Gold Price Soars to New All-Time High of $3,616

Gold prices smashed through the $3,600 barrier on Monday, hitting a stunning new record of $3,616 as investors pile into the precious metal. This latest gold rally comes just days after the yellow metal crossed the $3,500 threshold, cementing its position as 2025’s standout safe-haven investment.

What’s driving gold to these historic heights? A storm of Trump’s escalating Federal Reserve battle, weak jobs data fueling interest rate cut expectations, and growing concerns over central bank independence. With gold prices averaging $3,675/oz by Q4 2025 according to J.P. Morgan forecasts, this rally shows no signs of slowing.

“Gold keeps delivering,” says Neil Wilson from Saxo Markets, capturing the sentiment driving institutional and retail investors alike towards precious metals.

Trump Fed Independence Controversy Fuels Gold Demand

The Trump administration’s unprecedented attack on Federal Reserve independence has become a major catalyst for gold investment. President Trump’s attempt to fire Fed Governor Lisa Cook represents the first time in US history a president has tried to remove a Federal Reserve official.

This political interference with monetary policy is sending shockwaves through financial markets. When Trump announced Cook’s dismissal, gold prices jumped 0.5% in a single trading session, with investors viewing political chaos as bullish for precious metals.

The White House hasn’t held back its criticism either. Press Secretary Karoline Leavitt blamed Fed Chair Jerome Powell for weak economic data, calling him “Too Late” and claiming his policies are sabotaging Trump’s economic agenda.

Interest Rate Cut Expectations Drive Gold Rally

Friday’s disappointing jobs report has dramatically increased the probability of Federal Reserve rate cuts. With only 22,000 jobs added in August and unemployment rising to 4.3%, traders are now betting heavily on monetary easing.

Gold price forecasts for 2025 range between $3,500-$3,800, with some analysts predicting peaks near $5,155 by 2030. The CME’s FedWatcher tool shows a nearly 90% probability of a 25 basis point rate reduction on 17th September.

Why Gold Thrives When Interest Rates Fall

Gold’s appeal intensifies during periods of falling interest rates because the precious metal doesn’t pay dividends or interest. When bonds and savings accounts offer lower returns, the opportunity cost of holding gold decreases significantly.

This dynamic explains why gold ETF demand was particularly strong in H1 2025, with notable inflows from all regions as investors position for a lower rate environment.

Mining Stocks Rally on Gold Price Surge

London’s gold mining sector is capitalising on record precious metal prices. Key performers include:

- Fresnillo: Up over 2% to 2,164.00p

- Hochschild Mining: Rallied 4%+ to 339.60p on the FTSE 250

Mining companies offer leveraged exposure to gold price movements, often delivering amplified returns when precious metal prices surge. However, they also carry additional operational risks that pure gold investments avoid.

Gold Investment Outlook: What’s Next?

With Trump’s Fed confrontation escalating and economic data showing weakness, multiple factors support continued gold strength:

Bullish Factors:

- Persistent central bank buying (projected 900 tonnes in 2025)

