Gold just smashed through $5,100. Silver’s up 57% this year. And Bitcoin? Down 30% from its October peak, stuck in neutral around $86,000.

But Fundstrat’s Tom Lee isn’t worried. He reckons Bitcoin and Ethereum are coiled springs waiting for precious metals to take a breather. Once the gold and silver FOMO dies down, crypto’s fundamentals should finally catch up with price action.

Here’s why he’s betting on a comeback.

Why Crypto’s Lagging Behind Gold and Silver

Lee’s argument is straightforward: investors are chasing what’s working right now, and that’s precious metals.

Speaking on CNBC’s Power Lunch, he pointed out that Bitcoin and Ethereum should typically benefit from a weaker dollar and looser Fed policy. Both boxes are ticked. So what’s the problem?

Leverage has been wiped out.

“Crypto doesn’t have the leverage tailwind because the industry delevered,” Lee explained. Without that rocket fuel, digital assets are limping along while gold and silver soak up all the attention.

The divergence is brutal. Gold’s up 17.5% year-to-date, hitting record highs. Silver’s climbed even harder at 57%. Meanwhile, Bitcoin can’t break above $95,000 and keeps sliding back toward $86,000 support.

Lee puts it bluntly: “There’s a FOMO into buying that instead of crypto.”

The October Deleveraging Event Still Haunts Crypto

Lee traced crypto’s struggles back to 10th October, when a major deleveraging event “crippled many key players” across exchanges and market makers.

That shakeout forced the industry to clean house. The good news? Fundamentals have actually improved since then. The bad news? Prices haven’t caught up yet.

Bitcoin’s 30% drop from its October high doesn’t reflect deeper weakness, according to Lee. It’s just lagging because “the precious metal move has sucked a lot of the oxygen out of the room.”

What’s Driving the Gold and Silver Surge?

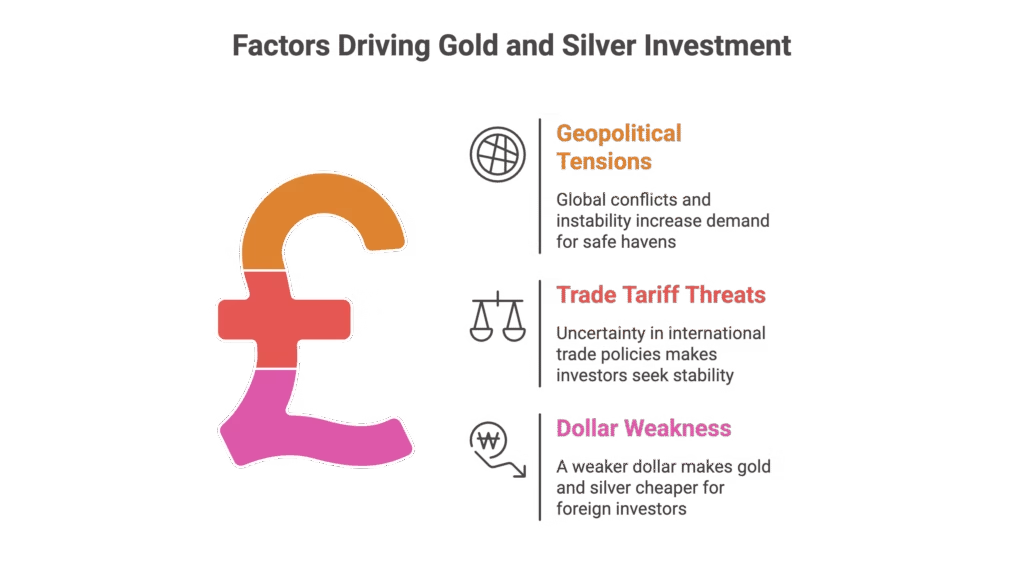

Three big factors are pushing investors toward traditional safe havens:

- Geopolitical tensions ramping up globally

- Trade tariff threats creating uncertainty

- Sustained dollar weakness making metals more attractive

Until these drivers ease or precious metals pause for breath, crypto’s waiting its turn.

Lee’s Still Backing Ethereum Hard

Lee’s not just talking. He’s putting money where his mouth is.

On Monday, BitMine—an Ether-focused treasury firm linked to Lee—dropped $58 million on 20,000 ETH, according to blockchain analytics firm Lookonchain.

Lee also highlighted growing institutional interest following recent discussions at the Davos forum. Financial institutions are increasingly serious about building on Ethereum and other smart contract platforms.

That’s not just hype. It’s infrastructure being laid for the next cycle.

Not Everyone’s Convinced

CryptoQuant analyst GugaOnChain threw cold water on the dollar weakness argument.

Recent ETF outflows show investors still prefer gold during stress periods. “For BTC to thrive,” they said, “the weakness of the American currency must come from risk appetite, not from fear.”

In other words: Bitcoin needs investors feeling greedy, not scared. Right now, fear’s winning.

What Happens When Metals Cool?

Lee’s betting on history repeating itself.

He argues that when precious metals have paused in the past, Bitcoin and Ethereum have typically staged sharp rallies. The fundamentals are there—they’re just waiting for investor attention to shift back.

The question is timing. Gold and silver aren’t showing signs of slowing down yet. But if they do stall out, crypto could finally get its moment to shine.

For now, Bitcoin’s stuck between improved fundamentals and brutal price action. Lee’s view? It’s a setup, not a breakdown.

Conclusion

Tom Lee’s making a straightforward bet: Bitcoin and Ethereum will surge once the gold and silver rally cools off. Despite Bitcoin’s 30% slide from October highs, fundamentals have actually improved—prices are just lagging while investor attention chases precious metals. Lee’s backing his conviction with real money, as BitMine just dropped $58 million on Ether. If you’re watching crypto markets closely, keep an eye on gold and silver momentum—when that rally stalls, digital assets might finally get their turn.

FAQ

Q1: Why is Bitcoin underperforming despite a weaker dollar?

A: Bitcoin typically benefits from dollar weakness, but right now investors are piling into gold and silver instead. The crypto industry also lacks leverage after October’s major deleveraging event, which removed a key price driver.

Q2: What happened in October that hurt crypto markets?

A: On 10th October, a significant deleveraging event hit crypto exchanges and market makers hard. Lee described it as having “crippled many key players,” forcing the industry to clean up its balance sheets.

Q3: Is Tom Lee still bullish on Ethereum?

A: Absolutely. BitMine, a firm linked to Lee, just purchased 20,000 ETH worth $58 million. He’s also pointed to growing institutional interest in building on Ethereum following discussions at Davos.

Q4: What needs to happen for Bitcoin to rally?

A: Lee argues Bitcoin will surge once the gold and silver rally cools off and investor attention shifts back to crypto. Some analysts say Bitcoin also needs dollar weakness driven by risk appetite rather than fear.

Q5: How high have gold and silver climbed this year?

A: Gold hit a record $5,100 on Monday, up roughly 17.5% year-to-date. Silver’s moved even more aggressively, climbing 57% to peak at $110.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.