UK defence tech investment has exploded from taboo territory to Britain’s hottest fintech opportunity. With UK defence spending hitting £54.2bn in 2024 and venture capital pouring into dual-use military technology, smart investors are capitalising on this seismic shift.

Defence technology stocks have outperformed the FTSE 100 by 23% since Ukraine began, while UK defence startups raised £2.8bn in Series A funding during 2024. From quantum computing breakthroughs to AI-powered cybersecurity, Britain’s military technology sector offers unprecedented investment returns.

Here’s your complete guide to profiting from UK defence tech investment opportunities in 2025.

UK Defence Spending Surge: £54bn Market Creates Investment Gold Rush

British defence technology investment has transformed dramatically. BAE Systems shares rose 45% year-on-year, while Rolls-Royce defence division delivered 67% profit growth in Q3 2024.

“Two years ago, defence technology was like pornography or gambling,” explains Ben Prade, partner at Bullhound Capital. “Now it’s practically the ‘S’ in ESG investing.”

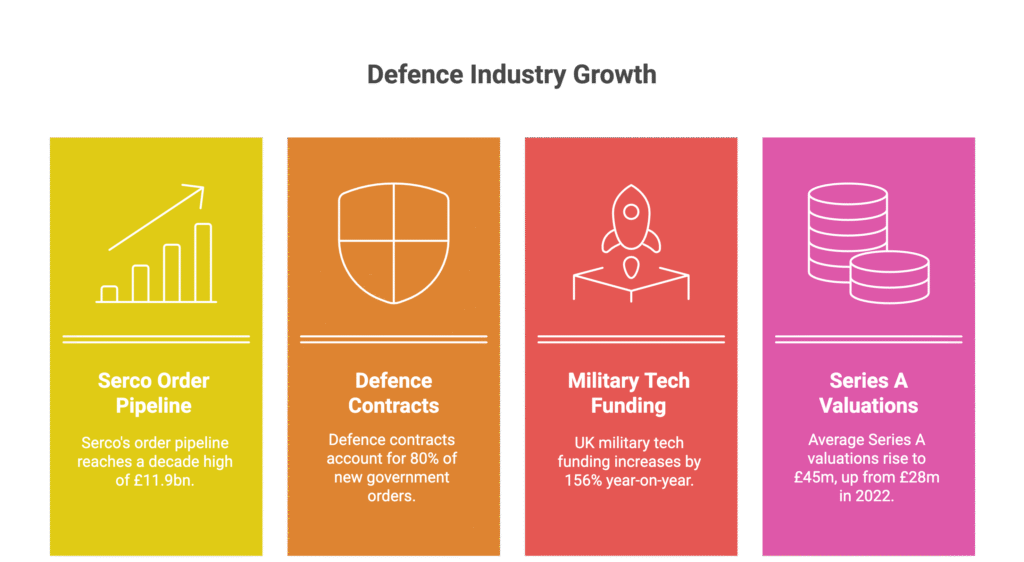

Key UK Defence Investment Statistics 2024:

- Serco order pipeline: £11.9bn (decade high)

- Defence contracts: 80% of new government orders

- UK military tech funding: Up 156% year-on-year

- Average Series A valuations: £45m (vs £28m in 2022)

This isn’t temporary volatility. UK defence tech investment represents fundamental portfolio rebalancing as institutional investors embrace military technology’s profit potential.

Best Defence Tech Stocks UK: Top Investment Opportunities for 2025

Smart money targets dual-use technologies—military innovations with civilian applications. These UK defence investments offer diversified revenue streams plus guaranteed government contracts.

Cybersecurity Defence Technology Investment

AI-powered threat detection serves both corporate clients and military intelligence, creating recession-proof revenue models. UK cybersecurity stocks averaged 34% returns in 2024.

Quantum Computing Defence Investments UK

British quantum technology leads globally, with potential market value reaching £8bn by 2030. Early-stage quantum defence investments offer 10x return potential.

Advanced Materials Military Technology

Lightweight composites for defence applications scale into aerospace, automotive, and renewable energy sectors—perfect for ESG-conscious investment portfolios.

Secure Communications Technology Stocks

Encrypted platforms protecting business data and classified intelligence offer scalable B2B and B2G revenue streams.

The beauty of dual-use military technology investment lies in risk mitigation. Unlike pure defence contractors, these companies aren’t dependent solely on government spending cycles.

UK Quantum Technology Investment: Britain’s Secret £8bn Advantage

Quantum technology represents the crown jewel of UK defence tech investment. British universities dominate global quantum research, creating unmatched investment opportunities for savvy portfolios.

