Introduction

Here’s a stat that’ll make you wince: UK inflation just hit 3.8% in August, nearly double the Bank of England’s 2% target. That means your weekly shop, energy bills, and pretty much everything else keeps getting pricier while your paycheque stays the same.

With the Bank of England’s crucial interest rate decision looming this Thursday, economists are watching closely. The bad news? Food inflation climbed above 5% for the first time in 18 months. The worse news? This mess might not get sorted until 2027.

What’s Really Driving UK Inflation Right Now?

Food Prices Are the Real Villain

Food inflation jumped to 5.1% – the fifth consecutive monthly rise. That’s officially faster than wage growth, which means families are genuinely struggling to keep up.

Kris Hamer from the British Retail Consortium spoke on the issue: rising employment costs and poor harvests are hammering retailers, who’re passing those costs straight to us.

Services Inflation Offers Small Relief

There’s one tiny silver lining: services inflation dropped slightly to 4.7% from 5% the previous month. It’s progress, but hardly cause for celebration when it’s still more than double the target.

Why This Inflation Problem Feels Different

It’s Not Just About Interest Rates Anymore

Tom Clougherty from the Institute of Economic Affairs makes a crucial point: this isn’t the same inflation we saw during the pandemic (when money printing went wild).

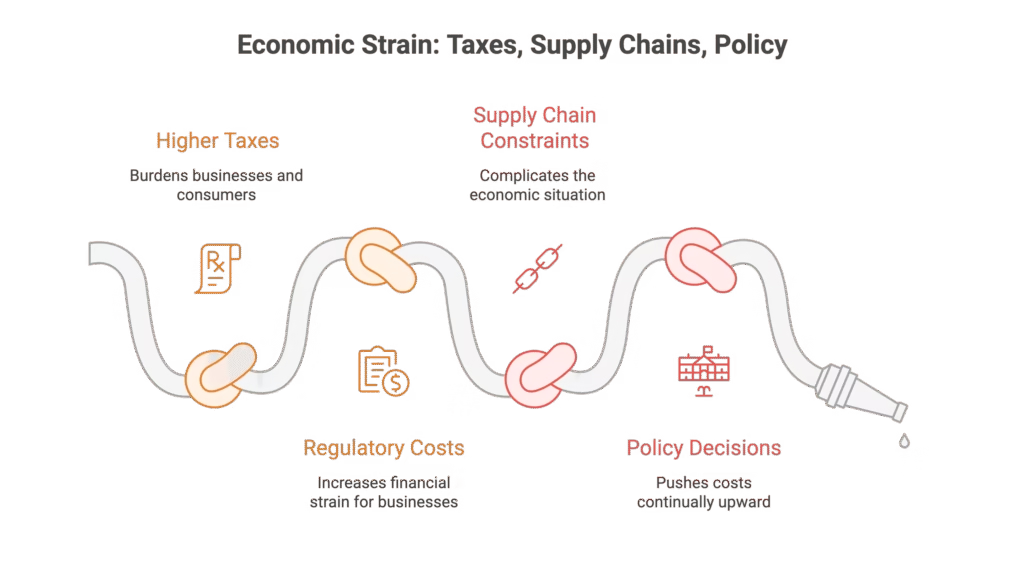

Today’s price rises stem from:

- Higher taxes and regulatory costs

- Supply chain constraints that never fully recovered

- Government policy decisions that keep pushing costs up

Translation? The Bank of England’s usual trick of raising interest rates might not fix this mess.

Politicians Point Fingers While Families Suffer

Chancellor Rachel Reeves is reportedly considering VAT exemptions on energy bills to ease the pressure. Meanwhile, Shadow Chancellor Mel Stride blames Labour’s £20bn employment tax raid for making things worse.

Here’s the reality: while politicians argue, your cost of living keeps climbing.

What Happens Next for UK Interest Rates?

Bank of England Faces Tough Choices

Most economists expect the Bank to hold rates steady on Thursday. City AM’s Shadow Monetary Policy Committee voted 8-1 to pause, with only one member pushing for a 25 basis point cut.

The thinking? With inflation this stubborn, cutting rates could pour fuel on the fire. But keeping them high risks choking an already struggling economy.

The 2027 Timeline Reality Check

JP Morgan’s Zara Nokes calls UK price growth “increasingly ugly,” and the Bank’s own forecasts suggest inflation won’t hit the 2% target until 2027. That’s three more years of this economic headache.

The Bottom Line

UK inflation at 3.8% isn’t just a number – it’s a real squeeze on family budgets. With food prices rising faster than wages and services inflation still elevated, Brits are paying for what experts call “years of poor economic management.”

The Bank of England’s interest rate decision Thursday will signal whether policymakers think monetary policy can solve this, or if we need broader economic reforms to break the cycle.

FAQ

Q1: Why is UK inflation so much higher than the 2% target?

A: It’s a mix of factors including rising food costs, higher taxes, regulatory expenses, and ongoing supply chain issues. Unlike pandemic-era inflation driven by money printing, today’s price rises stem more from government policy and structural economic problems.

Q2: Will the Bank of England cut interest rates this week?

A: Probably not. Most economists expect rates to stay put given stubborn inflation. An 8-1 vote by the Shadow Monetary Policy Committee suggests holding rates is the safer bet right now.

Q3: When will inflation actually come down?

A: The Bank of England forecasts inflation won’t hit the 2% target until 2027. That’s assuming no major economic shocks and gradual improvement in supply chains and government policy.

Q4: How does 5% food inflation affect my weekly shopping?

A: If you spent £100 on food last year, you’re now paying about £105 for the same items. With wages not keeping pace, many families are cutting back or switching to cheaper alternatives.

Q5: What can the government do besides interest rate changes?

A: Options include VAT cuts on energy bills (as Chancellor Reeves is reportedly considering), reducing regulatory costs on businesses, and addressing supply chain bottlenecks through economic liberalisation policies.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.