The SEC just delayed Solana ETF approval until 16th October 2025 – but here’s why crypto experts are calling this the setup for a massive Q4 catalyst. Four major Solana ETF applications from Bitwise, 21Shares, Canary Funds, and Marinade Finance are now in extended review, creating a clear deadline that’s already pushing SOL price past $200.

With spot Solana ETF approval odds hitting 95% according to Bloomberg analysts and institutional demand surging, October could deliver the next major crypto ETF breakthrough. Here’s what the SEC delay really means for your crypto portfolio and why SOL bulls aren’t backing down.

SEC Extends Solana ETF Review Period Until October 2025

The Securities and Exchange Commission extended its review period for spot Solana ETF applications from Bitwise and 21Shares until 16th October 2025. Originally due 17th August, these Solana ETF filings now face the maximum 60-day extension allowed under SEC rules.

“The Commission finds that it is appropriate to designate a longer period within which to issue an order,” the SEC stated in Thursday’s filing. Translation? They need sufficient time to consider whether spot Solana ETFs meet investor protection standards.

Canary Funds and Marinade Finance also got the delay treatment, according to Bloomberg ETF analyst James Seyffart. This October deadline represents the final decision point – no more extensions possible.

Why October 2025 Could Bring Solana ETF Approval

Don’t panic yet. Industry experts are surprisingly bullish about Solana ETF approval odds for October.

James Seyffart expects “standard spot Solana ETFs to be approved by mid-October at the latest.” Bloomberg Intelligence has raised approval probability to 95%, matching their forecast for XRP and Litecoin ETF approval.

Meanwhile, Nate Geraci from The ETF Store told CNBC that regulatory tailwinds and massive Bitcoin/Ethereum ETF inflows are creating unstoppable momentum for altcoin ETF products.

The logic? Bitcoin and Ethereum spot ETFs pulled in record cash flows. New SEC leadership under Paul Atkins shows crypto-friendly signals, and institutions want diversified crypto exposure beyond the big two.

SOL Price Surges on Spot ETF Speculation

Solana price didn’t wait for regulatory clarity. SOL token jumped to $209 Thursday, riding Solana ETF approval speculation and massive derivatives market activity.