- US dollar weakness and geopolitical uncertainty

- Inflation concerns and monetary policy uncertainty

- Growing institutional adoption of gold ETFs

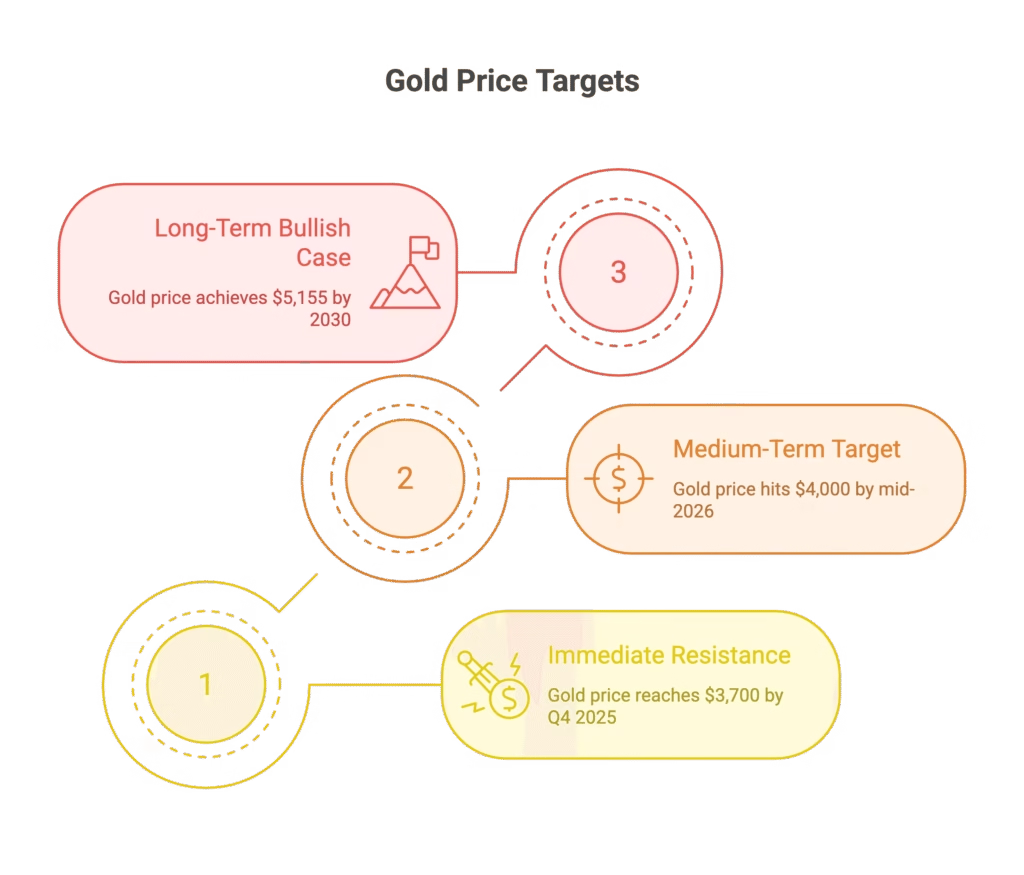

Key Price Levels to Watch:

- Immediate resistance: $3,700 (Q4 2025 target)

- Medium-term target: $4,000 by mid-2026

- Long-term bullish case: $5,155 by 2030

For investors considering gold exposure, options include physical gold, ETFs, and mining stocks, each offering different risk-reward profiles in this volatile environment.

Frequently Asked Questions

Q1: Why is gold hitting record highs in 2025?

A: Multiple factors are driving gold to new records: Trump’s attacks on Fed independence, weak jobs data increasing rate cut odds, persistent geopolitical uncertainty, and strong central bank buying. Gold has risen 26% in the first half of 2025 alone.

Q2: How do Federal Reserve rate cuts affect gold prices?

A: Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold. When bonds and savings accounts pay less, investors become more willing to own gold, which doesn’t pay interest but offers inflation protection and capital appreciation potential.

Q3: Should I buy gold mining stocks or physical gold?

A: Mining stocks offer leveraged exposure to gold prices with higher potential returns but greater volatility and operational risks. Physical gold provides direct exposure with lower volatility. Many investors diversify across both for balanced precious metals exposure.

Q4: What are expert gold price predictions for 2025-2026?

A: Major institutions forecast gold averaging $3,675/oz by Q4 2025 (J.P. Morgan) with targets near $4,000 by mid-2026. Long-term forecasts suggest potential peaks of $5,155 by 2030, driven by continued monetary uncertainty and geopolitical risks.

Q5: How does Trump’s Fed battle impact gold investment strategy?

A: Political interference with central bank independence creates monetary policy uncertainty, traditionally bullish for gold. If Trump gains Fed control and cuts rates aggressively, gold could benefit from currency debasement fears and inflation expectations.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.