You may remember when Tesla bought $1.5 billion in Bitcoin and everyone thought Elon was… drunk? Well, turns out he might’ve just been early (clever sausage). Now, XRP is having its own “corporate treasury” moment — and this time, it’s not just one maverick CEO making noise.

At least five public companies have already jumped on the XRP treasury bandwagon, and if you’re wondering why your boring old savings account suddenly feels outdated, you’re asking the right questions. This isn’t about crypto bros shouting “to the moon” anymore (been guilty of that…). It’s about CFOs in corner offices rethinking what “cash reserves” actually mean in 2025.

The XRP Treasury Playbook Takes Shape

Here’s what’s happening: Public companies are treating XRP like it’s the new corporate bonds — except with considerably more upside potential. Attorney John E. Deaton (who’s basically the Nostradamus of crypto predictions) called this trend months ago. On June 30, he popped on X: “There are already at least 5 companies implementing an XRP Treasury Strategy.”

Deaton says this isn’t even about XRP’s price performance. It’s about “human behavior, Wall Street and mass adoption for the asset class.” Truthfully? When Wall Street smells money, they move fast.

Meet the Early Adopters (Spoiler: They’re Not Who You’d Expect)

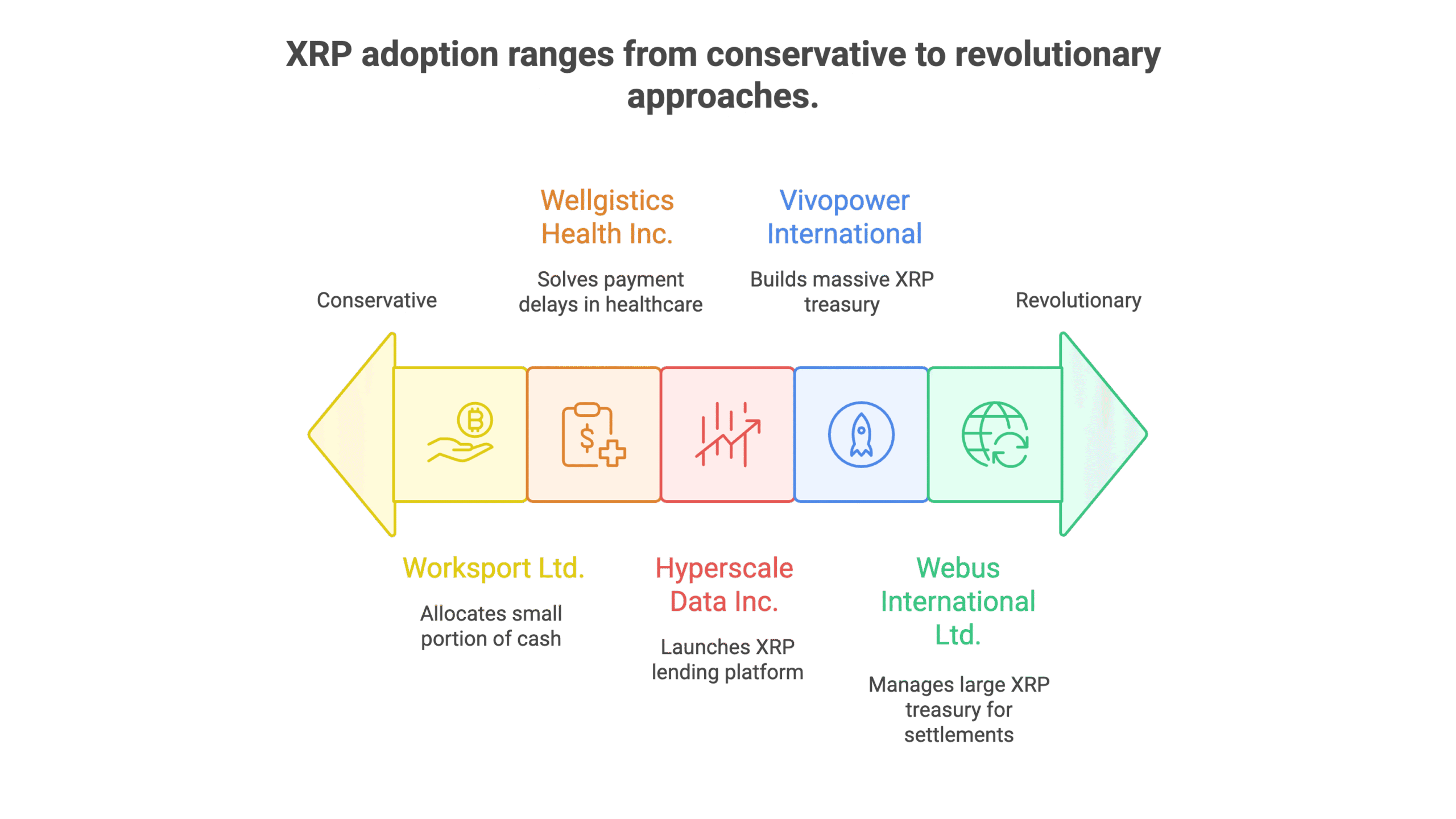

Vivopower International: The $100 Million Pioneer

This energy company is not here for play time. They raised $121 million specifically to build a $100 million XRP treasury. With Saudi investors backing them and Adam Traidman (former SBI Ripple Asia exec) advising, they’re gunning to become the first publicly traded company that’s basically an XRP ETF with a business attached.

Worksport Ltd.: The Conservative Revolutionary

This U.S.-based company is taking the “dip your toes in” approach — allocating $5 million (10% of excess cash) split between XRP and Bitcoin. Smart? Maybe. Safe? Definitely.

Hyperscale Data Inc.: The Lending Innovator

These folks aren’t just holding XRP — they’re planning to launch an entire XRP lending platform by late 2025. Think of it as turning your treasury into a profit center instead of letting it collect dust.

Webus International Ltd.: The Cross-Border Champion

Partnering with Samara Alpha Management, this China-based company is managing a whopping $300 million XRP treasury. Their focus? Cross-border settlements and Web3 applications. Because why pay SWIFT fees when you can use XRP?

Wellgistics Health Inc.: The Payment Problem Solver

Healthcare meets crypto. They’re using XRP to fix their “waiting forever for payments” problem that plagues the medical industry. Real-time payments in healthcare? About time.

Why XRP? Why Now?

