Feel like the economy’s throwing a party and forgot to invite your bank account? That’s what’s happening in the UK right now (sort of).

The Office for National Statistics (ONS) recently released some opposing signals about UK economic growth. Yes, the economy grew 0.7% in Q1 2024 — but plot twist (as there always is): disposable income per head actually tumbled 1%. It’s like getting a promotion with a pay cut. Makes total sense, right?

But why should you care? Because this disconnect between economic growth and disposable income directly impairs your ability to save, spend, and plan for the future. Let’s peel back a few layers and have a peek into what’s really going on and what it means for your finances.

The Good, The Bad, and The Ugly of UK GDP Growth

Q1 2024: When Numbers Tell Different Stories

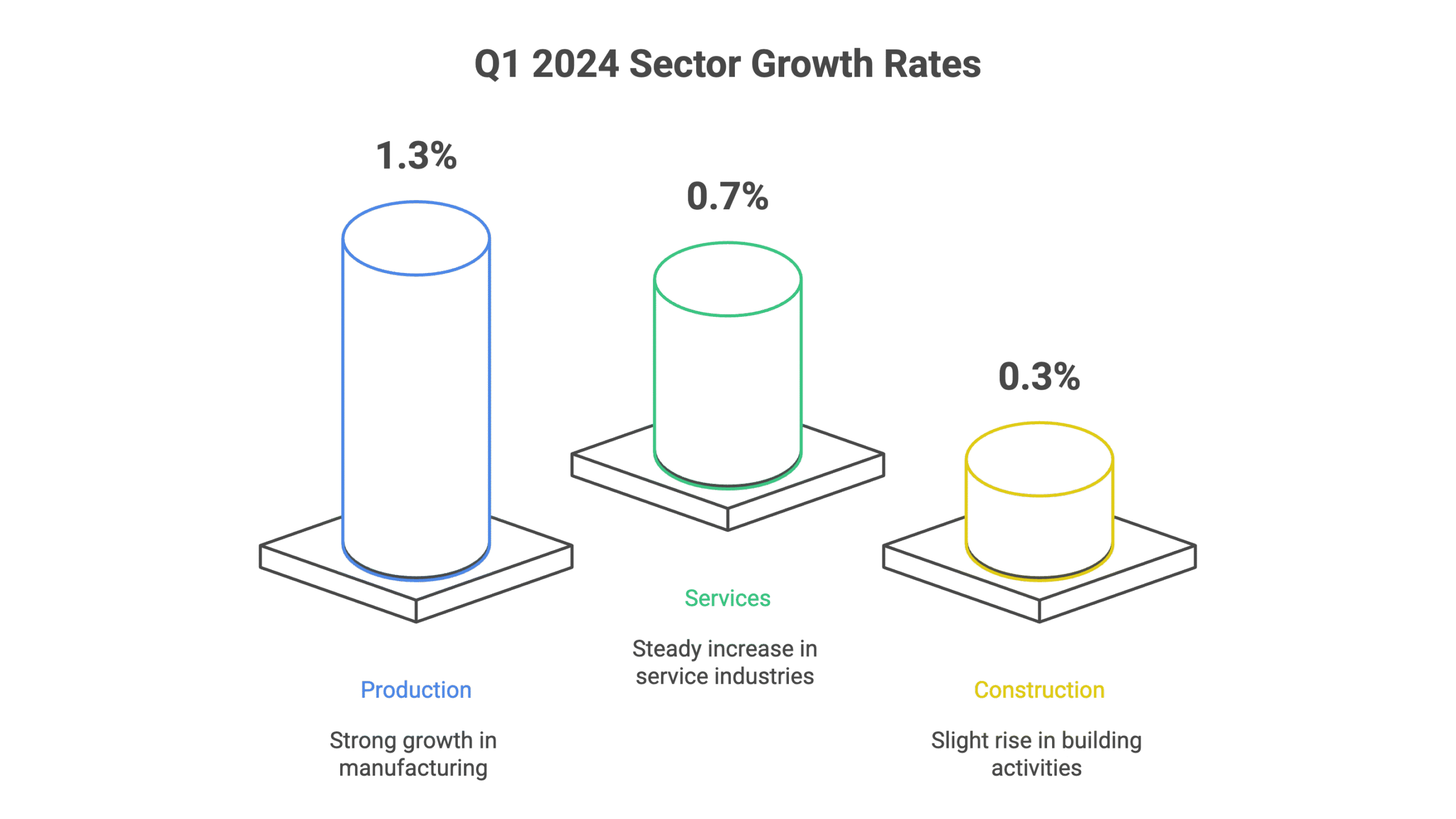

The ONS kept its first-quarter growth figures steady at 0.7%, with some sectors seriously outperforming others:

- Production sector: A commendable 1.3% growth

- Services: Solid 0.7% increase

- Construction: Modest 0.3% bump

Sounds fairly decent, yeah? The ONS went on further to say the economy “still grew strongly” in February, with March showing higher growth too. Hold up however — there’s more…

April’s Reality Check: The Growth Party Ends

Were you feeling all optimistic? Well, April had other plans. The UK economy contracted 0.3% — that’s three times worse than the 0.1% shrinkage City analysts had predicted.

