Remember when everyone said AI would change everything? Well, the market’s starting to take that seriously – and not in a good way. After Anthropic released a new legal AI tool in early 2026, tech stocks took a proper beating. London saw Relx crater nearly 11%, whilst the Nasdaq’s already down 3% for the year. The question investors are asking isn’t if AI disrupts traditional business models anymore – it’s which ones get hit first, and how hard. Suddenly, those sky-high valuations don’t look quite so bulletproof.

What Sparked the Sell-Off?

Here’s the timeline: Anthropic releases an AI tool designed to help legal teams triage contracts and draft routine responses. They’re careful to say it won’t replace lawyers (wink wink), but markets aren’t buying the diplomacy.

Within hours, London’s legal and data analytics darlings got hammered. Relx lost billions in market cap. Pearson dropped 4%. LSEG and Experian? Down over 7% each. Amsterdam’s Wolters Kluwer slid nearly 9%.

The message was clear: if AI can automate high-margin professional services, those fat software licence fees might be living on borrowed time.

The Contagion Spreads Across Markets

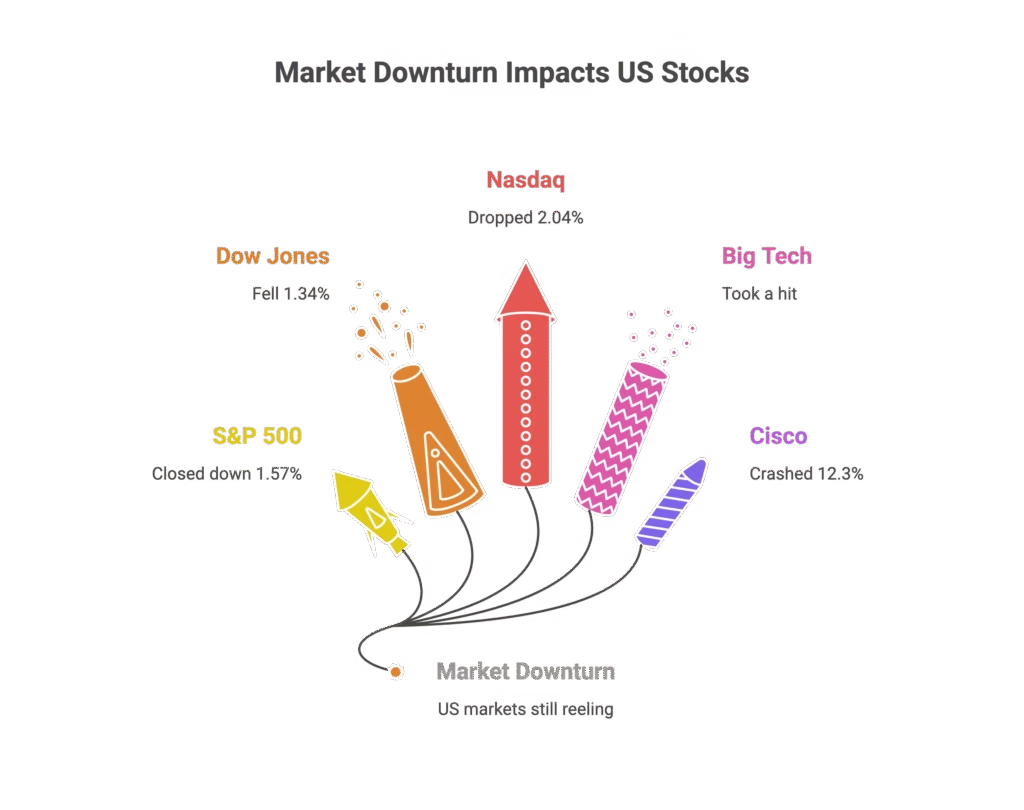

One week later, US markets were still reeling. The S&P 500 closed down 1.57%, the Dow fell 1.34%, and the Nasdaq dropped 2.04%.

Big Tech took it on the chin:

- Apple: down 5%

- Meta: down 2.8%

- Amazon: down 2.3%

- Cisco: crashed 12.3% after warning that memory chip prices would squeeze margins

Even SoftBank, with its heavy AI exposure, fell over 6% in Asian trading. Logistics stocks wobbled too, as investors fretted about AI disrupting freight brokerage models.

