$200M Bitcoin Infrastructure SPAC (BIXIU) Launches Amid Crypto IPO Boom

The cryptocurrency SPAC market exploded last week with $575 million raised across multiple blockchain acquisition vehicles. Leading the charge is Bitcoin Infrastructure Acquisition Corp (NASDAQ: BIXIU), a $200 million crypto SPAC targeting established digital asset companies for public listings.

This Bitcoin SPAC isn’t chasing speculative crypto tokens. Led by Lightning Network veteran Ryan Gentry, BIXIU specifically hunts crypto infrastructure companies—the essential blockchain businesses powering DeFi protocols, cryptocurrency exchanges, and Web3 applications that institutional investors actually want to own.

With major cryptocurrency IPOs like Circle Internet Group and Bullish proving public market appetite for quality blockchain stocks, this crypto infrastructure SPAC could deliver the next wave of profitable digital asset investments.

BIXIU Stock: Meet the Bitcoin SPAC Leadership Team

Ryan Gentry: CEO and Crypto Infrastructure Expert

Ryan Gentry brings unmatched cryptocurrency infrastructure credentials to this blockchain SPAC. As former business development lead at Lightning Labs for five years, Gentry helped build Bitcoin’s Lightning Network—the layer-2 scaling solution processing millions in crypto transactions daily.

Before Lightning Labs, Gentry spent two years analysing crypto investments at Multicoin Capital, a venture firm that’s reportedly partnering with Galaxy Digital and Jump Crypto to raise $1 billion for a Solana treasury acquisition. This combination of building and investing experience makes Gentry uniquely qualified to evaluate crypto infrastructure targets.

Jim DeAngelis: CFO with Crypto Market Experience

Jim DeAngelis joins from Kroll as Chief Financial Officer, bringing traditional finance expertise with deep crypto market understanding. Notably, Kroll serves as claims agent in major cryptocurrency bankruptcies including FTX, BlockFi, and Genesis—giving DeAngelis firsthand knowledge of both crypto opportunities and risks.

Vikas Mittal: Director with Proven Crypto SPAC Success

Vikas Mittal completed two successful crypto SPAC deals, including taking Bitcoin Depot (crypto ATM operator) public in 2023. This week, Mittal’s CSLM Digital Asset Acquisition Corp III closed a $230 million crypto SPAC IPO, demonstrating his ability to execute blockchain acquisitions in volatile markets.

Bitcoin Infrastructure SPAC Board: Cryptocurrency Industry All-Stars

BIXIU’s board features proven crypto infrastructure veterans:

Parker White (Chairman): Former Kraken engineering director, now operating chief at DeFi Development Corporation—a real estate firm turned Solana-buying company

Matt Lohstroh: Co-founder of crypto mining company Giga Energy

Tyler Evans: Co-founder of Bitcoin Magazine publisher BTC Inc and Bitcoin-focused investment firm UTXO Management

Evans recently joined healthcare firm Kindly MD, which merged with Bitcoin holding company Nakamoto Holdings and announced plans to raise $5 billion for cryptocurrency investments. This board combines technical crypto expertise with proven business execution.

