfare systems

- Stealth technology for reduced detection

- Modular design enabling future upgrades

- Sophisticated combat management systems

- NATO-compatible communications networks

The basic requirement of the Type 26 is to hold a Russian submarine at risk in the North Atlantic, making it ideal for Norway’s maritime defence needs.

Impact on UK Defence Manufacturing Jobs

The Norwegian warship contract will create significant employment across Britain:

- 4,000 jobs supported well into the 2030s

- 2,000 positions at BAE Systems’ Glasgow shipyard

- 432 businesses in the supply chain benefiting

- 222 small and medium enterprises involved

- Regional job creation: 103 in Scotland, 47 in North West England, 35 in West Midlands

This follows BAE Systems’ recent £285m combat management systems contract, sustaining over 200 additional UK jobs across multiple sites.

Investment Outlook for UK Defence Stocks

Defence sector analysts remain bullish on long-term prospects. Jean Roche, fund manager of Schroder UK Mid Cap, describes the current environment as “the start of a defence growth super-cycle”.

The HANetf Future of Defence ETF and other defence-focused funds are attracting significant investor interest. Investment trusts like Law Debenture Corporation and Invesco Global Equity Income Trust now hold over 5% of assets in defence stocks.

Key investment drivers include:

- European rearmament programmes worth hundreds of billions

- Long-term government contracts providing revenue stability

- Growing cybersecurity and AI defence spending

- Export opportunities to NATO allies and partners

FAQ

Q1: How significant is Norway’s £10bn warship order for UK exports?

A: It’s the UK’s largest-ever warship export deal by value and Norway’s biggest defence procurement contract. The deal demonstrates Britain’s competitive advantage in naval technology and strengthens the UK’s position in global defence markets.

Q2: Which UK defence stocks have performed best in 2025?

A: Babcock leads with over 100% gains, followed by Rolls-Royce at 93%, Chemring at 67%, and BAE Systems at 55%. QinetiQ has also gained 20%, with all major UK defence companies outperforming broader market indices.

Q3: Why are European countries increasing defence spending?

A: NATO members are responding to increased Russian threats and US pressure to meet 2.5% GDP defence spending targets. The war in Ukraine has accelerated European rearmament programmes, creating demand for advanced military technology.

Q4: What makes the Type 26 frigate attractive to international buyers?

A: The Type 26 offers world-class anti-submarine warfare capabilities, stealth technology, modular design for future upgrades, and proven Royal Navy pedigree. Its acoustic quieting and advanced sensors make it ideal for modern naval operations.

Q5; How many jobs will the Norwegian deal create?

A: The contract will support 4,000 UK jobs well into the 2030s, including 2,000 at BAE Systems’ Glasgow shipyard. It will also benefit 432 businesses across the supply chain, with significant regional employment in Scotland, North West England, and West Midlands.

Q6: Are more international warship orders expected?

A: Very likely. The Type 26 design has already secured orders from Canada (15 ships) and Australia (9 ships), with other NATO allies evaluating the platform. BAE Systems expects to build one warship annually once production ramps up.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.