Here’s a shocking fact: 8.3 million Brits will pay higher income tax by 2029—even without a promotion. This fiscal drag phenomenon is the UK government’s favourite stealth tax, set to cost taxpayers billions through frozen tax thresholds.

Think you’re safe because your salary hasn’t changed? Think again. Fiscal drag happens when your earnings rise but income tax bands stay frozen, dragging you into higher tax brackets. With thresholds frozen until 2028, even modest pay rises trigger significant tax increases.

What Is Fiscal Drag? Understanding the UK’s Stealth Tax

Fiscal drag occurs when your earnings increase but tax thresholds remain frozen, pushing you into higher income tax brackets. It’s like a financial escalator you can’t get off—your pay goes up, but the tax bands stay exactly where they were years ago.

The UK’s income tax thresholds have been frozen since 2021 and won’t move until 2028. If you’re earning just under the £50,270 higher-rate tax threshold, any pay rise puts you straight into 40% tax territory.

This stealth tax happens gradually, which is why millions of taxpayers don’t see it coming until their tax bill arrives.

Fiscal Drag Tax Impact: How Much More Will You Pay?

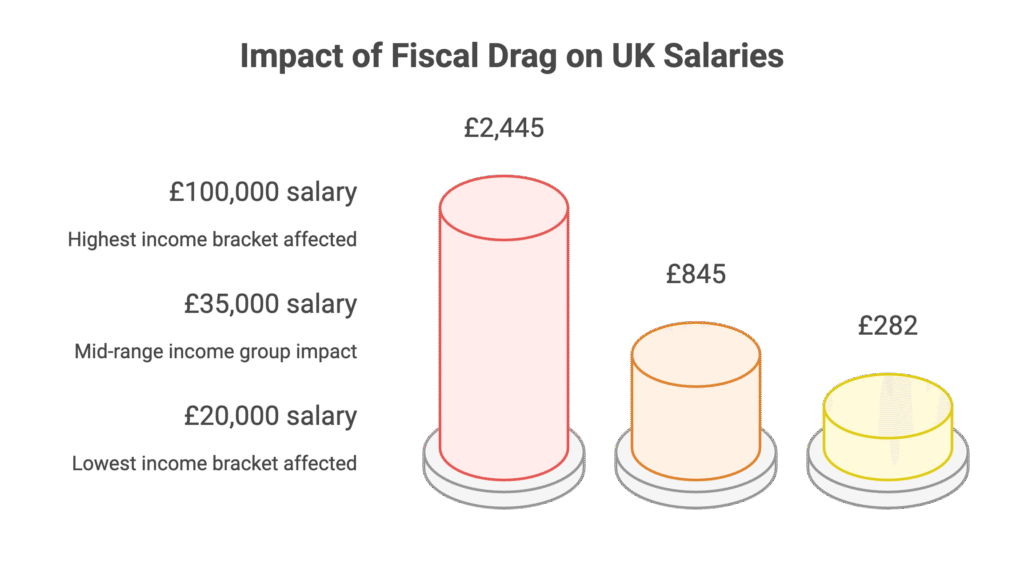

The fiscal drag effect will hit different income levels hard. According to Interactive Investor data, here’s what frozen tax thresholds will cost UK taxpayers annually until 2028:

- £100,000 salary: Extra £2,445 per year in income tax

- £35,000 salary: Additional £845 annual tax bill

- £20,000 salary: Extra £282 yearly tax burden

“The freeze on income tax thresholds means more people will be dragged into higher tax brackets,” explains Myron Jobson from Interactive Investor. Even modest salary increases now trigger substantial tax rises due to fiscal drag.

Higher earners face the biggest impact, with some paying 60% tax rates on earnings over £100,000.

How to Avoid Fiscal Drag: Tax-Efficient Strategies

Increase Pension Contributions to Reduce Taxable Income

The most effective way to avoid fiscal drag is increasing your pension contributions. This reduces your taxable income while building retirement savings—a win-win tax planning strategy.

Salary sacrifice schemes work particularly well for avoiding higher tax brackets. Instead of receiving salary (and paying tax), you divert money straight into your pension. Your gross salary drops, reducing both income tax and National Insurance contributions.

This tax avoidance strategy works especially well for high earners approaching the 60% tax rate on earnings over £100,000.

Remember: The annual pension allowance is £60,000. Exceed this limit and you’ll face tax charges on the excess. Self-invested personal pensions (SIPPs) count towards this allowance alongside workplace pensions.

Maximise ISA Allowances for Tax-Free Growth

Your £20,000 annual ISA allowance offers complete tax relief on investment growth and interest—making ISAs powerful tools against fiscal drag.

Directing an extra £5,000 annually into ISAs shields money from future tax increases.

Fiscal Drag Planning: Key Takeaways for UK Taxpayers

Fiscal drag isn’t disappearing until 2028, making proactive tax planning essential. Whether you’re maximising pension contributions through salary sacrifice or utilising ISA allowances, small tax-efficient moves now prevent thousands in additional tax bills.

With frozen income tax thresholds affecting 8.3 million taxpayers, understanding fiscal drag and implementing tax avoidance strategies has never been more crucial.

Start planning your fiscal drag defence today—your future self will thank you.

Frequently Asked Questions About Fiscal Drag

Q1: When will UK tax thresholds increase again after the fiscal drag period?

A: Income tax thresholds are frozen until April 2028. After this, they should rise with inflation again, though the government could extend the freeze.

Q2: Can self-employed workers use salary sacrifice to avoid fiscal drag?

A: No, salary sacrifice only works for PAYE employees. Self-employed individuals must focus on pension contributions and ISA maximisation to reduce fiscal drag impact.

Q3: What’s the maximum I can salary sacrifice without triggering fiscal drag issues?

A: You must receive at least minimum wage after salary sacrifice. The practical limit is your £60,000 annual pension allowance, beyond which you’ll face tax charges.

Q4: What happens if I exceed the £60,000 pension allowance while avoiding fiscal drag?

A: You’ll pay tax charges on excess contributions. The government claws back tax relief you shouldn’t have received, potentially costing more than fiscal drag itself.

Q5: Should I prioritise pension contributions or ISAs for fiscal drag tax planning?

A: Pension contributions offer immediate income tax relief, making them more effective against fiscal drag. ISAs provide tax-free growth but don’t reduce your current taxable income.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.