Britain’s wealthiest pensioners might be about to get a tax bill that’ll make their morning tea taste bitter.

Top economists and former ministers are telling Chancellor Rachel Reeves to stop tiptoeing around wealthy retirees. Why? She needs to raise between £25bn and £50bn to fix the UK’s fiscal mess – and those property-rich pensioners are looking like prime targets.

This isn’t about your average retiree struggling with heating bills. We’re talking about the pensioners sitting on million-pound properties and chunky pension pots whilst everyone else foots the bill for NHS and social care costs.

The £50bn Problem That Won’t Go Away

Rachel Reeves has a headache that paracetamol won’t fix. The Office for Budget Responsibility (OBR) is reportedly planning to slash productivity forecasts ahead of the Budget, which could blow a hole worth tens of billions in government finances.

Translation? The Chancellor’s already tiny £9.9bn fiscal cushion – the third smallest in 15 years – is about to get even smaller. That’s like trying to renovate your house with loose change from the sofa.

Who’s Calling the Shots on Pension Reform?

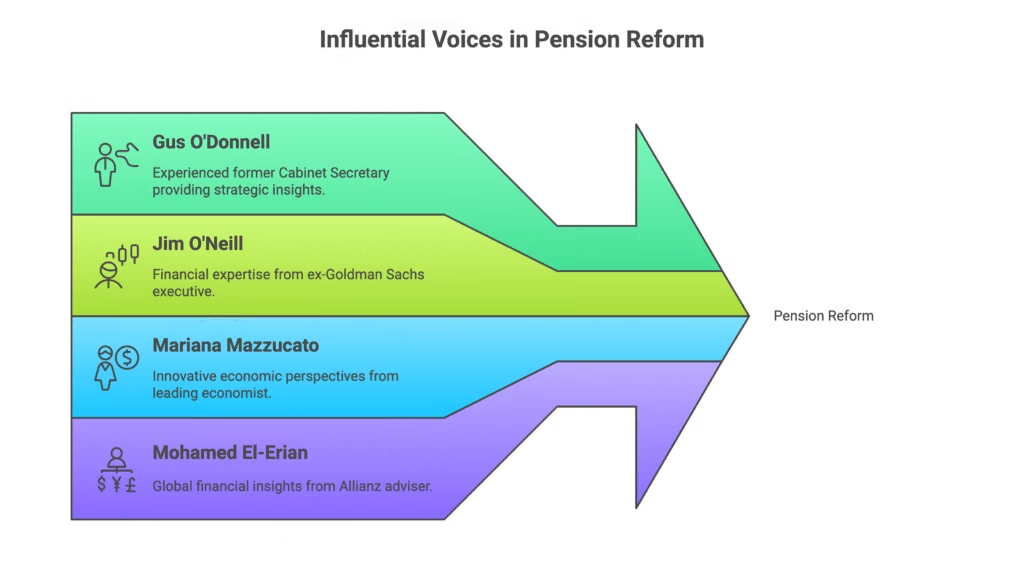

The pressure isn’t coming from random X economists. We’re talking serious heavyweight names:

- Gus O’Donnell: Former Cabinet Secretary

- Jim O’Neill: Ex-Goldman Sachs executive and former Tory minister

- Mariana Mazzucato: Leading economist

- Mohamed El-Erian: Allianz adviser

Their message is crystal clear: wealthy older people with “substantial property and pension wealth” need to contribute more to the system they’re increasingly using.

The Fiscal Rules Shuffle

Beyond targeting wealthy pensioners, economists want Reeves to get creative with her fiscal rules. They’re suggesting she could:

Make the OBR less trigger-happy with forecasts by limiting them to once yearly (the IMF already backs this idea)

Leverage her debt measurement choice by using public sector net financial liabilities (PSNFL) instead of total debt – basically giving her more wiggle room for borrowing

Focus on long-term risks like climate change in fiscal planning

It’s like changing the game rules to make winning easier – but in a legitimate, economically sound way.

