UK food and drink inflation hit 5.1% in August—the fifth straight month of increases and the highest since January 2024. The culprit? A storm of weather disasters and disease outbreaks that’s making cocoa more expensive than some precious metals.

Here’s why your favourite chocolate bar is about to shrink (again) and what it means for your wallet this Christmas.

The Great Cocoa Catastrophe: When Weather Goes Wrong

Cocoa prices are absolutely bonkers right now. We’re talking £5,000 per tonne, up from £3,300 just a year ago. At one point in late 2024, prices spiked to £9,000 per tonne—nearly triple the normal rate.

“Cocoa prices remain elevated by historical standards, even after easing back from last year’s stratospheric high,” explains Neil Wilson, investor strategist at Saxo UK.

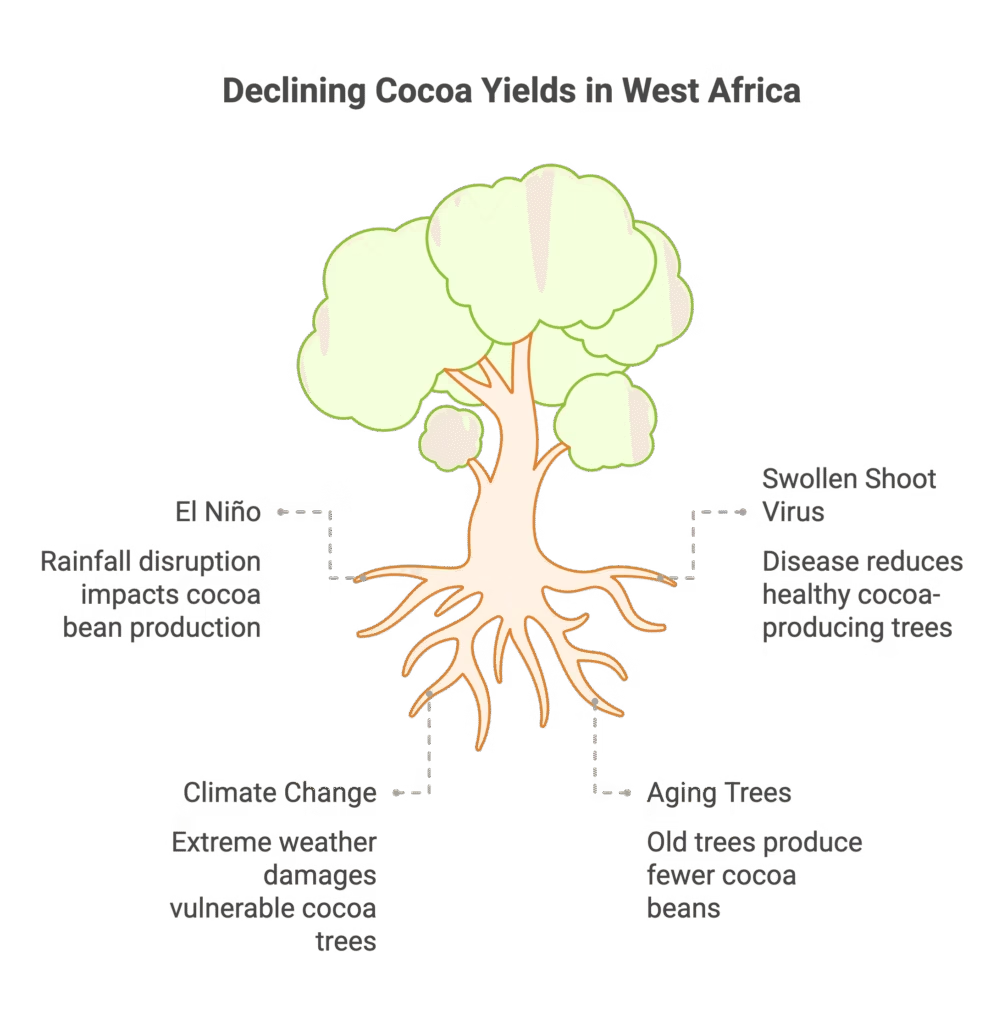

The chaos started in West Africa, which supplies most of the world’s cocoa. Ghana and Ivory Coast (which alone accounts for 84% of UK cocoa imports) got hammered by a deadly combo:

- El Niño weather patterns disrupting normal rainfall

- Swollen shoot virus spreading through plantations

- Extreme humidity and heat waves made worse by climate change

- Aging cocoa trees that farmers haven’t replaced

It’s the second year in a row that production has fallen, creating a massive supply shortage that’s forcing chocolate makers to jack up prices.

Christmas Chocolate Will Hit Different This Year

Remember when Toblerone changed its iconic shape to use less chocolate? Get ready for more of that. Manufacturers are turning to shrinkflation—keeping prices the same but making products smaller.

Swiss chocolatier Lindt & Sprüngli already raised prices 15.8% in the first half of 2025. A company spokesperson told City AM they’re “navigating a highly dynamic market environment shaped by inflationary pressures and extreme weather events.”

Translation: Your Christmas chocolate selection is going to look pretty different (and expensive) this year.

London’s Cocoa Market Shows the Strain

Here’s where it gets interesting from a trading perspective. London’s cocoa market is in backwardation—meaning immediate delivery prices are higher than future contracts. That’s the opposite of how commodities normally trade.

Why? Because everyone needs cocoa now, but nobody’s confident about future supply. Compare that to New York’s cocoa market (tied to South American supply), which is still trading normally with future prices above current ones.

What’s Next for Cocoa Prices?

Wilson predicts the upcoming October harvest will be “mixed.” Ivory Coast might see better crops, but Ghana’s looking rough. The bigger problem? Nobody’s replanting aging cocoa trees fast enough to fix the long-term supply issues.

“Weather risks could keep cocoa trading at historically elevated levels,” Wilson warns.

Bottom line: Don’t expect chocolate prices to normalise anytime soon. Climate change isn’t going anywhere, and it takes years for new cocoa trees to produce beans.

FAQ

Q1: Will chocolate prices keep rising through 2025?

A: Likely yes. Industry analysts predict UK food inflation could hit 5.7% by the end of 2025. Weather patterns remain unstable in key growing regions.

Q2: Which chocolate products will be most affected?

A: Mass-market chocolates and seasonal items (like Easter eggs and Christmas selections) typically see the biggest price impacts. Premium brands may absorb costs better initially.

Q3: Are there alternatives to West African cocoa?

A: South American suppliers exist but can’t replace West African volume quickly. Most global cocoa suppliers are in climate-vulnerable regions with limited adaptation resources.

Q4: What’s shrinkflation and how can I spot it?

A: Shrinkflation reduces product size while keeping prices the same. Check package weights and compare gram-per-pound ratios when shopping.

Q5: Could cocoa prices crash if supply improves?

A: Possible but unlikely short-term. Even with better harvests, it takes 3-5 years for new cocoa trees to produce, and climate risks remain high.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.