Turns out scrapping a 200-year-old tax break has consequences. Who knew?

Rachel Reeves’ decision to axe the non-dom regime in the Autumn Budget sent wealthy investors running for the exits faster than you can say “Dubai real estate.” Now Whitehall’s in damage control mode, holding crisis talks with City leaders to stem the bleeding.

The government’s already eyeing fixes: extending the current four-year grace period and rolling out a £200,000-a-year “pay-to-play” visa for the ultra-wealthy. Translation? They’re trying to convince billionaires that Britain’s still worth the money.

What Actually Happened to Non-Dom Status?

Chancellor Rachel Reeves replaced the non-dom system with a residence-based model that taxes long-term residents on their worldwide income. No more sweetheart deals for wealthy foreigners.

The new setup includes a four-year grace period before the tax hammer falls. But that wasn’t enough to stop the stampede.

High-profile exits include Revolut boss Nik Storonsky, who ditched his UK residency for the United Arab Emirates. Companies House filings from October confirmed the move, and he’s far from alone.

The Government’s Damage Control Plan

Business Secretary Peter Kyle (fresh from his post-reshuffle appointment after Angela Rayner’s resignation) is leading the charge to lure wealth creators back.

His Department for Business and Trade launched a “global talent taskforce” aimed at making Britain attractive to entrepreneurs again. Kyle’s ambitious goal? Creating the UK’s first $1tn company.

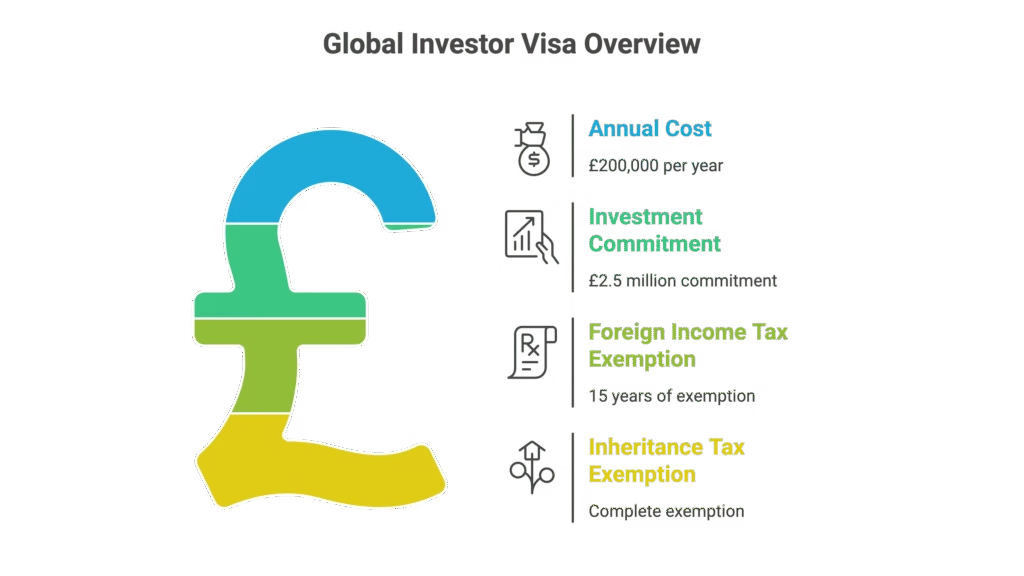

Meanwhile, lobby group Foreign Investors for Britain has pitched MPs on a “global investor visa” that would:

- Cost £200,000 annually

- Require a £2.5m investment commitment

- Exempt holders from foreign income tax for 15 years

- Skip inheritance tax entirely

It’s basically non-dom status with extra steps and a hefty price tag.

Why This Matters for UK Competitiveness

The non-dom exodus isn’t just about lost tax revenue. It’s about talent, investment, and Britain’s reputation as a global business hub.

When founders like Storonsky relocate, they take their companies, connections, and capital with them. That means fewer jobs, less innovation, and reduced tax receipts across the board.

Pressure groups point to recent Treasury U-turns on inheritance tax for farmers and business rates as proof the government can pivot. They’re betting Reeves will blink again.

What the Government Says

A government spokesperson doubled down on the party line: “The UK remains a highly attractive place to live and invest. Our main capital gains tax rate is lower than any other G7 European country and our new residence-based regime is now simpler and more attractive.”

They emphasised the system now “addresses tax system unfairness so every long-term resident pays their taxes here.”

Fair point. But if everyone’s leaving, does it matter how fair the system is?

The Bottom Line

Labour wanted tax fairness. They got an exodus instead.

Now they’re scrambling to find a middle ground between “tax the rich” rhetoric and “please don’t all move to Monaco” reality. Whether a £200,000 visa fee can win back billionaires remains to be seen.

One thing’s certain: nothing screams “we miscalculated” quite like emergency talks with City bigwigs six months after a major policy shift.

Want to understand how tax policy affects your investments? Keep an eye on government reviews and lobbying efforts—they signal where the wind’s blowing.

FAQ

1: What was the UK non-dom regime?

A: Non-dom status let wealthy foreign nationals living in the UK avoid paying tax on overseas income for up to 15 years. Rachel Reeves scrapped it in the Autumn Budget, replacing it with a residence-based system that taxes all long-term residents on worldwide income after four years.

2: Why are wealthy investors leaving the UK?

A: The new tax rules mean ultra-wealthy individuals now face higher tax bills on their global income. Many have relocated to low-tax jurisdictions like the UAE, Monaco, or Switzerland where they can legally avoid these charges whilst maintaining business operations.

3: What is the proposed global investor visa?

A: It’s a lobbied proposal for a £200,000 annual visa that requires a £2.5m UK investment. In exchange, holders would avoid foreign income tax for 15 years and skip inheritance tax—essentially recreating non-dom benefits with a price tag attached.

4: Who is Peter Kyle and what’s his role in this?

A: Peter Kyle is the Business Secretary appointed after Angela Rayner’s resignation. He’s leading efforts to attract wealth creators to the UK through the Department for Business and Trade’s new “global talent taskforce,” with the ambitious goal of helping Britain create its first $1tn company.

5: Will the government reverse the non-dom changes?

A: Unlikely to reverse completely, but they’re clearly open to modifications. Emergency talks with City leaders and consideration of visa extensions suggest they’re looking for compromises that balance tax fairness with economic competitiveness.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.