The Great Crypto Flip That Lasted Hours

Remember when Solana had its moment in the sun? For a few glorious hours in late June, SOL muscled past BNB to claim the fifth spot in crypto rankings. At $200 per coin and a whopping $107 billion market cap, it looked like Solana was finally getting the respect it deserved.

That victory lap however, was shorter than a Hobbit. SOL quickly tumbled below $190, and BNB reclaimed its throne. Yet before you write off Solana’s comeback story, the DeFi numbers tell a different tale. This race is far from over.

DeFi Metrics Show Solana’s Real Strength

TVL Stays Strong Despite Price Drops

Here’s what caught my attention: whilst Solana’s price took a hit, its DeFi ecosystem barely flinched. The total value locked (TVL) stayed above $10 billion even as SOL’s price corrected. That signals genuine underlying demand.

The Revenue Reality Check

The original data shows some inconsistencies, but what’s clear is that Solana’s DeFi ecosystem generates significantly more activity and value than BNB’s more limited DeFi presence.

Meanwhile, BNB’s DeFi scene looks pretty quiet with just $6.832 billion in TVL. It’s like comparing a bustling marketplace to a corner shop.

Why BNB Keeps Fighting Back

The Binance Advantage

But here’s BNB’s secret weapon: it’s got Binance in its corner. Every time someone trades on the world’s largest crypto exchange, those fees get funnelled into BNB token burns. It’s like having a built-in scarcity machine that doesn’t care about market sentiment.

Binance’s market share has stayed rock-solid against both centralised and decentralised competitors. As long as people keep trading crypto (spoiler: they will), BNB gets that steady demand boost.

The Path to $200: What Needs to Happen

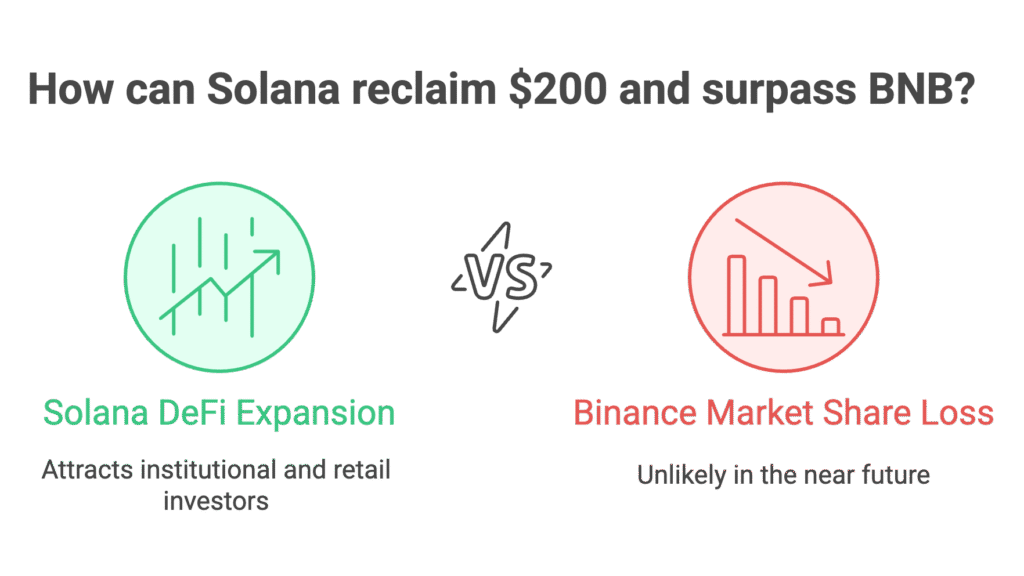

For Solana to reclaim $200 and flip BNB permanently, we’d need to see one of two things:

Option A: Solana’s DeFi ecosystem explodes even further, pulling in more institutional money and retail investors who actually use the network.

Option B: Binance loses significant market share to DeFi platforms – which, let’s be honest, isn’t happening anytime soon.

The Bottom Line

Solana’s brief moment above BNB wasn’t just a fluke. The strong DeFi fundamentals show there’s real substance behind the hype. Whilst BNB has its Binance safety net, Solana’s building an ecosystem that doesn’t need permission from any single exchange.

Will SOL hit $200 again? The DeFi metrics suggest it’s more of a “when” than an “if” question. But taking down BNB permanently? That’s a tougher battle that’ll require more than just strong fundamentals.

FAQ

Q1: Why did Solana’s price drop so quickly after hitting $200?

A: Crypto markets are volatile, and profit-taking is common at psychological levels like $200. The key is that Solana’s DeFi ecosystem stayed strong despite the price correction, showing genuine user adoption.

Q2: Is Solana’s DeFi TVL more important than its price?

A: TVL reflects actual usage and demand for the network’s services, whilst price can be driven by speculation. A high TVL with temporarily lower prices often suggests a buying opportunity for long-term investors.

Q3: Can BNB maintain its position without Binance’s support?

A: BNB’s value is closely tied to Binance’s success and token burn mechanism. Without the exchange’s backing, BNB would likely struggle to compete with more decentralised alternatives like Solana.

Q4: What would it take for Solana to permanently overtake BNB?

A: Solana would need sustained DeFi growth, institutional adoption, or a significant decline in Binance’s market dominance. The strong fundamentals are there, but timing and market conditions matter.

Q5: Should investors focus on SOL or BNB for the next bull run?

A: Both have different risk profiles. SOL offers more upside potential through DeFi growth, whilst BNB provides steadier returns tied to Binance’s trading volumes. Diversification between both could be the smart play.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.