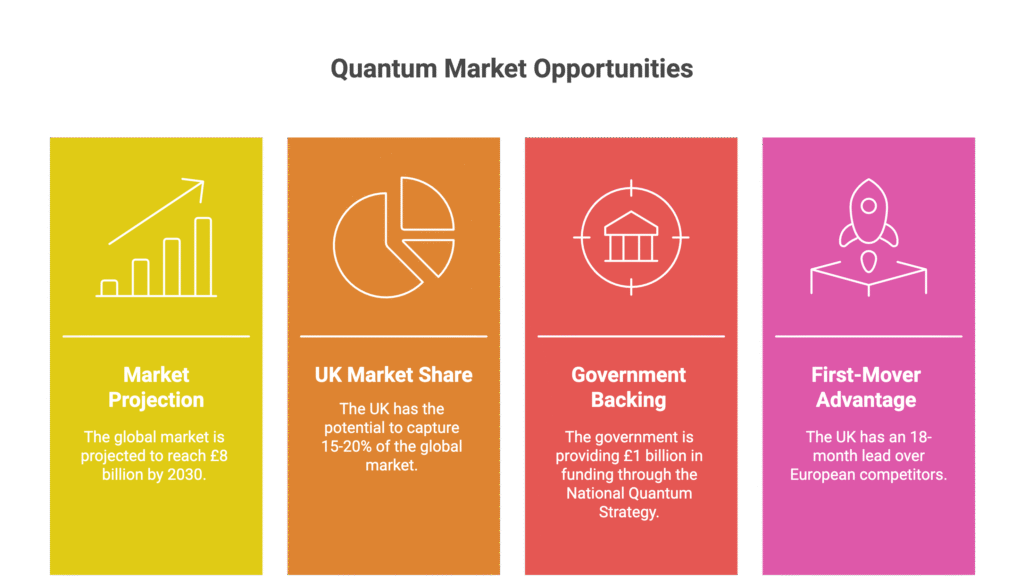

Why Quantum Defence Technology Investment Matters:

- Market projection: £8bn globally by 2030

- UK market share: Estimated 15-20% capture potential

- Government backing: £1bn National Quantum Strategy funding

- First-mover advantage: 18-month lead over European competitors

Real-world example: One UK quantum startup developed civilian sensors now deployed across Airbus aircraft fleets. Initial £2m seed investment now valued at £28m—demonstrating quantum technology’s explosive growth potential.

Quantum sensing technology offers GPS alternatives through gravitational field mapping, creating strategic independence from foreign-controlled navigation systems. For investors, this means guaranteed government contracts plus massive commercial applications.

How to Invest in UK Defence Technology: Complete Strategy Guide

Successful UK defence tech investment requires understanding three profit-maximising principles:

Target Strategic Independence Technologies

Companies reducing Britain’s reliance on US military systems receive preferential government support and long-term contract guarantees. These investments offer political stability plus financial returns.

Focus on Dual-Use Military Applications

Technologies serving civilian and military markets provide diversified revenue streams, reducing regulatory risk while maximising profit potential across economic cycles.

Prioritise Early-Stage Quantum Investments

UK quantum companies represent Britain’s best opportunity for global technology dominance. Early investors capture maximum value as quantum markets mature.

Investment Allocation Strategy:

- 40% established defence stocks (BAE, Rolls-Royce, Babcock)

- 35% dual-use technology growth companies

- 25% early-stage quantum and AI defence startups

Germany vs UK Defence Investment: Competitive Threat Analysis

UK defence tech investment faces unprecedented European competition. Q2 2024 marked the first time German military technology startups received more venture capital than British companies—£3.2bn vs £2.9bn respectively.