BIXIU SPAC Target Companies: Premium Crypto Infrastructure Assets

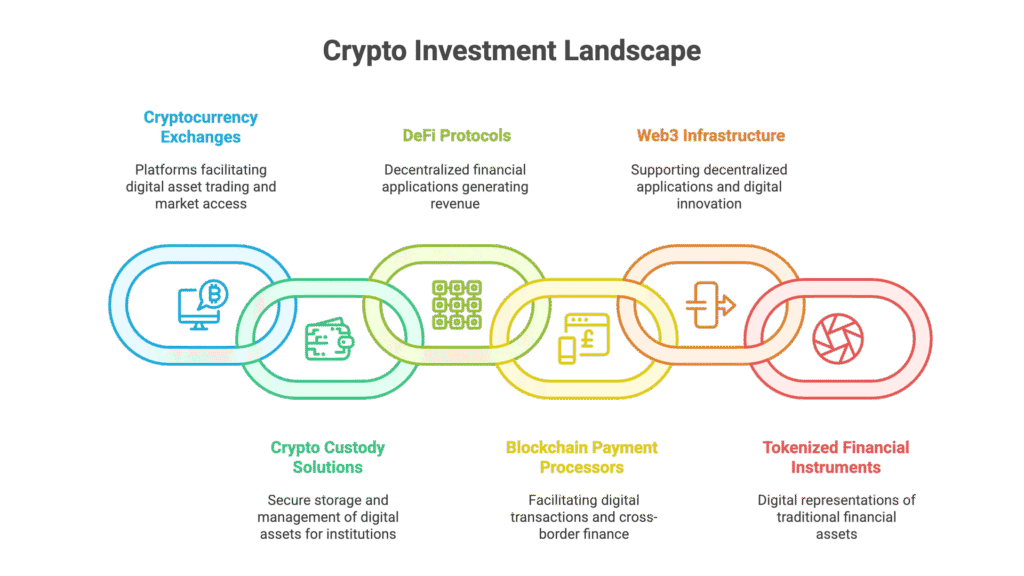

Bitcoin Infrastructure SPAC’s acquisition strategy focuses on profitable cryptocurrency infrastructure rather than speculative blockchain projects:

Core Crypto Infrastructure Targets:

- Cryptocurrency exchanges and digital asset trading platforms

- Crypto custody solutions and institutional wallet providers

- DeFi protocols with proven revenue streams

- Blockchain payment processors and cross-border finance

- Web3 infrastructure and decentralised application platforms

- Tokenised financial instruments and digital securities

Geographic Focus:

BIXIU targets both US crypto companies and international blockchain businesses seeking Nasdaq listings. This global approach expands their addressable market beyond domestic cryptocurrency firms.

