The Market Loved It. The Treasury Might Not.

Keir Starmer told the country the UK needs to “go faster” on defence spending and investors wasted no time. On Monday, defence stocks on the FTSE 100 shot up as speculation grew that the government could accelerate its spending timeline by half a decade. BAE Systems, Babcock, Melrose, and Rolls-Royce all jumped. But while the market cheered, economists started doing some awkward sums. The numbers, it turns out, don’t make for comfortable reading.

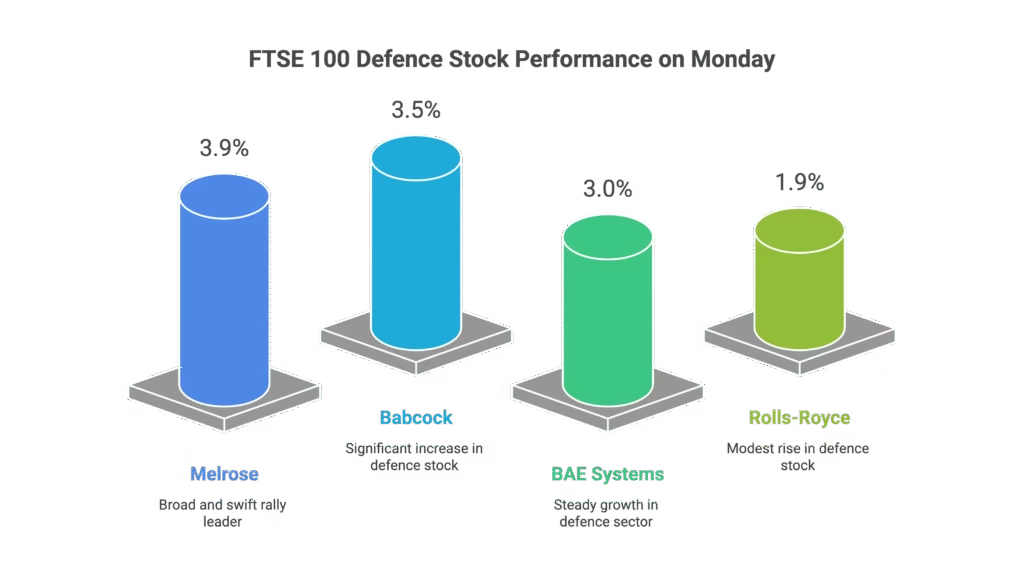

Which Defence Stocks Moved — and By How Much?

The rally was broad and swift. Here’s how the FTSE 100’s major defence names closed on Monday:

- Melrose — up 3.9%

- Babcock — up 3.5%

- BAE Systems — up 3.0%

- Rolls-Royce — up 1.9%

Danni Hewson, head of financial analysis at AJ Bell, summed it up: “Speculation is mounting that the increase in defence spend will come ahead of the government’s current target.” Markets ran with that and haven’t looked back.

What’s Actually Being Proposed?

The government currently has a target to raise defence spending to 3% of GDP — but not until 2034. A BBC report suggested that timeline could be pulled forward to 2029, shaving five years off the schedule.

Starmer confirmed the direction of travel, saying: “We need to step up. That means on defence spending, we need to go faster.”

Downing Street later pumped the brakes slightly, with sources telling reporters there were no “concrete plans” in place — though they didn’t deny that discussions had happened. So: not confirmed, not denied. Classic.

The Fiscal Headroom Problem

James Smith, developed markets economist at ING, estimated the accelerated spending plan could cost an extra £17bn per year on top of existing budget commitments.

That’s a significant problem given the government’s two fiscal rules:

- Day-to-day spending must be balanced by tax receipts

- Public sector net financial liabilities (PSNFL) must be falling within five years

The UK currently has £24bn of headroom against that second rule, according to the Office for Budget Responsibility. A large, front-loaded defence increase could eat through that — or wipe it out entirely.

“Higher defence spending would shave a decent chunk off that and potentially wipe it out entirely if the spending increase is frontloaded,” Smith warned.

Can the Government Find the Money Elsewhere?

Short answer: probably not easily. Henry Cook, Europe economist at MUFG, pointed out that unprotected departmental budgets — already squeezed — have little left to trim.

“It would be hard to trim anything meaningful from unprotected departmental budgets,” he said. “Finding the fiscal space would certainly be challenging.”

Independent economist Julian Jessop added another wrinkle: even if the headroom technically survives, bond markets are already nervy about UK debt levels. More borrowing is more borrowing, whatever the stated purpose — and gilts investors tend to notice.

“The markets are already nervous about the outlook for UK debt,” Jessop noted.

Cook put it plainly: “The government clearly wanted to end the cycle of fiscal speculation when it increased its headroom at the last Budget, but it’s still not out of the woods.”

The Bottom Line

UK defence stocks had a strong Monday, and the longer-term investment case for the sector looks solid if spending does accelerate. But the government faces a real tension: national security demands are pushing spending up, while fiscal rules — and bond market jitters — are pulling in the opposite direction. Watch this space closely, especially ahead of the next Spending Review.

FAQ

Q1: Why did UK defence stocks rally on Monday?

A: Markets reacted to signals from PM Keir Starmer that the UK could accelerate its defence spending timeline. Speculation that the 3% GDP target could arrive by 2029 — rather than 2034 — sent defence-sector shares sharply higher.

Q2: Which UK defence stocks performed best?

A: Melrose led the pack with a 3.9% gain, followed by Babcock (3.5%), BAE Systems (3.0%), and Rolls-Royce (1.9%).

Q3: What are the UK government’s fiscal rules?

A: The government has two rules: day-to-day spending must be covered by tax receipts, and public sector net financial liabilities must be on a downward path within five years. A large increase in defence spending could put the second rule under pressure.

Q4: How much would accelerated defence spending cost?

A: ING economist James Smith estimated the acceleration could add around £17bn per year to the existing budget plan — a figure that could eat significantly into the UK’s £24bn of fiscal headroom.

Q5: Could the government cut elsewhere to pay for it?

A: Economists are sceptical. Unprotected departmental budgets are already stretched, and there’s broad political support for higher defence spending — meaning cuts to offset it would face serious resistance.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.