Well, well, well. Bitcoin just crashed through $118,000 and nobody’s talking about it enough. On Sunday, July 13th, the world’s favourite digital currency hit $119,444 before settling at $118,724, officially making it more valuable than all the silver on Earth. Yep, believe it.

Bitcoin’s market cap now sits at $2.361 trillion, putting it in sixth place among the world’s most valuable assets. And Amazon? They’re nervously looking over their prime shoulders at just $2.388 trillion. We’re talking about a gap so small, one good rally could flip the order. So what does this mean for investors — and should you care if you’ve never bought crypto before?

The Race to the Top: Where Bitcoin Stands Now

Bitcoin vs. The Corporate Giants

Let’s break this down in terms anyone can understand. Market cap is basically the total value of all Bitcoin in existence (or all shares of a company).

Right now, Bitcoin has officially:

- Surpassed silver’s $2.199 trillion valuation (bye-bye, boomer hedge!)

- Nearly caught Amazon at $2.388 trillion

- Set its sights on the really big fish ahead

But here’s the Nando’s Extra Hot sauce. Bitcoin only needs to hit $120,051 per coin to overtake Amazon. That’s less than a 2% jump from where we are now. The catch? That $120,000 mark is what traders call a “psychological barrier” — essentially, it’s a round number that makes people either chicken out or FOMO in hard.

The Mountain Ahead: What Bitcoin Needs to Conquer

Want to know what it’ll take for Bitcoin to keep climbing the leaderboard? Buckle in:

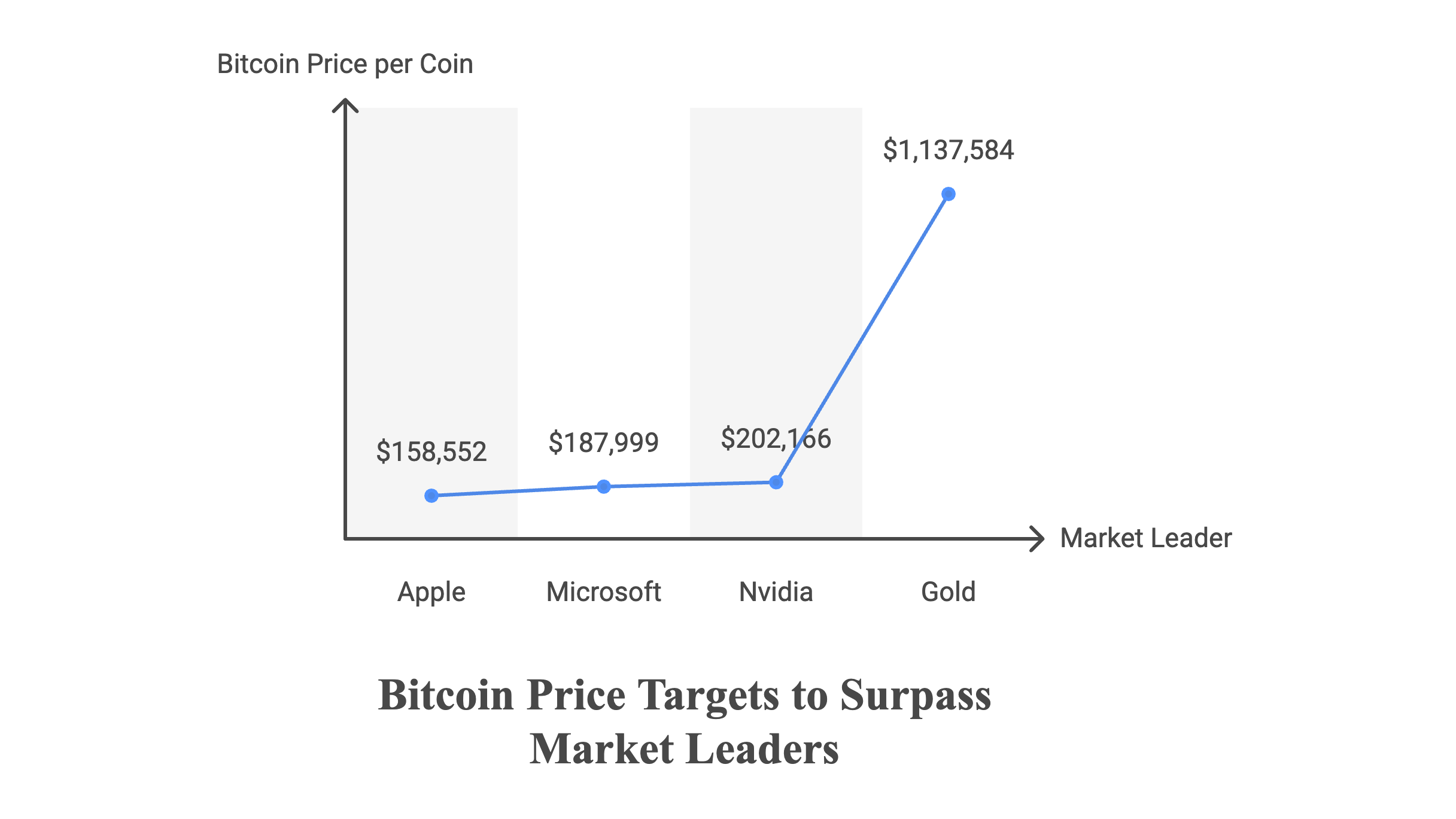

- To beat Apple (4th place, $3.153 trillion): Bitcoin needs to hit $158,552 per coin