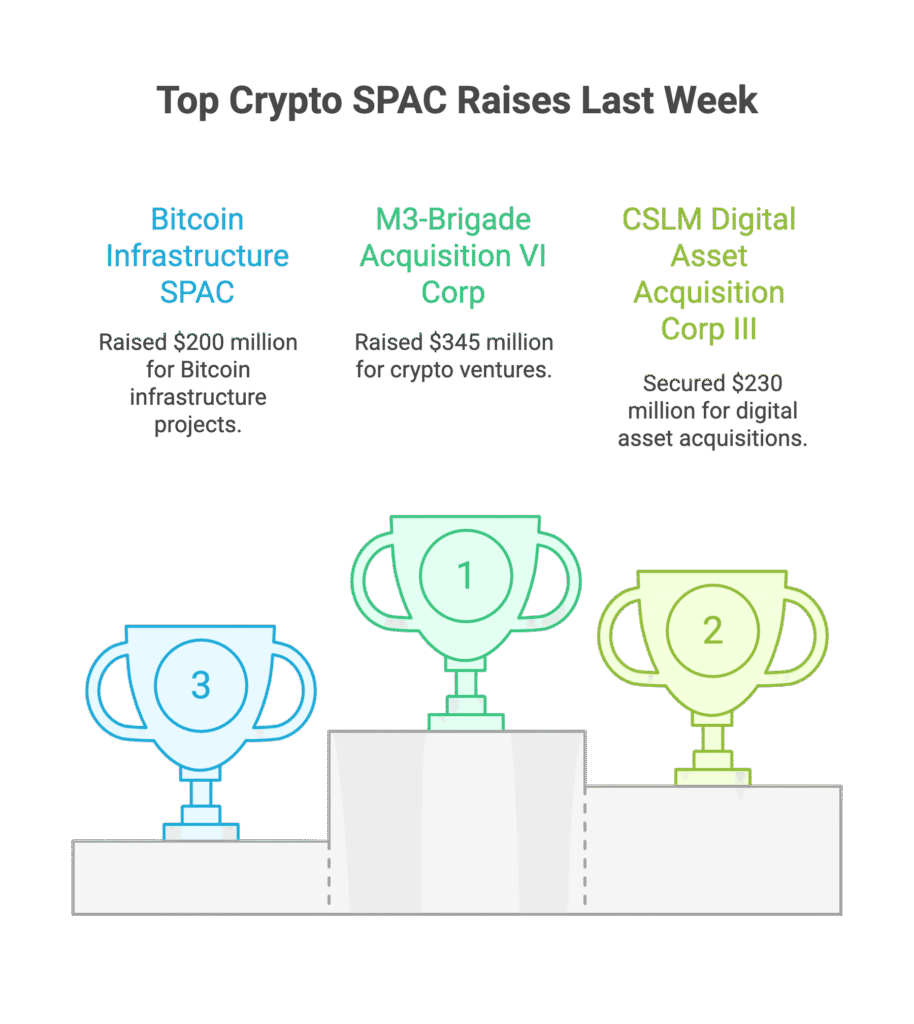

Crypto SPAC Market Analysis: $575M Fundraising Surge

The cryptocurrency SPAC market is experiencing unprecedented growth in 2025:

Last Week’s Crypto SPAC Raises:

- Bitcoin Infrastructure SPAC: $200 million

- CSLM Digital Asset Acquisition Corp III: $230 million

- M3-Brigade Acquisition VI Corp: $345 million

- Total: $775 million in 48 hours

Major 2024-2025 Crypto IPOs:

- Circle Internet Group (stablecoin issuer)

- Bullish (cryptocurrency exchange)

- Bitcoin Depot (crypto ATM network)

- ReserveOne (crypto asset management)

This validates investor appetite for established cryptocurrency businesses with real revenue, positioning BIXIU to target premium blockchain infrastructure assets.

BIXIU Stock Details: Trading Information and Investment Timeline

Bitcoin Infrastructure Acquisition Corp Trading:

- Ticker Symbol: BIXIU (Nasdaq)

- Share Price: $10.00 per share

- Total Shares: 20 million

- Market Cap: $200 million

- Domicile: Cayman Islands

- SPAC Timeline: 18-24 months to complete acquisition

Investment Thesis: With institutional crypto adoption accelerating and Bitcoin ETFs driving mainstream acceptance, BIXIU provides exposure to quality blockchain infrastructure before individual crypto company IPOs.

