Here’s a stat that’ll make you spit out your Stella: AB InBev UK has racked up nearly £200 million in losses since 2020. That’s enough money to fund dozens of craft brewery startups—yet the world’s largest brewer can’t make money in Britain.

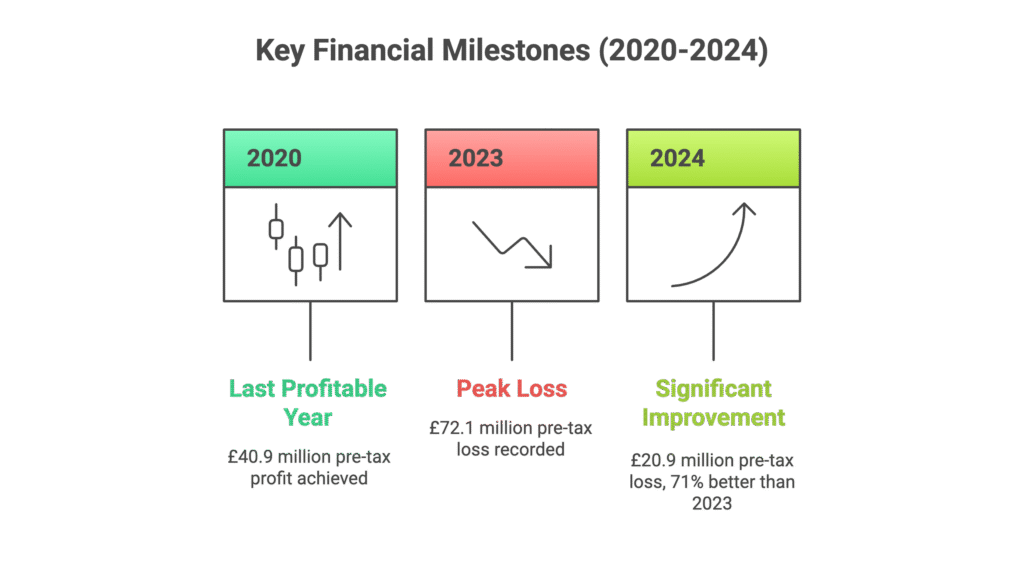

The brewing giant behind Budweiser, Stella Artois, and Corona just posted a £20.9 million loss for 2024. Sure, that’s a massive improvement from the brutal 2023 £72.1 million nosedive, but AB InBev UK hasn’t turned a profit since 2020. Four years of losses would make any investor reach for something stronger.

AB InBev UK Financial Results: The Numbers Behind Britain’s Beer Industry Struggles

Let’s break down AB InBev’s UK brewing industry performance:

Current Financial Position

- 2024 pre-tax loss: £20.9 million (71% improvement from 2023)

- Total losses since 2020: Nearly £188 million

- Revenue in 2024: £1.67 billion (up from £1.66 billion)

- Last profitable year: 2020 with £40.9 million profit

UK Beer Market Challenges

Here’s the weird part: AB InBev actually grew revenue in 2024. But growing beer sales whilst bleeding money? That’s the reality of Britain’s challenging brewing landscape.

The company’s struggling with the classic UK beer industry squeeze—rising brewing costs eating into margins faster than they can raise prices. Persistent inflation, supply chain disruptions and falling household incomes have hammered the entire UK brewing industry.

Why AB InBev Remains Optimistic About UK Beer Market Trends 2024-2025

Despite the red ink, AB InBev’s board is surprisingly bullish about beer industry trends heading into 2025:

Economic Recovery Drives UK Beer Industry Growth

The UK economic environment in 2024 showed signs of recovery, with inflation easing and consumer confidence gradually improving. Translation: Brits might start splashing more cash on premium beer brands again.

Premium Beer Revolution Reshapes UK Market

Consumers are trading up to higher-quality brews. Consumer interest in premium and super-premium offerings continued to rise, driven by a shift toward quality, experience and sustainability. AB InBev’s betting their premium lager brands like Stella Artois will ride this beer market trend.

UK Beer Industry Stabilisation

After years of pandemic chaos, beer supply chains are finally behaving. This enabled more consistent supply chain operations and allowed for more strategic pricing and promotional activity.

UK Beer Market Analysis: What Global Brewing Trends Mean for AB InBev

AB InBev’s UK troubles mirror global brewing industry challenges. The parent company’s shares fell after disappointing sales in Brazil and China—two massive markets that usually prop up the business.

