£137 billion. That’s how much the UK windfall tax reform could boost the economy by 2050 if Chancellor Rachel Reeves replaces the current energy profits levy with something smarter. But… kicker – without windfall tax changes, Britain’s entire North Sea oil and gas industry might vanish “within years, not decades.”

Offshore Energy UK just released a report that’s somewhat of a financial ultimatum. Reform the UK energy profits levy now, or watch a major industry disappear whilst we’re still heating 85% of British homes with gas.

What’s Wrong with the Current UK Windfall Tax System?

The current UK windfall tax (officially called the energy profits levy) sits at a hefty 38%. It’s supposed to disappear in 2030 (maybe sooner if oil company profits tank), but that timeline might be too little, too late for North Sea energy investment.

OEUK’s CEO David Whitehouse had their say about UK energy taxation: “We’re saying reform the energy profits levy to boost national energy production, investment, unlock 23,000 jobs, and add over £137bn to communities – or keep the tax, gain short-term revenue, and risk the North Sea industry’s collapse.”

That’s not corporate fear-mongering about UK oil and gas taxation. The windfall tax economics back it up.

The Smart Alternative: Profits-Based UK Energy Tax Reform

Instead of a flat windfall tax rate that hammers energy companies regardless of market conditions, OEUK wants a profits-based windfall tax mechanism triggered by “unusually high oil prices.” Think of it as a sliding scale UK energy tax – when oil prices spike, energy company taxes go up. When crude oil prices drop, so do the windfall tax rates.

This UK energy tax approach would let North Sea operators invest with confidence, knowing they won’t get slammed with the same windfall tax rate whether oil’s at $50 or $150 per barrel.

Why UK Windfall Tax Reform Actually Matters for Energy Bills

Here’s the UK energy reality check: Britain needs 10-15 billion barrels of oil and gas to hit net zero goals whilst maintaining energy security. UK energy producers are only lined up for about 4 billion barrels – and even that North Sea production target is now at risk from current windfall tax policy.

What happens when UK domestic energy production drops? We import more oil and gas, energy prices go up, and your household energy bills get uglier. Meanwhile, 23 million British vehicles still run on petrol and diesel, not renewable energy fairy dust and good intentions.

The UK Energy Investment Economic Upside is Massive

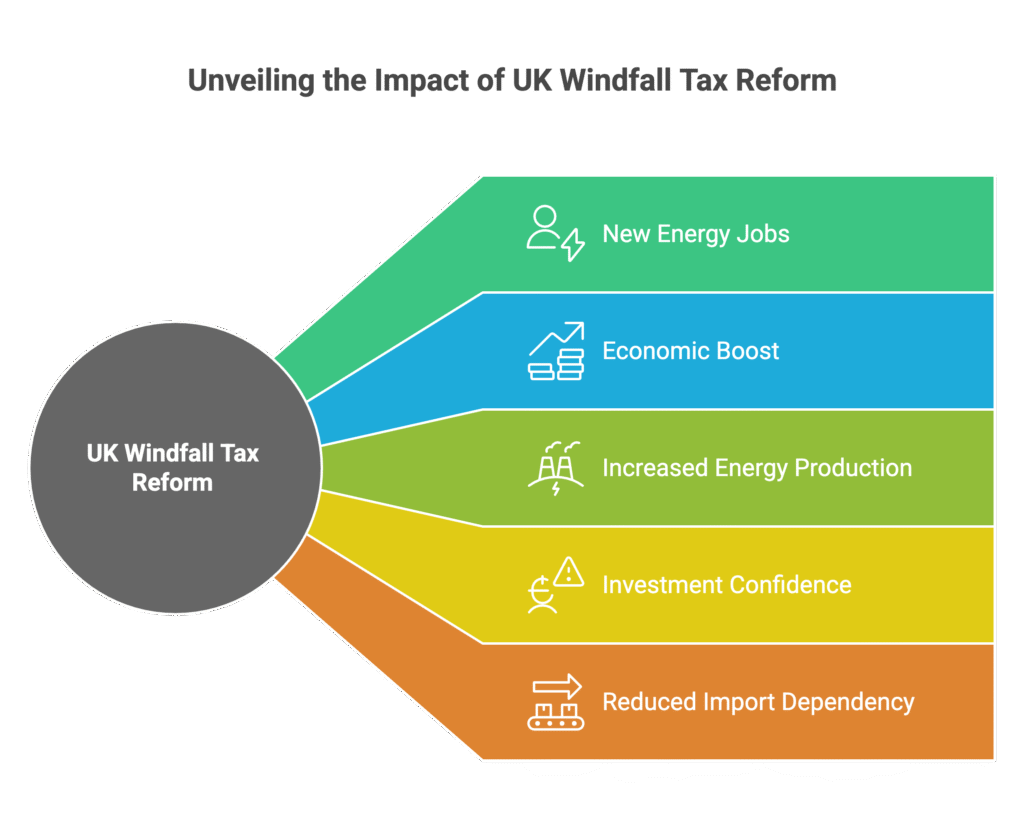

The proposed UK windfall tax reform could unlock:

- 23,000 new UK energy jobs

- £137bn economic boost to UK economy by 2050

- Increased British domestic energy production

- Higher North Sea investment confidence

- Reduced UK energy import dependency

Compare that to the current windfall tax path: short-term government revenue followed by UK energy industry collapse and higher import dependency.

What Happens Next for UK Energy Policy?

The autumn budget is coming, and OEUK is pushing Chancellor Rachel Reeves for “big ideas and ambition” on UK energy taxation. The Treasury hasn’t commented yet on windfall tax reform, but the pressure’s mounting from UK energy sector leaders.

The choice is simple for UK energy future: reform windfall tax now and boost the economy, or stick with the status quo and watch a major British industry disappear whilst energy bills keep climbing.

FAQ: UK Windfall Tax Reform and Energy Policy

Q1: When would the UK windfall tax reform take effect?

A: OEUK wants the energy profits levy replaced next year to save North Sea investment. The current 38% windfall tax is scheduled to end in 2030, but UK energy reform advocates say that’s too late to save the industry.

Q2: How would a profits-based UK windfall tax work?

A: Instead of a flat 38% energy tax rate, windfall tax rates would adjust based on oil and gas market prices. When energy prices spike unusually high, excess oil company profits get taxed more heavily under the reformed windfall tax system.

Q3: What happens if the UK doesn’t reform the windfall tax policy?

A: According to UK energy industry experts, the North Sea oil and gas sector could disappear within years due to current windfall tax levels. This would increase British energy import dependency and likely drive up household energy costs.

Q4: Does UK windfall tax reform conflict with net zero goals?

A: Not according to OEUK energy policy experts. They argue the UK needs 10-15 billion barrels of oil and gas to meet net zero targets whilst transitioning to renewable energy, but domestic producers face windfall tax barriers to achieving even 4 billion barrels.

Q5: What’s the economic impact of UK windfall tax reform?

A: The energy tax reform could generate £137bn for the UK economy by 2050 and create 23,000 British energy jobs. It would also increase domestic energy production and reduce costly energy import dependency.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.