“Relx has a large presence in the legal space, and was in the teeth of the resulting storm,” said Dan Coatsworth, head of markets at AJ Bell. “A lot of investors weren’t sticking around to find out” how deep AI disruption might go.

The Infrastructure Spend Reality Check

For two years, AI has been the market’s golden narrative. Tech giants have pledged hundreds of billions for data centres and chips. Everyone wanted in.

But UBS just downgraded the US tech sector, citing “pervasive uncertainty in the software industry” and expectations that infrastructure spending will cool off.

The bank reckons Microsoft, Alphabet, Amazon, Meta and Oracle could collectively drop $700bn on capex this year. Trouble is, UBS expects that growth rate to slow – great news for the companies writing cheques, potentially awful news for the chipmakers and infrastructure players cashing them.

Even Strong Earnings Can’t Save You

Microsoft posted quarterly revenue of $81.27bn, beating forecasts. Its Intelligent Cloud revenue jumped 39% year on year. Textbook success, right?

Shares still tanked nearly 10% – hitting their worst day since March 2020. Why? Jefferies analyst Brent Thill pointed to “concerns about Azure growth coming in close to expectations and the concentration of Microsoft’s backlog.”

Translation: when you’re priced for perfection, meeting expectations feels like disappointment.

Jobs, Volatility, and Market Jitters

Jason Borbora-Sheen, portfolio manager at Ninety One, described a market that’s “trigger happy”, reacting to every perceived AI threat. Some investors are also de-risking ahead of inflation data, adding fuel to the volatility fire.

Safe-haven demand pushed the 10-year Treasury yield down to 4.10% – its lowest this year. A $25bn 30-year bond auction saw strong demand, with primary dealers taking their smallest share on record.

Oddly, gold fell 3.2%. HSBC analyst James Steel explained: “The equity market decline has triggered gold liquidation to raise cash.”

Meanwhile, Morgan Stanley reckons the UK has seen an 8% net job loss over the past year thanks to AI. London mayor Sadiq Khan warned that white-collar roles in law, finance and marketing are “at the sharpest edge of change.”

Anthropic’s CEO Dario Amodei wrote last month that AI development will “test who we are as a species.” For markets, it’s testing which business models survive – and which get obsoleted.

Is This Just a Wobble or the Start of Something Bigger?

Earnings season still looks solid overall. Bloomberg Intelligence expects S&P 500 earnings to rise 8.4% in Q4 – marking ten consecutive quarters of year-on-year growth. So far, 76% of reporting firms have beaten expectations.

The FTSE 100’s even gained ground, helped by strength outside tech. And Meta surged over 10% on strong advertising results, despite raising capex guidance to between $115bn and $135bn.

But here’s the thing: volatility’s not going anywhere. AI has shifted from being purely a growth story to a competitive risk – one that could pop valuations built on assumptions of endless expansion.

The first tech sell-off of 2026 might just be a wobble. Or it could be the market finally asking the hard questions about which AI promises are real, and which are just expensive hype.

Either way, buckle up. It’s going to be an interesting year.

FAQ

Q1: Is this the start of an AI bubble bursting?

A: Too early to say definitively. Markets are reassessing which companies benefit from AI versus which get disrupted by it. The sell-off reflects uncertainty more than a full-blown bubble pop – but the cracks are showing.

Q2: Why did legal and data firms get hit so hard?

A: Anthropic’s legal AI tool demonstrated that high-margin professional services – previously thought safe from automation – are now squarely in AI’s crosshairs. Investors fled companies reliant on those revenue streams.

Q3: Are Big Tech earnings still strong despite the sell-off?

A: Yes. Microsoft, Meta and others are posting solid results. But when you’re priced for perfection, “solid” isn’t enough. Markets are nervous about slowing infrastructure spending and whether AI investments will actually pay off.

Q4: What’s happening with AI infrastructure spending?

A: Tech giants are still spending heavily – potentially $700bn this year across Microsoft, Alphabet, Amazon, Meta and Oracle. But UBS expects that growth rate to slow, which worries chipmakers and infrastructure suppliers.

Q5: Should investors be worried about AI-related job losses?

A: Morgan Stanley estimates the UK has lost 8% of jobs to AI over the past year, concentrated in white-collar sectors. This adds economic uncertainty on top of market volatility, making investors more cautious about AI-exposed stocks.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.