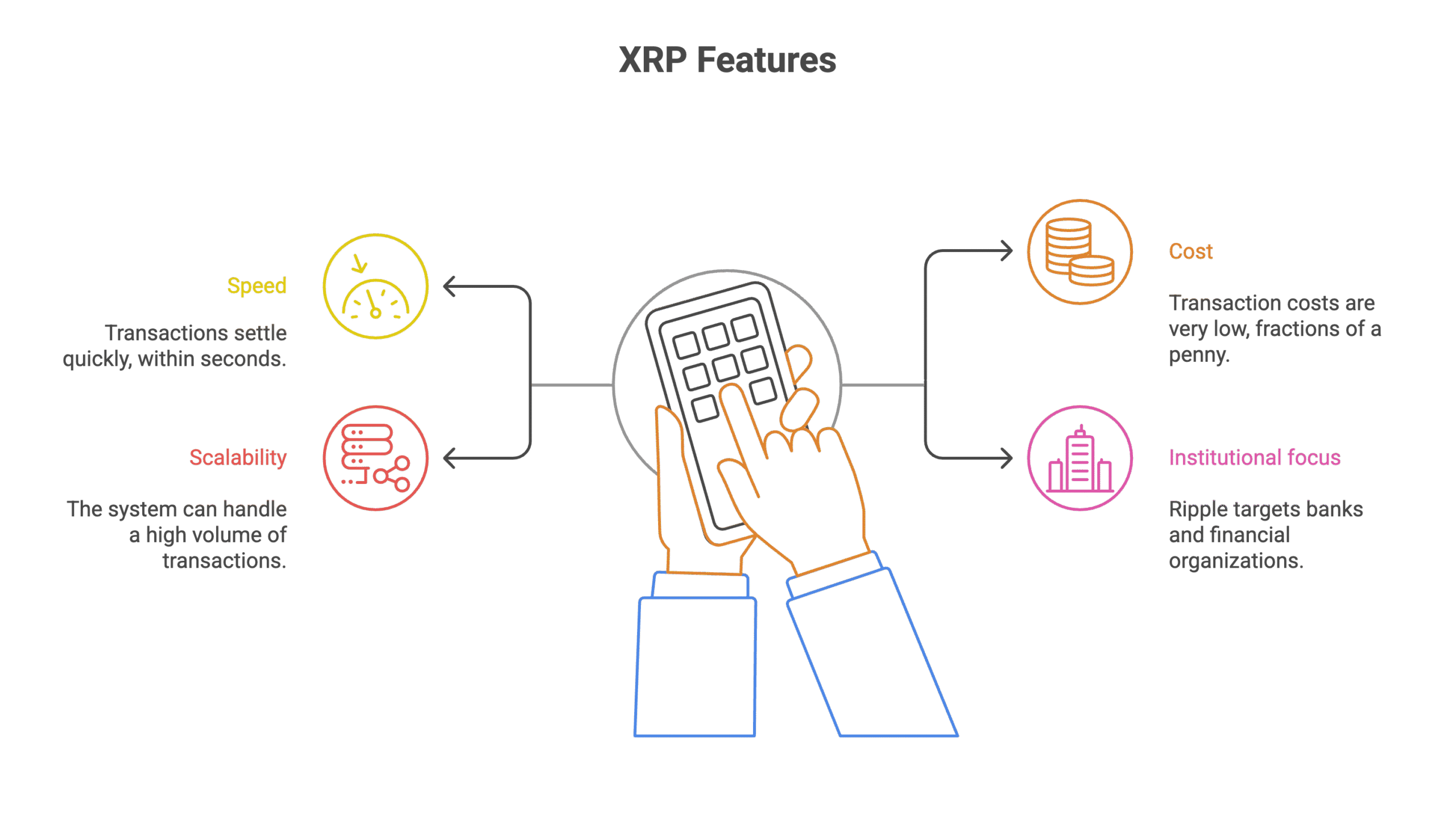

You might be thinking, “Okay, but why XRP specifically?” Fair question. While Bitcoin gets all the headlines (and Microstrategy’s billions), XRP offers something different:

- Speed: Transactions settle in 3-5 seconds (Bitcoin takes 10+ minutes)

- Cost: Fractions of a penny per transaction

- Scalability: Can handle 1,500 transactions per second

- Institutional focus: Ripple’s been courting banks and financial institutions for years

Plus, with Ripple’s partial legal victory against the SEC, institutional investors feel safer stepping into XRP waters.

The Microstrategy Effect Goes Multi-Crypto

So, Mr Michael Saylor. The guy who turned Microstrategy into basically a Bitcoin investment fund disguised as a software company (another clever sausage). Well, his game plan is getting copied — but with a twist.

As Deaton predicted: “I also said there will be companies that implement the Saylor BTC Treasury Strategy except with other tokens.”

The difference? These companies aren’t betting everything on one crypto. They’re diversifying across different use cases:

- Bitcoin for store of value

- XRP for payments and liquidity

- Other tokens for specific business applications

What This Means for Your Portfolio

Before you stuff every penny to your name into XRP (please don’t), let’s talk implications:

- Institutional adoption = stability: When public companies add crypto to their balance sheets, it legitimises the asset class

- Liquidity increases: More corporate holders mean deeper markets

- Use cases matter: XRP’s payment focus attracts different companies than Bitcoin’s digital gold narrative

- Regulatory clarity helps: The SEC case resolution opened doors that were previously locked

The Bottom Line: Wall Street’s Greed Works in Crypto’s Favor

Deaton summed it up perfectly: “Wall Street is too greedy to not do it.”

He’s absolutely right. When trillion-dollar asset managers see public companies generating returns from crypto treasuries while traditional cash earns near-zero interest, FOMO kicks in with vengeance.

This isn’t about believing in the blockchain revolution or decentralisation philosophy anymore. It’s about cold, hard returns. Right now, XRP is offering something that corporate treasurers can’t ignore: a way to make their lazy cash work harder.