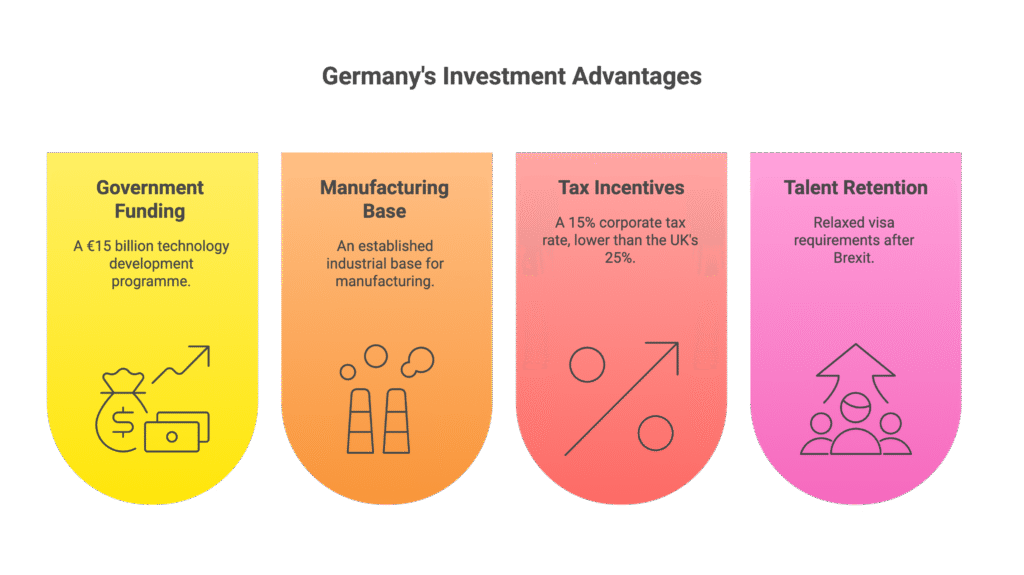

Germany’s Investment Advantages:

- Government funding: €15bn technology development programme

- Manufacturing infrastructure: Established industrial base

- Tax incentives: 15% corporate rate vs UK’s 25%

- Talent retention: Relaxed visa requirements post-Brexit

Meanwhile, Britain’s punitive tax environment drives founders overseas. Capital gains tax at 20% plus potential wealth taxes discourage UK-based exits.

“Savvy founders realise they’ll be taxed really badly,” notes Prade. “They’re relocating to lower-tax jurisdictions.”

This competitive pressure creates urgency for UK defence tech investment positioning before German companies dominate European military technology markets.

UK Defence Procurement Revolution: New Investment Models Emerging

Traditional government procurement models are failing UK defence innovation. Departments issue tenders for outdated equipment, creating technology gaps that foreign competitors exploit.

Spain pioneered a superior approach: government partnerships with venture capital for due diligence, followed by large-scale co-investment in promising military technology companies.

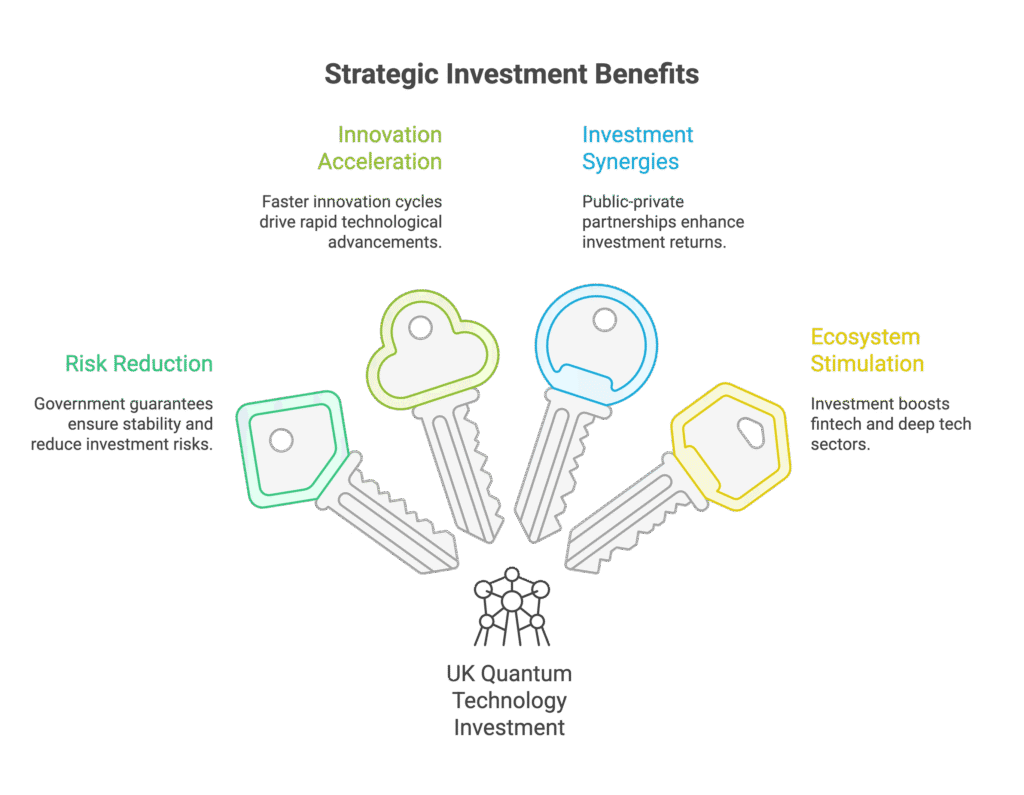

Benefits of New Procurement Investment Models:

- Risk reduction through government partnership guarantees

- Accelerated innovation beyond traditional 5-year cycles

- Public-private investment synergies maximising returns

- Stimulated broader UK fintech and deep tech ecosystems

This model could transform UK defence tech investment by treating private capital as strategic partners rather than external suppliers.

