Introduction

Here’s a plot twist that few saw coming: Brits actually want to keep their wealthy investors around.

A new poll shows 67% of UK voters support offering tax incentives to stop rich investors from packing their bags and leaving the country. After the government axed non-dom tax breaks, think tanks are now pitching a “Prosperity Package” that could add £30bn to the UK economy.

The question isn’t whether we need wealthy investors – it’s whether we’re smart enough to keep them.

What’s Inside the Prosperity Package?

The Adam Smith Institute and Onward have cooked up a deal that sounds almost too good to be true. Here’s what wealthy investors would get – and what they’d have to give back.

The Sweet Deal for Investors

Under this scheme, high-net-worth individuals would enjoy a 15-year holiday from foreign income tax, capital gains tax, and global inheritance tax. Basically, the same perks non-doms used to get before Jeremy Hunt and Rachel Reeves pulled the plug on that party.

What They’d Pay Back

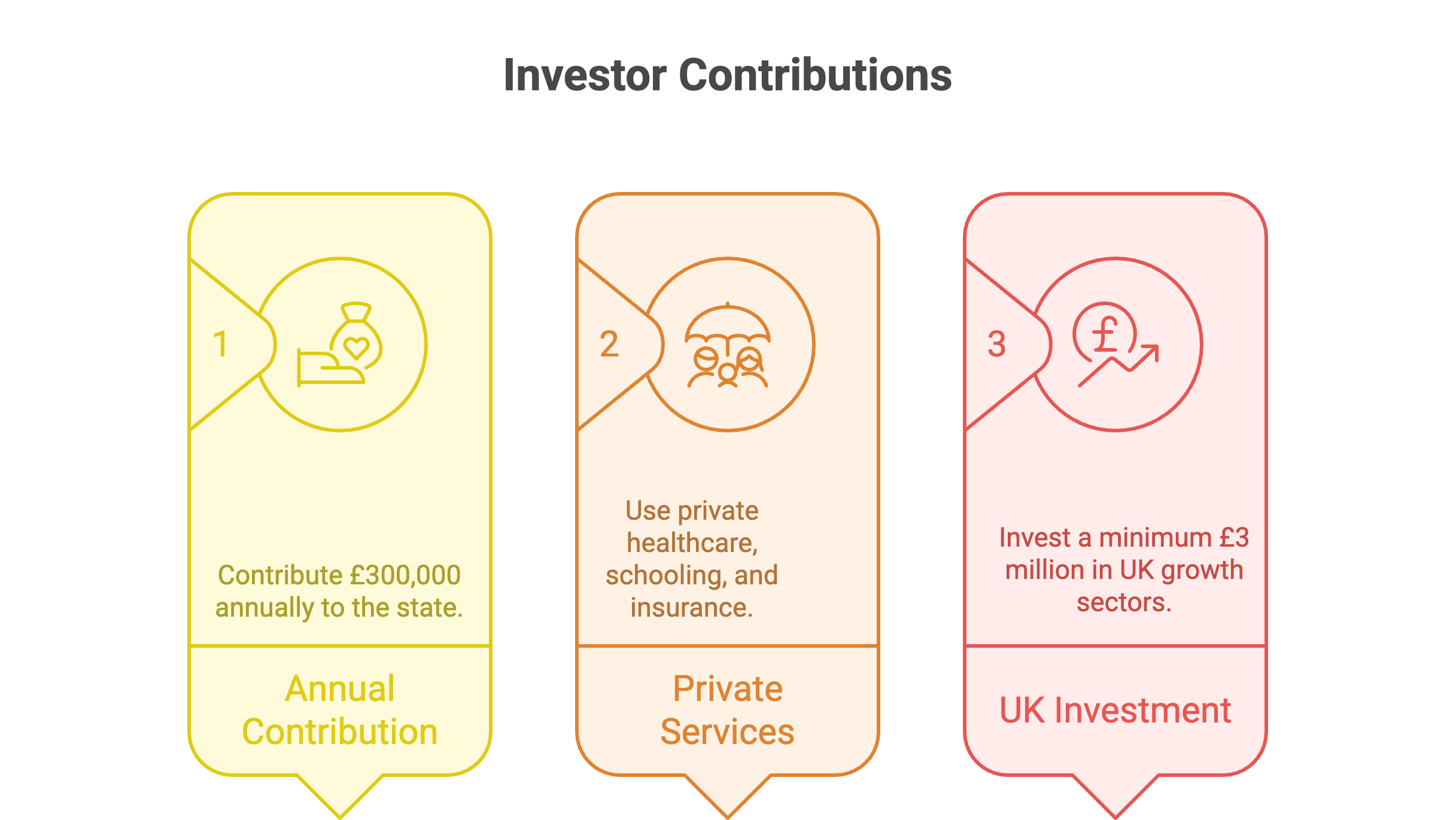

But there’s no free lunch. These investors would need to:

- Contribute £300,000 annually to the state

- Use private healthcare, schooling, and insurance (no burden on public services)

- Invest a minimum £3 million in UK growth sectors like life sciences and creative industries

Think of it as a membership fee to Club Britain – expensive, but with serious perks.

The Numbers That Matter

The polling data tells a fascinating story about what Brits really think about wealth and taxes.

Cross-Party Support

53% of all voters back the plan, with only 15% opposing it. The kicker – 69% of Labour voters support tax incentives for wealthy investors. That’s awkward timing for a Labour government that just killed the non-dom regime.