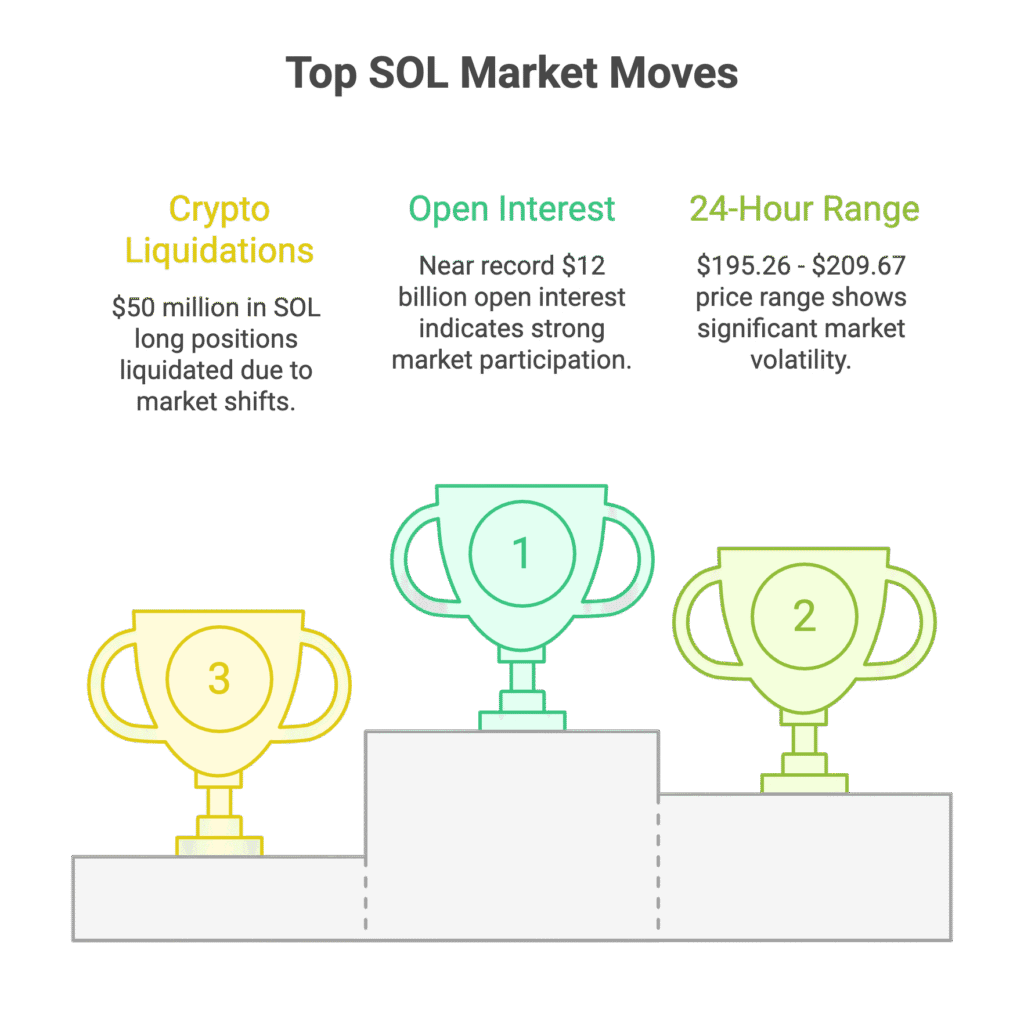

Key SOL price metrics:

- 24-hour range: $195.26 – $209.67

- Open interest: Near record $12 billion

- Crypto liquidations: $50 million in SOL long positions wiped out

That liquidation number tells the real story – traders are betting big on continued SOL upside momentum, even as overleveraged positions got squeezed during the price surge.

What Spot Solana ETF Approval Means for Crypto Markets

Andrejs Balans from YouHodler offers a reality check: while Solana and Polkadot attract serious institutional interest, they’re still “experimental” compared to Bitcoin and Ethereum spot ETF products.

“Only a few of these altcoin projects are likely to survive long enough to gain serious attention from major capital allocators,” he noted.

But if spot Solana ETFs get SEC approval in October, expect a flood of altcoin ETF applications. The SEC rarely approves just one crypto ETF when a new asset category gets the regulatory green light.

Bottom Line: October 2025 Setup for Crypto ETF Breakthrough

The 16th October deadline gives the SEC breathing room to address investor protection concerns, but it also creates a massive crypto catalyst for Q4 2025. If spot Solana ETF approval happens, we could see the next phase of institutional crypto adoption accelerate rapidly.

For now, SOL holders are betting October brings regulatory clarity and ETF approval. The SOL price action and 95% approval odds suggest they’re far from alone in this conviction.

FAQ

Q1: When will the SEC decide on spot Solana ETF approval?

A: 16th October 2025 is the final deadline for SEC approval or denial. This 60-day extension is the maximum allowed under SEC rules, meaning no further delays possible.

Q2: Which companies filed Solana ETF applications with the SEC?

A: Bitwise, 21Shares, Canary Funds, Marinade Finance, VanEck, Grayscale, and Franklin Templeton all have pending spot Solana ETF applications under SEC review.

Q3: Why did SOL price surge despite the SEC delay?

A: Markets often view regulatory delays as neutral-to-positive news for crypto ETF approval prospects. The October timeline also creates a clear catalyst date that traders can position around.

Q4: What are Solana ETF approval odds for 2025?

A: Bloomberg Intelligence pegs spot Solana ETF approval odds at 95% for 2025. Polymarket betting odds show 99% probability, reflecting strong market confidence in eventual approval.

Q5: How do Solana ETF prospects compare to Bitcoin and Ethereum ETF success?

A: While Bitcoin and Ethereum ETFs have regulatory precedent and massive inflows, Solana faces more scrutiny as an “experimental” asset. However, strong institutional interest and CME futures support could tip the scales toward approval.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.