You would be forgiven to think it looks like a minor stumble, but there’s more to it. Retail sales crashed 2.7% in May (economists expected just 0.5% decline), marking their worst performance in 18 months. Suddenly, the Q1 numbers have lost their shine.

Why UK Disposable Income Is Taking a Beating

The Chancellor’s Tax Raid Backfires

Rachel Reeves made economic growth her signature policy, promising to deliver it “further and faster.” Ironic, considering her £20bn employer tax raid from the Autumn Budget might be doing the exact opposite.

Think about it: when you slam businesses with massive tax bills, they can’t just simply absorb the cost. They have to freeze hiring, cap wages, or worse of all — cut jobs. Thomas Pugh from RSM UK questioned whether this weakness is “a one-off, due to the initial shock of tax increases… or whether it’s the start of a new trend.” A question worth discovering the answer to.

Global Economy: 2008 Called, It Wants Its Crisis Back

The World Bank just served up another helping of bad news (when don’t they?): we’re facing the worst global economic performance since the 2008 financial crash. Yeah, that financial crash.

Meanwhile, the Bank of England’s keeping interest rates at 4.25% because Middle East tensions (Israel-Iran specifically) could spike energy prices. Could that be the rate cuts everyone was hoping for out the window?

What This Means for Your Personal Finances

The Savings Squeeze

Ruth Gregory from Capital Economics discussed something telling: household savings rates dropped from 12% to 10.9% between Q4 2023 and Q1 2024. People are dipping into their rainy-day funds just to maintain their lifestyle.

Gregory sees this as “encouraging signs that consumer spending growth will edge higher.” But let’s be realistic — spending savings when your disposable income is falling isn’t exactly what I would call a sustainable strategy.

The 1% Growth Reality

Both the Office for Budget Responsibility (OBR) and Bank of England expect UK GDP growth to hit just 1% for 2025. Capital Economics agrees, stating the revised figures “do not change our view that the economy will grow by just 1% this year.”

One percent. In an economy where disposable income per head is already falling. You don’t need a maths degree to know — it’s not pretty.

How to Protect Your Finances When Growth Doesn’t Mean Prosperity

With UK economic growth decoupling from personal prosperity, here’s what smart money does:

- Build that emergency fund — boring but essential when disposable income is shrinking

- Lock in savings rates now — before potential rate cuts make them worse

- Review your budget — especially discretionary spending

- Consider side hustles — don’t rely solely on wage growth that might not come, diversify

The Bottom Line on UK Economic Growth

The UK economy’s sending mixed signals like a bad kebab. GDP growth looks okay-ish on paper, but your disposable income tells a different tale. With global headwinds, tax pressures on employers, and interest rates stuck in neutral, don’t expect your personal finances to benefit from economic growth anytime soon.

Want more insights on navigating the UK’s economic maze? Soon you’ll be able to sign up for our weekly newsletter — we’ll help you make sense of the numbers that actually matter to your money.

FAQ: UK Economic Growth and Your Disposable Income

Q1: How can the UK economy grow while disposable income falls?

GDP growth measures total economic output, not individual prosperity. When businesses face higher costs (like Reeves’ £20bn tax raid), they protect profits by limiting wage increases or cutting jobs. Plus, inflation erodes purchasing power even during growth periods.

Q2: Is the April GDP contraction a sign of recession?

Not yet — one month doesn’t equal recession. But the 0.3% contraction (triple expectations) following tax hikes is concerning. If this continues through Q2 and Q3, recession talks will heat up. Watch for June’s data as a key indicator.

Q3: How do Middle East tensions affect UK interest rates?

Israel-Iran tensions threaten energy supply chains, potentially spiking oil and gas prices. The Bank of England won’t cut rates if inflation risks rise from energy costs — meaning your mortgage and loan rates stay higher for longer.

Q4: When will UK disposable income improve?

With just 1% GDP growth expected in 2025 and businesses absorbing tax increases, significant improvements look unlikely before 2026. Focus on what you can control: budgeting, saving strategically, and potentially increasing income through side projects.

Q5: Should I change my investment strategy based on these GDP figures?

Slow growth typically favors defensive investments over growth stocks. But don’t panic-sell. Consider diversifying internationally since UK-specific challenges (like employer tax raids) don’t affect global markets. Always consult a financial advisor for personalised advice.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.