Introduction

The FTSE 100 is knocking on the door of 10,000 – and it might get there faster than any threshold jump in history. After nearly a year of outperforming American indices, London’s blue-chip index is proving the doubters wrong. Whilst tech-heavy US markets wobble under AI bubble fears, the FTSE’s “boring” mix of banks, miners, and energy stocks is suddenly looking rather brilliant. Could Britain’s old-school market finally get its moment?

Why the FTSE 100 Is Beating Wall Street

Here’s the plot twist nobody saw coming: the UK market is having a better year than the US.

The FTSE 100 has outperformed all major American indices in 2025, shrugging off private credit concerns and AI jitters that spooked Wall Street. The Nasdaq’s down nearly 2% over the past month, whilst London keeps pushing higher.

“It’s been a historic year for the UK,” says Dan Coatsworth, head of markets at AJ Bell. “Hitting 10,000 would be the cherry on top, proving to cynics that the UK market isn’t stuck in the mud.”

The index crossed 9,000 on 15 July – just 120ish days ago. If it hits 10,000 soon, it’ll be the fastest threshold jump on record.

Old Economy Stocks Are Having Their Revenge

Whilst chipmaker Nvidia tanked 3% after Softbank dumped its $5bn stake, traditional FTSE stocks rallied. The City’s heavy weighting towards banks, miners, and energy firms – once criticised as dull – is now its secret weapon.

“Yes, it lacks the excitement of go-go-growth stocks omnipresent in the US, but boring can also be beautiful when it comes to investing,” Coatsworth notes.

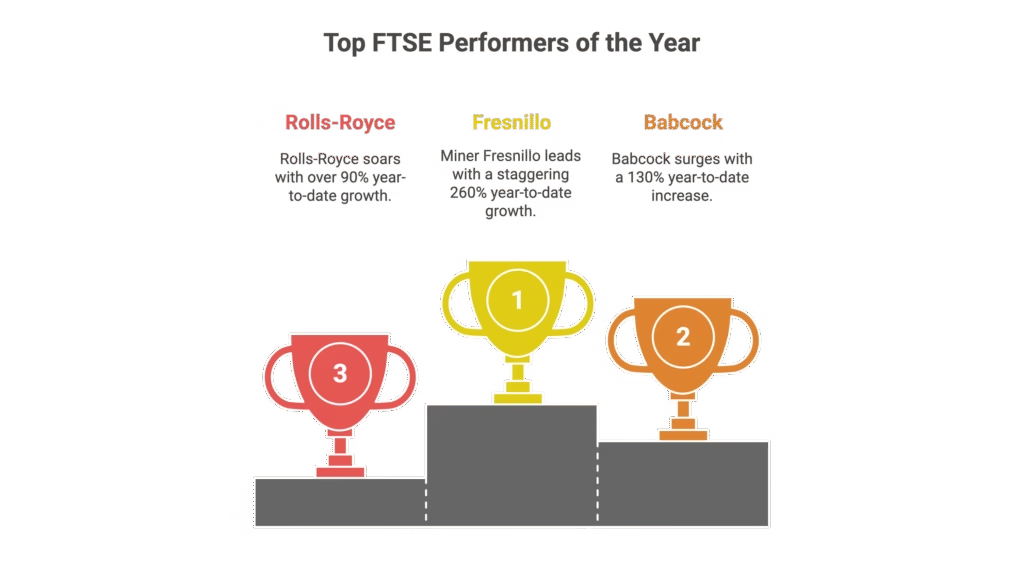

The proof’s in the numbers:

- Miner Fresnillo: up nearly 260% year-to-date

- Rolls-Royce: up over 90%

- Lloyds: up over 70%

- Babcock: up over 130%

Trump’s Tariffs Triggered a Rotation

Volatility across the pond helped Britain’s case. Trump’s Liberation Day tariffs sparked a major shift, with investors rotating out of pricey US assets.

Asset manager Royal London sold down its US allocation over summer and boosted UK exposure instead. The boss of Cavendish investment bank told City AM that Trump’s trade war caused serious fund movement across the Atlantic.

Suddenly, undervalued UK stocks with steady dividends look like smart money.

The Budget Looms Large

Before you pop the champagne, there’s a catch: the Budget.

Chancellor Rachel Reeves is reportedly mulling a dividend tax hike, which could dampen investor enthusiasm. Current rates sit at 8.75% for basic-rate taxpayers, 33.75% for higher earners, and 39.35% for the top band.

“The Budget will be the key test for the market,” Coatsworth warns. “Anything deemed negative for the economy could weigh on shares in retail, banking, construction, housebuilding, and property sectors.”

Investors are watching closely. A poorly timed tax grab could kill the FTSE’s momentum just as it reaches its historic milestone.

What Happens If We Hit 10,000?

Breaking 10,000 isn’t just a psychological win – it’s vindication.

For years, UK equities have been written off as second-rate compared to flashy US tech stocks. But this rally proves there’s life in traditional industries yet. Banks, miners, and energy firms might not have the raw appeal of Silicon Valley, but they’ve delivered the goods.

The FTSE’s dividend-rich hunting ground has rewarded patient investors whilst American growth stocks stumbled. If London’s index crosses 10,000, it’ll cement 2025 as the year Britain’s “old economy” market proved it still has plenty of fight left.

Conclusion

The FTSE 100’s charge towards 10,000 is a reminder that boring wins races. Whilst US tech stocks nurse AI hangovers, London’s traditional industries are quietly performing. The Budget could throw a spanner in the works, but for now, Britain’s blue-chip index is having its best year in ages. Keep your eyes on that 10,000 mark – history might be about to happen.

Want to stay ahead of UK market moves? Keep watching as the FTSE makes its final push.

FAQ

Q1: What is the FTSE 100 and why does 10,000 matter?

A: The FTSE 100 tracks the UK’s 100 largest listed companies. Hitting 10,000 would be a historic psychological milestone, proving British stocks can compete globally. It would also mark the fastest threshold jump (from 9,000 to 10,000) on record if achieved within the next few days.

Q2: Why is the FTSE 100 outperforming US markets this year?

A: The FTSE’s heavy weighting towards traditional sectors like banking, mining, and energy has protected it from AI bubble fears battering US tech stocks. Investors have rotated into undervalued UK equities seeking stable dividends and away from overpriced American growth stocks.

Q3: Which FTSE 100 stocks have performed best in 2024?

A: Miner Fresnillo leads with nearly 260% gains year-to-date. Other top performers include Rolls-Royce (up over 90%), Lloyds (over 70%), and defence firm Babcock (over 130%). Traditional sectors are dominating this year’s winners list.

Q4: How could the UK Budget affect the FTSE 100?

A: Chancellor Rachel Reeves is considering raising dividend tax rates, which could reduce investor appetite for UK stocks. Negative Budget measures could particularly hit retail, banking, construction, housebuilding, and property sectors that drive significant FTSE performance.

Q5: Are UK stocks a better investment than US stocks right now?

A: UK stocks offer better value and higher dividend yields currently, whilst US markets face valuation concerns and AI volatility. However, diversification remains important – the UK’s lack of high-growth tech exposure is both a strength and limitation depending on market conditions.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.