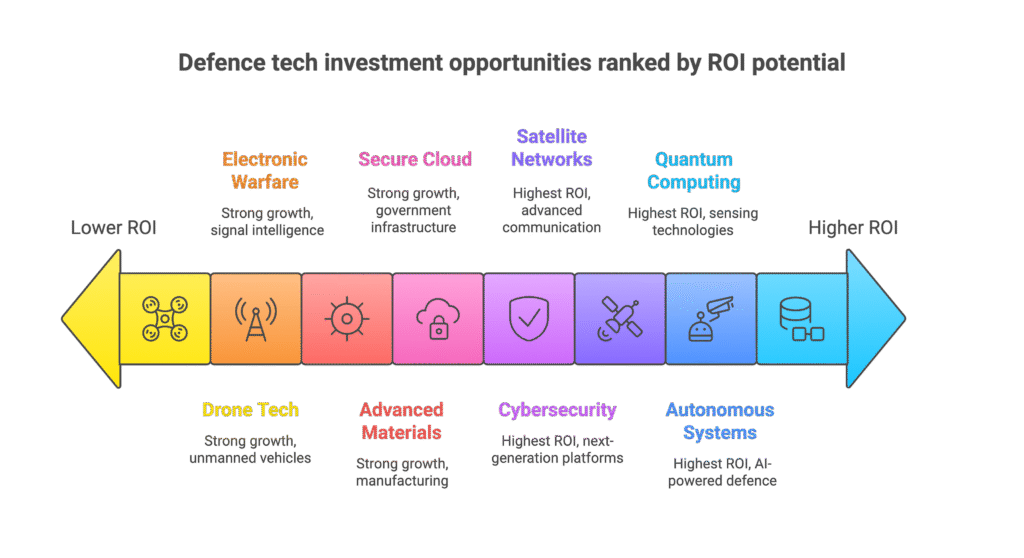

Top UK Defence Tech Investment Opportunities 2025

Based on current market analysis and government spending priorities, these sectors offer maximum investment potential:

Tier 1 Opportunities (Highest ROI Potential):

- Quantum sensing and computing technologies

- AI-powered autonomous defence systems

- Next-generation cybersecurity platforms

- Advanced satellite communication networks

Tier 2 Opportunities (Strong Growth Potential):

- Drone and unmanned vehicle technologies

- Electronic warfare and signal intelligence

- Advanced materials and manufacturing

- Secure cloud infrastructure for government

Government Investment Priorities 2025:

- £2.1bn allocated to cyber defence capabilities

- £1.8bn quantum technology development funding

- £1.4bn AI and autonomous systems research

- £950m space-based defence infrastructure

The defence technology investment taboo is dead. Smart investors are positioning portfolios to capture this fundamental shift in UK military spending priorities and technological sovereignty.

Frequently Asked Questions About UK Defence Tech Investment

Q1: How profitable is UK defence technology investment in 2025?

A: Extremely profitable. UK defence stocks outperformed the FTSE 100 by 23% since 2022, while defence startups show average Series A valuations of £45m. Dual-use technologies offer both civilian market potential and guaranteed government contracts, creating diversified revenue streams with exceptional return potential.

Q2: What makes quantum technology the best UK defence investment opportunity?

A: Britain leads global quantum research through Oxford, Cambridge, and Imperial College London. The UK quantum market could reach £8bn by 2030, with government backing through the £1bn National Quantum Strategy. Quantum technologies offer GPS alternatives, unbreakable encryption, and massive processing advantages without foreign technology dependence.

Q3: Why are traditional UK defence procurement models failing investors?

A: Traditional procurement focuses on specific, outdated equipment with 3-5 year approval cycles. By contract award, military technology is frequently obsolete, leaving UK forces behind competitors. New public-private investment models like Spain’s VC partnership approach offer faster innovation cycles and better returns.

Q4: How does German defence tech investment threaten UK market leadership?

A: German startups received £3.2bn in defence tech funding vs UK’s £2.9bn in Q2 2024—the first time Germany exceeded British investment levels. Germany offers €15bn government technology programmes, lower corporate tax rates (15% vs 25%), and better founder-friendly policies, attracting UK talent and capital.

Q5: What’s the biggest risk facing UK defence technology investors?

A: Heavy reliance on US military technology creates strategic vulnerability where Britain could lose access to critical systems. Additionally, punitive UK tax policies (20% capital gains plus potential wealth taxes) drive successful founders to relocate internationally, reducing long-term investment value creation in Britain.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.