- To overtake Microsoft (3rd place, $3.740 trillion): We’re looking at $187,999 per coin

- To dethrone Nvidia (2nd place): Bitcoin would need to reach $202,166

- To become the ultimate champion and beat gold ($22.632 trillion): Hold onto your breakfast — $1,137,584 per coin

That last number sounds absolutely nutty, right? Well…

The Million-Dollar Bitcoin Club: Who’s Betting Big

Some of the smartest (or craziest, depending on your perspective) money managers in the world genuinely believe Bitcoin will hit $1 million someday. We’re not talking about random Reddit users here — these are heavyweight investors:

- Cathie Wood (Ark Invest): The queen of disruptive tech investing

- Michael Saylor (MicroStrategy): Literally bet his entire company on Bitcoin

- Mike Novogratz (Galaxy Digital): Former Wall Street titan turned crypto evangelist

- Arthur Hayes (BitMEX founder): The derivatives king who’s seen it all

- CZ (Binance co-founder): Built the world’s biggest crypto exchange

These folks aren’t just throwing darts at a board. They see Bitcoin as digital gold on steroids — scarce, decentralised, and increasingly adopted by everyone from El Salvador to Tesla.

What This Actually Means for Regular Investors

The Good News

If you’re sitting on the sidelines wondering if you’ve missed the boat — relax. Bitcoin beating silver isn’t just a vanity metric. It signals mainstream acceptance that even your sceptical cousin at family gatherings can’t ignore anymore. When an asset becomes the 6th most valuable thing on the planet, institutions pay attention, regulations get clearer, and adoption accelerates.

The Reality Check

Let’s keep our feet on the ground however. Bitcoin’s volatility hasn’t gone anywhere. That climb to $119,444? It could reverse just as quickly. The cryptocurrency market operates 24/7, unlike stocks, which means you could wake up to drastically different prices — for better or worse. Been there…

Should You Jump In?

Here’s a thought: Bitcoin at $118,000 sounds expensive, but people said the same thing at $1,000, $10,000, and $50,000. The question isn’t really about the price — it’s about whether you believe in the technology and can stomach the roller coaster ride.

If you’re curious but cautious:

- Start small (like, really small — even £10 works)

- Only invest what you can afford to lose

- Consider pound-cost averaging (buying a little bit regularly)

- Do your homework beyond this article

The Road Ahead: What Could Push Bitcoin Higher?

Several factors could propel Bitcoin past Amazon and beyond:

- Institutional adoption: More companies adding Bitcoin to their balance sheets

- ETF approvals: Making it easier for regular investors to buy in

- Inflation concerns: People seeking alternatives to traditional currencies

- Technological improvements: Making Bitcoin faster and cheaper to use

- Global economic uncertainty: Driving demand for “digital gold”

Conclusion

Bitcoin surpassing silver and threatening Amazon isn’t just another crypto headline — it’s a watershed moment that shows how far this “internet money” has come. Whether it hits $120,000 tomorrow or takes a breather, one thing’s clear: Bitcoin has graduated from experimental technology to a legitimate asset class that’s reshaping how we think about money.

The million-dollar question (literally) is whether you’ll be watching from the sidelines or taking part in what could be the greatest wealth transfer of our generation. Either way, keep your eyes on that $120,000 level — because when Bitcoin breaks through psychological barriers, things tend to get wild fast.

Want to stay updated on Bitcoin’s race to overtake Amazon? Subscribe to our newsletter for weekly market insights that won’t put you to sleep.

FAQ Section

Q1: Is Bitcoin really more valuable than silver now?

A: Yes! Bitcoin’s total market cap ($2.361 trillion) has officially surpassed all the silver in the world ($2.199 trillion). This means if you added up all Bitcoin vs. all silver, Bitcoin would be worth more — though individual silver bars are obviously still cheaper than one Bitcoin!

Q2: How realistic is Bitcoin hitting $1 million per coin?

A: While it sounds crazy, prominent investors like Cathie Wood and Michael Saylor believe it’s possible long-term. For context, Bitcoin would need to reach about half of gold’s current market cap to hit $1 million. It’s ambitious but not mathematically impossible given Bitcoin’s historical growth.

Q3: Should beginners buy Bitcoin at these high prices?

A: The price itself matters less than your personal financial situation and risk tolerance. Many platforms now let you buy tiny fractions of Bitcoin (like £10 worth), so you don’t need $118,000 to get started. Never invest more than you can afford to lose, and consider starting small to learn the ropes.

Q4: What’s a psychological barrier and why does $120,000 matter?

A: Psychological barriers are round numbers that traders fixate on (like $100,000 or $120,000). They often trigger massive buying or selling because humans love round numbers. Breaking through these levels can spark momentum in either direction — think of them as invisible walls in the market.

Q5: How does Bitcoin’s market cap compare to traditional stocks?

A: Bitcoin operates more like a commodity (think gold) than a stock. While Amazon’s value comes from its business operations and profits, Bitcoin’s value comes from scarcity, network effects, and its use as a store of value or payment method. Comparing them is useful for scale but remember they’re fundamentally different assets.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.