Whether you’re a crypto skeptic or a true believer, one thing is becoming clearer — the corporate treasury game is getting lot more interesting. If these early adopters are right, we’re still in the first inning of a very long game.

Ready to dive deeper into crypto treasury strategies? Soon you’ll be able to join our newsletter for weekly updates on which companies are making moves in the digital asset space.

FAQ: Your Burning Questions About XRP Corporate Treasuries

Q1: Is it risky for companies to hold XRP in their treasuries?

Absolutely — crypto is volatile. But these companies aren’t betting the farm. Most are allocating 5-10% of excess cash, treating it like a high-risk, high-reward portion of their portfolio. It’s less “YOLO” and more “calculated risk with money we can afford to lose.”

Q2: How is this different from Microstrategy’s Bitcoin strategy?

Microstrategy went all-in on Bitcoin as digital gold. These XRP adopters are more focused on utility — using XRP for actual business operations like payments and settlements, not just holding it as an investment. Think tool versus treasure.

Q3: Could regulatory issues derail these XRP treasury plans?

The SEC case is mostly settled, giving XRP more regulatory clarity than most cryptos. But yes, regulation remains a wildcard. That’s why smart companies are keeping their XRP allocations reasonable and having backup plans.

Q4: Should individual investors follow these companies’ lead?

Not necessarily. Corporate treasuries have different goals and risk tolerances than personal portfolios. These companies can weather 50% drops better than your retirement fund. Do your research and never invest more than you can afford to lose.

Q5: What happens if XRP crashes?

Same thing that happens when any investment tanks — losses on the balance sheet. But here’s the thing: these companies are using XRP for business operations too. Even if the price drops, the utility remains. It’s like owning a truck for your delivery business — even if its resale value drops, it still delivers packages.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.