Economic Impact

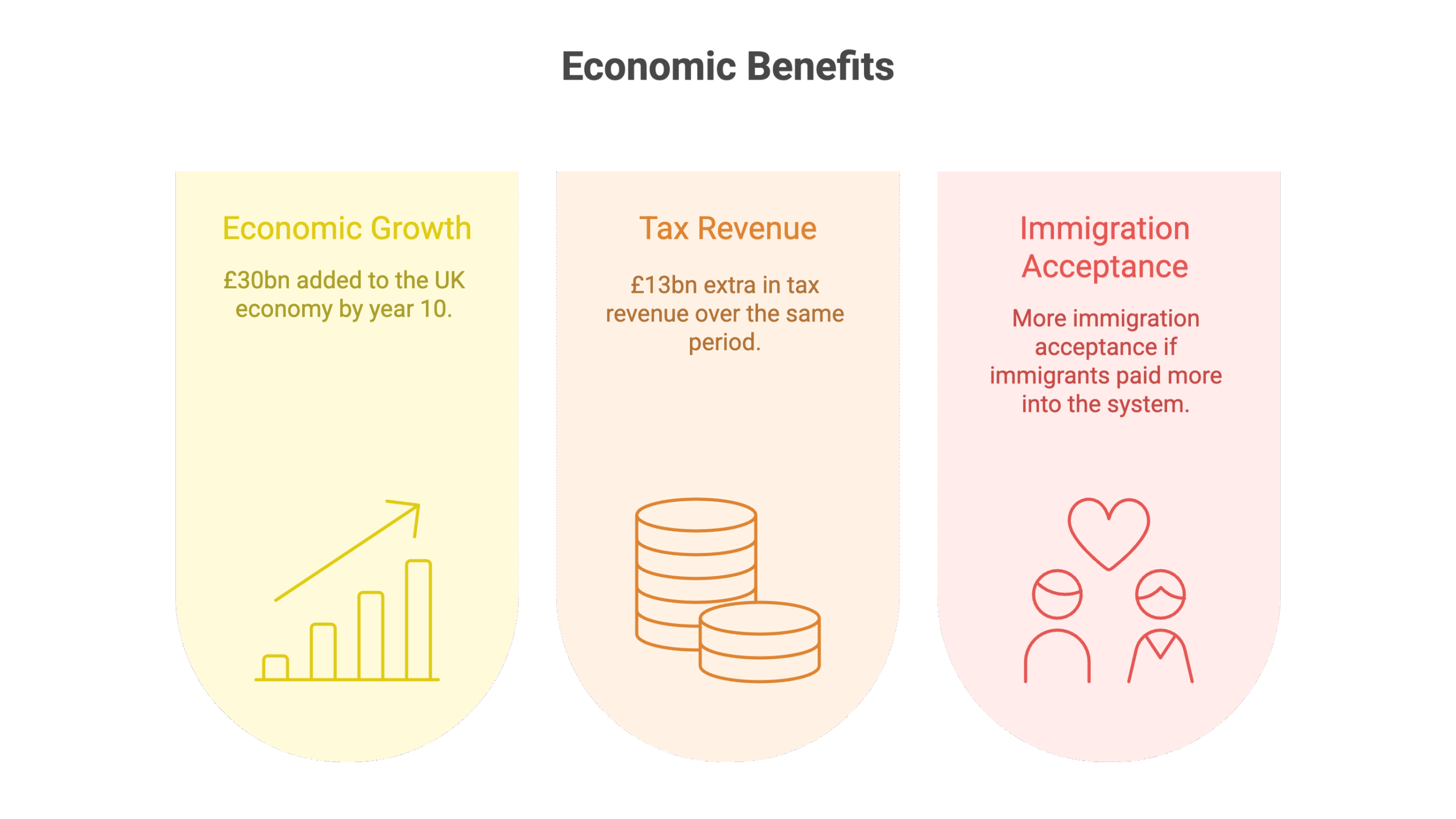

If 1,000 wealthy individuals signed up, the think tanks project:

- £30bn added to the UK economy by year 10

- £13bn extra in tax revenue over the same period

- More immigration acceptance (74% of Brits would welcome it if immigrants paid more into the system)

Why This Matters Now

Global tax competition isn’t going anywhere. Countries are fighting tooth and nail to attract wealthy investors, and the UK just handed them a gift by scrapping non-dom status.

Simon Clarke, former Treasury secretary and Onward director, called it “crazy” to drive wealthy people away during a period of low growth. His point? At a time when every pound of investment counts, Britain can’t afford to get this wrong.

Shadow business secretary Andrew Griffith put it more colourfully: the government needs to reverse course “faster than a seal in a shark tank.”

The Bottom Line

The data suggests Brits aren’t anti-wealth – they’re anti-freeloading. If wealthy investors contribute significantly without draining public resources, most voters are on board.

Maxwell Marlow from the Adam Smith Institute nailed it: “If the wealthy contribute significantly and don’t draw on the state, most voters are open to their investment.”.

FAQ

Q1: How would the Prosperity Package differ from the old non-dom system?

A: Unlike the previous non-dom regime, this package requires mandatory contributions of £300,000 annually and £3 million minimum investment in UK growth sectors. It’s less of a tax dodge and more of a structured investment deal.

Q2: Which sectors would benefit from the required investments?

A: The package targets high-growth areas outlined in the government’s industrial strategy, particularly life sciences and creative industries. These sectors are seen as key to Britain’s economic future.

Q3: Why do Labour voters support tax incentives for the wealthy?

A: The polling suggests voters distinguish between wealthy individuals who contribute to the system versus those who simply avoid taxes. When investors pay into public coffers and use private services, support crosses party lines.

Q4: Could this policy actually increase tax revenue?

A: Yes, according to projections. Even with tax exemptions, the mandatory contributions and investment requirements could generate £13bn in additional revenue over 10 years if 1,000 investors participate.

Q5: What happens if wealthy investors keep leaving the UK?

A: The remaining taxpayers bear a heavier burden as the tax base shrinks. Think tanks argue that keeping wealthy investors with structured contributions is better than losing them entirely to other countries.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.