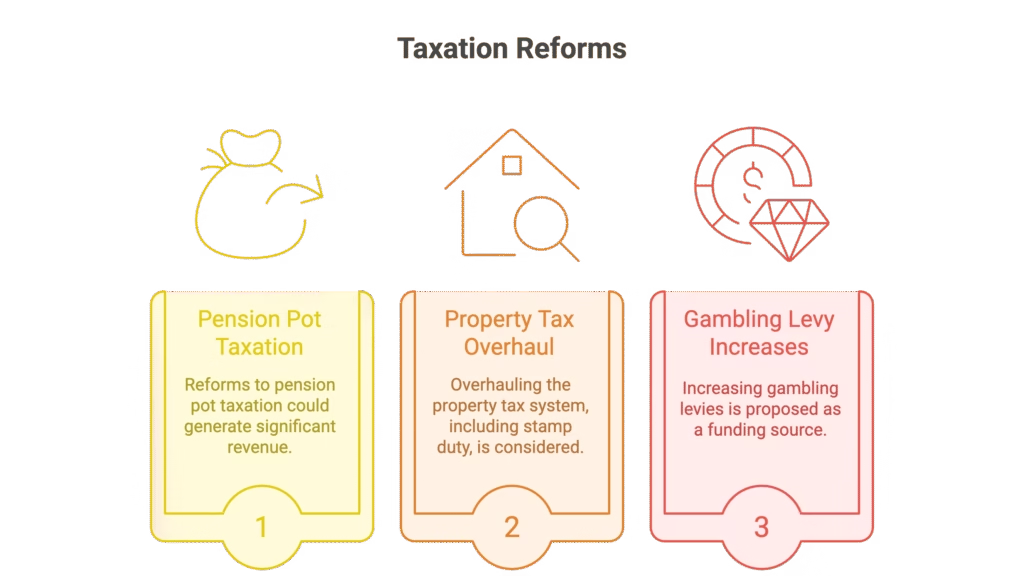

What’s Actually on the Table?

Don’t expect Reeves to announce these changes with fanfare. The realistic options floating around include:

- Pension pot taxation reforms – the big kahuna that could raise serious money

- Property tax system overhaul – including potential changes to stamp duty structure

- Gambling levy increases – because someone’s got to pay for all this

City analysts aren’t exactly optimistic though. JP Morgan thinks Reeves might end up with even less fiscal headroom, while Goldman Sachs analysts suggest raising taxes further might not actually ease the pressure on public finances.

The Bottom Line

Here’s the reality check: Britain’s ageing population is expensive, and someone has to pay for it. The economists’ letter makes the point – why should younger, often poorer taxpayers subsidise wealthy retirees’ NHS care and social services?

Whether Reeves has the political courage to actually target wealthy pensioners remains to be seen. But with a £50bn funding gap staring her in the face, she might not have much choice.

Ready to see how this plays out? Keep an eye on the upcoming Budget – it could reshape who pays for Britain’s future.

FAQ

Q1: Will all pensioners face higher taxes under these proposals?

A: No, the focus is specifically on wealthy pensioners with substantial property and pension wealth. Average retirees shouldn’t be affected by these targeted measures.

Q2: How much money could taxing wealthy pensioners actually raise?

A: While exact figures aren’t public, economists believe it could contribute significantly to the £25-50bn funding gap. The devil will be in the implementation details.

Q3: What does changing fiscal rules actually mean for ordinary people?

A: It could give the government more flexibility to invest in infrastructure and public services without technically increasing the debt burden. Think of it as creative accounting that’s actually legitimate.

Q4: Why are economists pushing for these changes now?

A: The UK faces mounting costs from an ageing population, NHS pressures, and social care needs. The current tax system isn’t sustainable without major reforms.

Q5: Could these proposals actually backfire on the economy?

A: Some analysts worry that further tax increases might not solve fiscal pressures and could potentially harm economic growth. It’s a delicate balancing act.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.