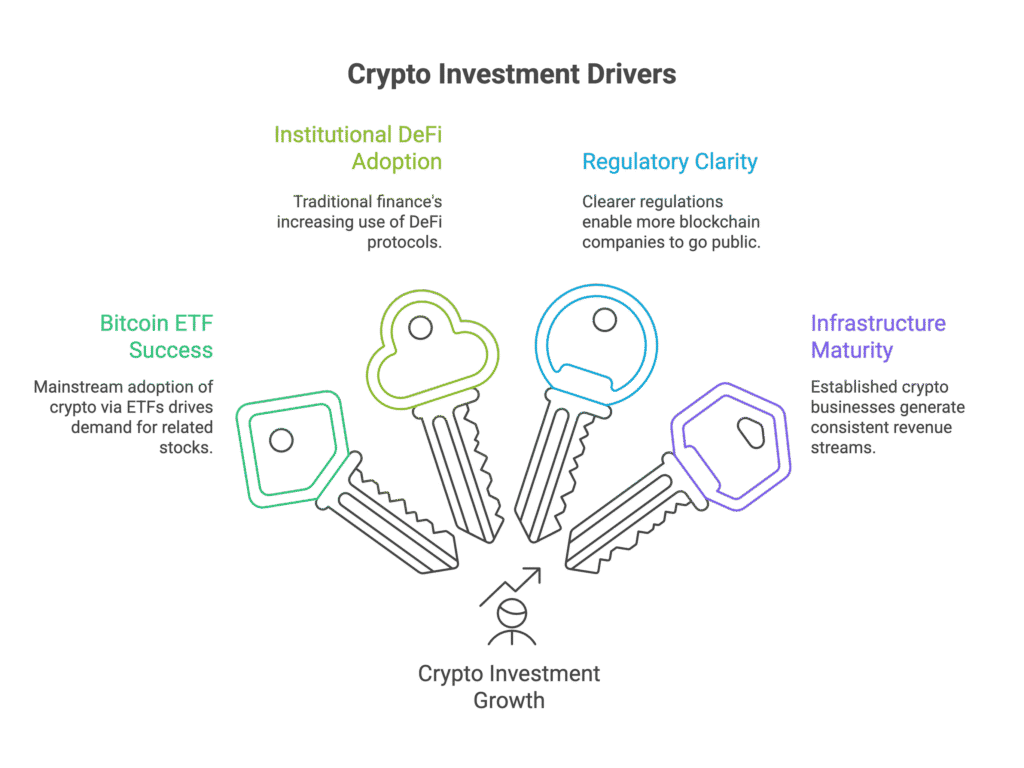

Crypto Market Timing: Why Bitcoin SPACs Are Hot Now

Several macroeconomic factors favour cryptocurrency SPAC investments in 2025:

- Bitcoin ETF Success: Mainstream crypto adoption via ETFs creates demand for related infrastructure stocks

- Institutional DeFi Adoption: Traditional finance increasingly uses decentralised finance protocols

- Regulatory Clarity: Clearer crypto regulations enable more blockchain companies to go public

- Infrastructure Maturity: Established crypto businesses now generate consistent revenue streams

BIXIU’s focus on profitable crypto infrastructure positions them to benefit from these tailwinds.

