Introduction

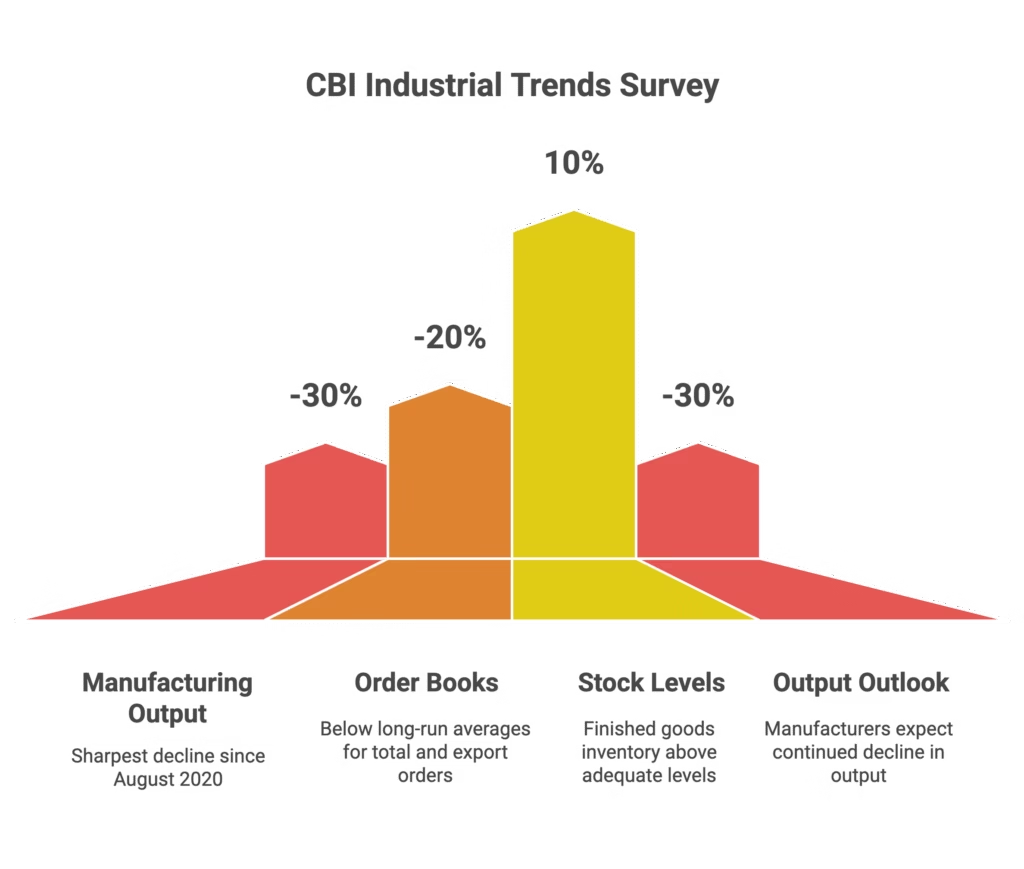

UK manufacturing output just hit its worst decline since COVID-19. In the three months to November, factory production plummeted at a pace not seen since the dark days of 2020. The Confederation of British Industry’s (CBI) latest survey paints a grim picture: output volumes dropped to a weighted balance of -30%, compared to -16% in the previous quarter. With Labour’s growth agenda under pressure and next week’s Budget looming, manufacturers are bracing for impact. So what’s driving this manufacturing downturn, and can anything stop the slide?

Why UK Manufacturing Output Is Falling Off a Cliff

The Numbers Don’t Lie

The CBI’s industrial trends survey reveals manufacturing output in the three months to November dropped faster than any period since August 2020. That -30% balance reading? It’s not just bad, it’s historically awful.

Here’s what else the data shows:

- Order books are tanking: Both total and export orders sit well below long-run averages

- Stock levels are bloated: Finished goods inventory stands above “adequate” levels

- The outlook stays dark: Manufacturers expect output to keep falling at the same rate over the next three months

This isn’t a blip. It’s a sustained manufacturing contraction that’s sending alarm bells ringing across Whitehall.