Beer Industry Trends 2024: Key Market Drivers

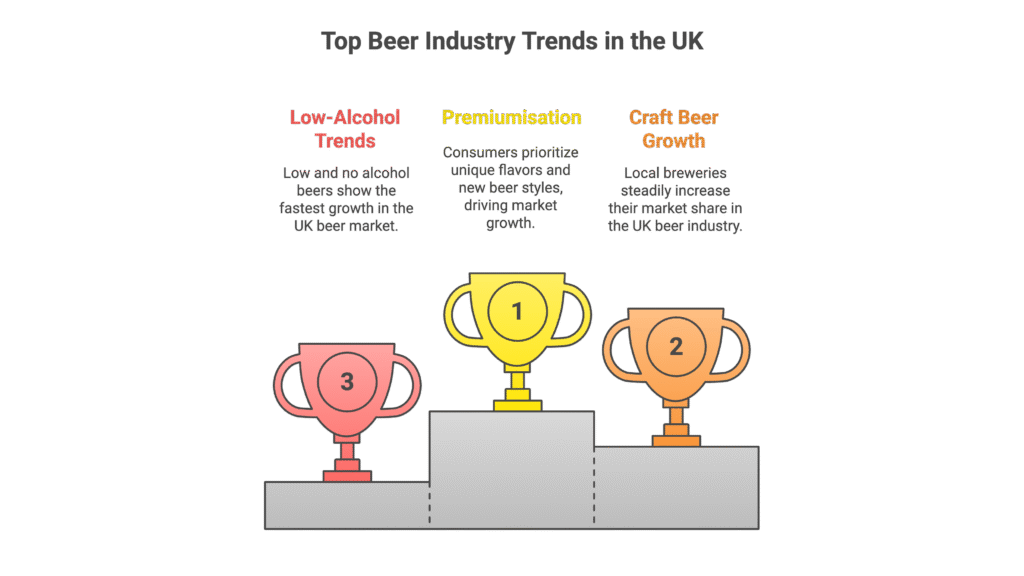

- Premiumisation: Consumers are willing to pay more for new beer styles and unique flavors

- Craft beer growth: Local breweries continue gaining UK beer market share

- Low-alcohol trends: Low and no alcohol may take up a smaller percentage but it is by far the fastest growing sector

What AB InBev’s Losses Mean for UK Beer Consumers and Industry

Don’t expect your favourite AB InBev beer brands to disappear anytime soon. The UK division’s losses, whilst eye-watering, are manageable for a global brewing company pulling in tens of billions annually.

But you might notice:

- More focus on premium beer offerings

- Strategic beer price adjustments

- Continued investment in sustainable brewing practices

UK Brewing Industry Outlook 2025

The company’s betting that 2025 will mark the turnaround. Whether they’re right depends on UK economic recovery holding steady and Brits developing an even stronger taste for premium beer brands.

Want to stay ahead of brewing industry trends? Monitor AB InBev’s quarterly results and UK beer market reports for early signs of recovery in Britain’s changing beer landscape.

Frequently Asked Questions About AB InBev UK and Beer Industry Trends

Q1: Is AB InBev UK going bankrupt despite beer industry challenges?

A: Absolutely not. These brewing industry losses are significant but manageable for the world’s largest brewer. AB InBev Group generates tens of billions in global beer sales annually, so the UK division’s struggles won’t sink the company.

Q2: Why can’t AB InBev UK turn a profit despite growing beer revenue?

A: Rising brewing costs are outpacing revenue growth in the challenging UK beer market. Think inflation hitting everything from ingredients to energy, whilst British consumers remain price-sensitive during economic uncertainty.

Q3: Will AB InBev’s losses affect UK beer prices in 2025?

A: Likely. AB InBev mentioned “strategic pricing” in their beer industry outlook, which suggests premium beer prices might rise. Expect Stella Artois, Corona, and Budweiser to lead any increases.

Q4: Which beer brands does AB InBev own in the UK brewing market?

A: Major AB InBev beer brands include Budweiser, Stella Artois, Corona, and Beck’s. If you’ve had a pint at most UK pubs, you’ve probably tried an AB InBev beer.

Q5: Should investors worry about AB InBev stock amid brewing industry challenges?

A: The UK losses concern analysts but represent a small slice of global beer operations. Watch broader brewing industry trends in key markets like Brazil and China for better insight into overall beer company performance.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.