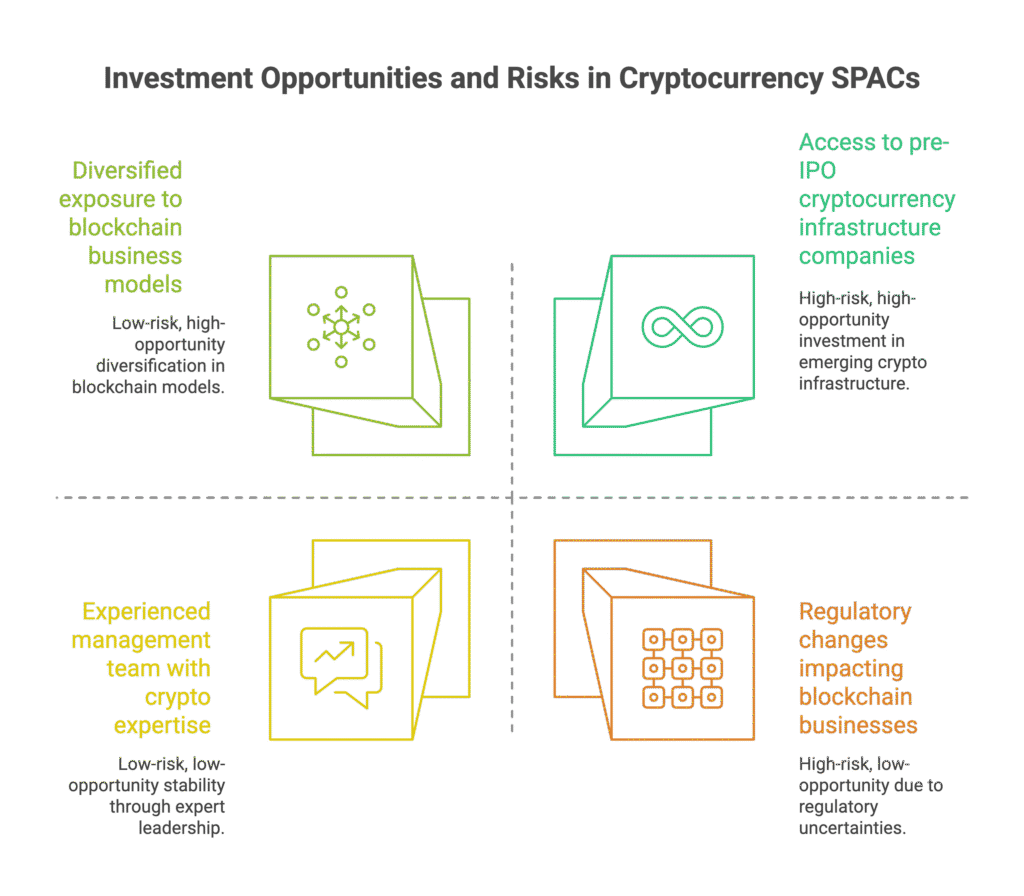

Bitcoin SPAC Investment Risks and Opportunities

Investment Opportunities:

- Access to pre-IPO cryptocurrency infrastructure companies

- Diversified exposure to blockchain business models

- Experienced management team with crypto expertise

- $200 million provides flexibility for substantial acquisitions

Key Risks:

- Crypto market volatility affecting target valuations

- Competition from other cryptocurrency SPACs

- Regulatory changes impacting blockchain businesses

- 18-24 month deadline pressure for acquisition completion

Conclusion: BIXIU Represents Crypto’s Public Market Evolution

Bitcoin Infrastructure SPAC signals cryptocurrency’s maturation from speculative trading to legitimate infrastructure investment. With $200 million in capital, proven crypto executives, and focus on profitable blockchain businesses, BIXIU could deliver institutional-quality exposure to the digital asset economy.

Rather than betting on Bitcoin price movements, BIXIU investors gain access to the companies building crypto’s future—from DeFi protocols generating real yield to cryptocurrency exchanges processing billions in daily volume.

Bitcoin SPAC FAQ: Everything About BIXIU Stock

Q1: What is Bitcoin Infrastructure SPAC (BIXIU)?

A: BIXIU is a $200 million special purpose acquisition company targeting profitable cryptocurrency infrastructure businesses for Nasdaq IPO. Led by Lightning Network veteran Ryan Gentry, the crypto SPAC focuses on blockchain companies like digital asset exchanges, DeFi protocols, and Web3 infrastructure rather than speculative crypto projects.

Q2: How do I buy BIXIU stock and when does it trade?

A: BIXIU stock trades on Nasdaq under ticker “BIXIU” at $10 per share. The Bitcoin SPAC went public this week as part of a $575 million crypto SPAC fundraising surge. Investors can purchase BIXIU shares through standard brokerage accounts to gain exposure to upcoming cryptocurrency acquisitions.

Q3: What cryptocurrency companies will BIXIU acquire?

A: Bitcoin Infrastructure SPAC targets established crypto infrastructure with proven revenue: cryptocurrency exchanges, DeFi lending protocols, blockchain custody solutions, Web3 applications, and digital payment processors. They avoid speculative crypto tokens, focusing on the “picks and shovels” businesses powering the digital asset economy.

Q4: Who leads Bitcoin Infrastructure SPAC management?

CEO Ryan Gentry (5 years at Lightning Labs building Bitcoin infrastructure), CFO Jim DeAngelis (Kroll financial services), Director Vikas Mittal (successful crypto SPAC track record). Board includes former Kraken executive Parker White and Bitcoin Magazine co-founder Tyler Evans—proven cryptocurrency industry veterans.

Q5: When will BIXIU announce their acquisition target?

A: Bitcoin Infrastructure SPAC has 18-24 months to complete their blockchain acquisition, suggesting an announcement between late 2025 and mid-2026. With $200 million available and experienced crypto executives, BIXIU can target substantial cryptocurrency infrastructure companies. Follow BIXIU stock for acquisition updates and crypto market analysis.

Q6: Is BIXIU a good cryptocurrency investment?

A: BIXIU offers institutional exposure to pre-IPO crypto infrastructure companies without directly buying volatile cryptocurrencies. The Bitcoin SPAC provides diversified blockchain investment through experienced management targeting profitable digital asset businesses. However, crypto market volatility and SPAC timeline pressure create investment risks requiring careful analysis.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.