Front-Loading and Tariff Fears

There’s an interesting wrinkle in the data. Those elevated stock levels suggest firms were front-loading production earlier in the year, essentially making stuff in advance to dodge potential tariff hits. Now they’re sitting on inventory they can’t shift, which helps explain why new orders and production have cratered.

What’s Killing Manufacturer Confidence?

Budget Uncertainty Is Crushing Investment

CBI economist Ben Jones didn’t hold back his words: manufacturers flagged uncertainty around upcoming fiscal measures as a key reason they’ve slammed the brakes on purchases and investment.

Translation? Businesses have no idea what’s coming in next week’s Budget, so they’re freezing spending until they know how much it’ll hurt.

“Manufacturers face a challenging end to the year,” Jones said, urging the Chancellor to “provide much needed certainty and back the government’s growth mission rhetoric with pro-business policies.”

Tax Burden About to Get Heavier

The manufacturing sector’s tax burden is expected to increase after the Budget. That’s the opposite of what struggling factories need right now.

Business chiefs have warned that further taxes will hamper operations and depress growth over the coming months. When you’re already in a production nosedive, higher costs are the last thing you want.

Official Data Confirms the Manufacturing Slump

The Office for National Statistics (ONS) backed up the CBI’s findings with equally dismal numbers. Production fell 0.5% in Q3, with September alone seeing a 2% drop.

Some of that decline came from external shocks, notably the cyber attack on Jaguar Land Rover that froze production lines. But even accounting for one-off events, the underlying trend is weak.

Could Interest Rate Cuts Offer Relief?

There’s a silver lining, albeit a thin one. Average selling price inflation expectations eased in November and now sit in line with long-run averages.

Weak manufacturing growth combined with cooling inflation pressures increases the likelihood the Bank of England will cut interest rates in December. Lower borrowing costs could help, but they won’t solve the fundamental problems of weak demand and policy uncertainty.

What This Means for Labour’s Growth Mission

Remember how Labour made growing the UK economy and turning Britain into a “clean energy superpower” central campaign missions? This manufacturing data is a brutal reality check.

The CBI survey makes for “devastating reading across Westminster” as the government tries to deliver on its economic promises. Without a manufacturing rebound, hitting those growth targets becomes exponentially harder.

The Bottom Line

UK manufacturing is in serious trouble. Output is falling at pandemic-era rates, order books are weak, and businesses are paralysed by Budget uncertainty. With tax rises likely and no obvious policy rescue on the horizon, manufacturers face a grim winter.

The Chancellor has a choice next week: provide the certainty and pro-business policies the sector desperately needs, or watch manufacturing output continue its freefall.

Want to understand how economic policy impacts your investments? Keep following UK manufacturing trends, they normally are signals for broader economic health.

FAQ

Q1: What caused UK manufacturing output to fall so dramatically?

A: A combination of weak domestic and export demand, elevated inventory levels from earlier front-loading, and uncertainty around upcoming Budget measures. Businesses have frozen investment spending until they know what fiscal changes are coming.

Q2: How does this manufacturing decline compare to previous downturns?

A: This is the fastest drop in manufacturing output since August 2020, during the pandemic. The -30% balance reading is historically severe and signals a significant contraction across the sector.

Q3: Will the Bank of England cut interest rates to help manufacturers?

A: It’s looking more likely. Weak growth and easing inflation pressures make a December rate cut more probable, which could reduce borrowing costs for manufacturers—though it won’t solve underlying demand problems.

Q4: What impact will the upcoming Budget have on manufacturing?

A: Most expectations point to an increased tax burden for manufacturers, which will add costs at exactly the wrong time. Business leaders have warned this could further depress growth and investment.

Q5: Is there any good news for UK manufacturing?

A: Limited. Inflation expectations have eased to long-run averages, which is positive. But with order books below average, stocks above adequate levels, and no clear policy support coming, the near-term outlook remains bleak.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.