Introduction

TSB just posted some impressive numbers, and the timing couldn’t be better. The high street bank’s pre-tax profit jumped 38.2% to £271m in the first nine months of 2025, right as it prepares for its blockbuster £2.9bn takeover by Santander. With costs slashed, margins fattening, and a Spanish banking giant ready to write a cheque, TSB’s looking like a well-oiled machine heading into new ownership. So what’s driving the surge, and what does this mega-deal mean for UK banking?

TSB’s Profit Surge: The Numbers Behind the Headlines

TSB’s financial performance has turned heads this quarter. Pre-tax profit hit £271m for the first nine months of 2025—a solid 38.2% jump from the same period last year.

The secret? Cost-cutting. TSB slashed operating costs by 7.5% to £581.7m, driving its cost-to-income ratio down from 73.2% to 65.7%. Translation: for every pound earned, TSB’s spending less on overheads. That’s the kind of efficiency that makes acquirers salivate.

Meanwhile, the bank’s net interest margin (essentially how much profit it squeezes from lending) expanded 21 basis points to 2.86%. Not spectacular by historical standards, but in today’s rate environment, it’s decent progress.

Santander Beats the Competition for TSB

When Banco Sabadell (TSB’s owner since buying it from Lloyds for £1.7bn in 2015) put the bank up for sale earlier this year, the UK’s banking heavyweights circled. But Santander swooped in with the winning bid.

The deal’s headline figure is £2.9bn, though shareholders will vote on a £2.65bn price tag—the higher number factors in estimated future profits. Either way, it’s a chunky acquisition.

What Santander’s Getting

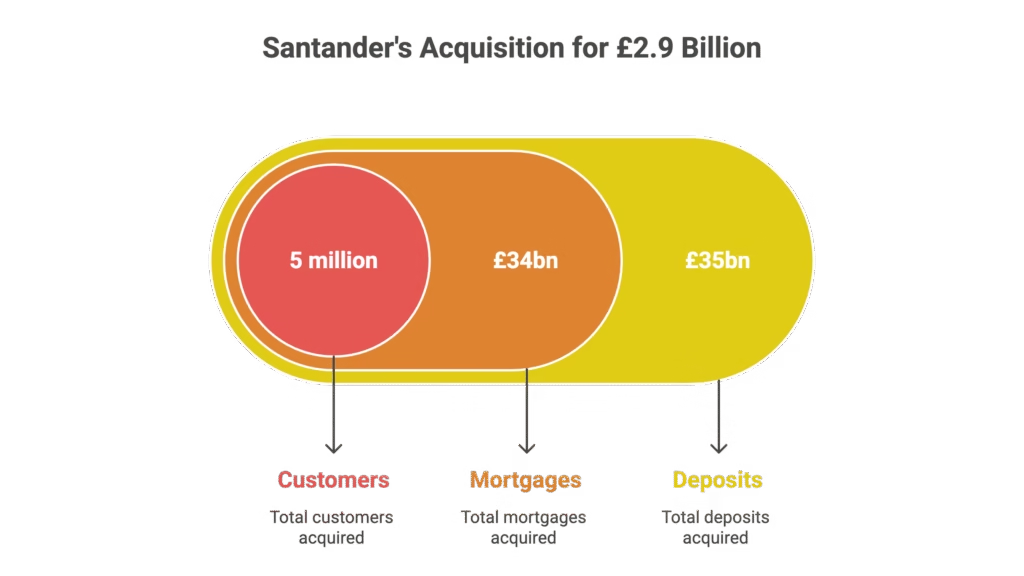

Here’s what £2.9bn buys you:

- 5 million customers

- £34bn in mortgages

- £35bn in deposits

- 218 branches across the UK

Once the deal closes (expected Q1 2026), the combined entity will serve 28 million customers and become the UK’s second-largest player in personal current accounts by branch network.

Why This Deal Matters for UK Banking

Santander boss Ana Botín has been battling rumours that the Spanish bank might retreat from the UK market. This acquisition puts those whispers to bed.

“The acquisition of TSB represents a continuing strategic commitment to our customers in the UK,” Botín said. She described it as “financially attractive” and aligned with Santander’s long-term goals—adding a “low-risk and complementary business” to the group’s portfolio.

For TSB customers, the transition should be relatively smooth. Santander’s already a household name in the UK, and regulatory approvals are expected without major drama. The real question is whether Santander can maintain TSB’s improving efficiency while integrating five million new customers.

Conclusion

TSB’s 38% profit jump proves it’s in fighting shape ahead of the Santander takeover. With costs down, margins up, and a £2.9bn deal on the table, the bank’s transformation from Lloyds castoff to acquisition target is complete. For UK banking, it’s another sign of consolidation—and for Santander, it’s a major vote of confidence in the British market. Keep an eye on Q1 2026 when the deal’s expected to close.

Want to stay updated on UK banking moves? Bookmark our finance section for the latest merger news and market analysis.

FAQ

Q1: When will the Santander-TSB deal officially close?

A: The acquisition is expected to formally close in the first quarter of 2026, subject to regulatory approvals and shareholder votes. The deal has already cleared the major competitive hurdles.

Q2: How much is Santander paying for TSB?

A: Santander’s paying £2.9bn when you factor in estimated future profits. Shareholders will vote on a £2.65bn base price, with the final amount adjusted based on TSB’s performance leading up to completion.

Q3: What happens to TSB customers after the takeover?

A: TSB’s 5 million customers will become part of Santander’s UK operation. While branding and systems may eventually change, transitions like these typically happen gradually to minimise disruption.

Q4: Why did TSB’s profit jump so dramatically?

A: TSB cut operating costs by 7.5% and improved its net interest margin by 21 basis points. The improved cost-to-income ratio (down to 65.7%) shows the bank’s getting more efficient at converting revenue into profit.

Q5: Is this deal good for competition in UK banking?

A: It’s a mixed bag. The merger creates a stronger number-two player in personal banking, which could challenge the big four’s dominance. However, fewer independent banks means less choice for consumers long-term.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.