Introduction

Remember “Tell Sid”? Well, Rachel Reeves is bringing back the investment ads – but this time, the City’s footing the £120m bill. The Chancellor’s ambitious stock market revival campaign is asking financial firms to dig deep, and some smaller players are already having second thoughts about the hefty price tag. Here’s what you need to know about this modern-day investment revolution and who’s paying for it.

What’s the Campaign Actually About?

The New “Tell Sid” Moment

Reeves announced this major advertising push as part of her Mansion House package – a classic pro-business charm offensive aimed at reviving London’s struggling stock market. The campaign will feature everything from “hero” films encouraging Brits to own stocks to social media blitzes and TV slots.

WPP is proposing three scenarios costing between £15m and £40m for the core advertising. But the kicker – firms also need to cover agency fees, production costs, and variable expenses depending on how many “bursts” of activity they want throughout the year.

Who’s Leading the Charge?

Sasha Wiggins, CEO of Barclays Private Bank and Wealth Management, is chairing the campaign. The Investment Association is orchestrating the whole thing, bringing together everyone from banking giants like NatWest, Lloyds, and HSBC to newer players like Robinhood UK.

The Price Breakdown: Who Pays What?

Size Matters for Your Bill

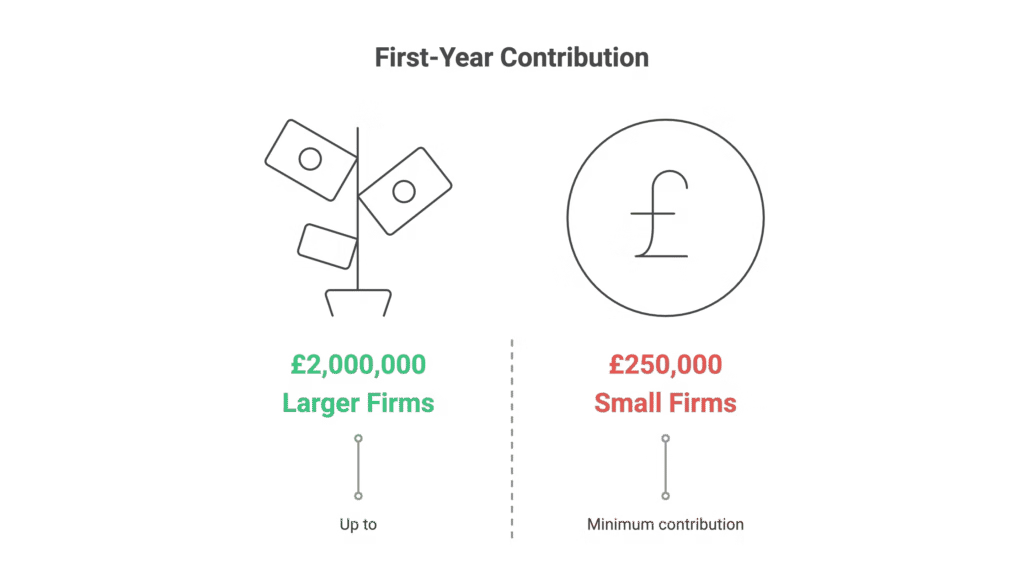

The Investment Association isn’t playing favorites – your contribution depends on your headcount:

Small firms (under 1,000 staff): £250,000 to £500,000 first-year contribution

Medium-sized firms (1,001 to 9,999 staff): £500,000 to £1m

Large firms (10,000+ staff): Up to £2m

Plus membership and legal costs on top. No wonder some smaller firms are reconsidering their participation.

Treasury Keeps Its Wallet Closed

Notably absent from the funding? The Treasury itself. While Reeves is cheerleading from the sidelines, the government won’t be writing any checks for this investment revival.

Why London Needs This Campaign

A Market in Crisis

Let’s be honest – London’s stock market has seen better days. This year alone, Wise ditched its UK primary listing for the US, and there are growing rumors that AstraZeneca (the City’s most valuable company) might follow suit after pausing a £200m UK investment.

The lack of liquidity has companies running for the exits, making Reeves’ campaign feel less like marketing and more like emergency CPR for British capital markets.

The Bigger Picture: Leeds Reforms

This campaign sits within Reeves’ broader Leeds Reforms, where she’s aiming to double the real growth rate in financial services net exports over the next decade. Bold target, but it’ll need more than flashy ads to achieve.

What Happens Next?

The campaign kicks off in April 2026, assuming WPP wins the agency pitch (though competitive bidding is still ongoing). Final costs are still being hammered out, so that £120m figure could shift.

For now, City firms are weighing whether the potential benefits of a revived London market are worth the upfront investment. Given the current state of UK capital markets, it might be their best shot at keeping London relevant in global finance.

FAQ

Q1: Will this campaign actually work to revive London’s stock market?

A: It’s hard to say – advertising can boost retail investment, but London’s deeper issues around liquidity and regulatory competitiveness need addressing too. Think of this as necessary but not sufficient.

Q2: Why isn’t the government funding this if they want it so badly?

A: Classic political move – Reeves gets to champion the initiative while keeping public spending off the books. The Treasury argues it benefits investment firms directly, so they should pay.

Q3: What happens if smaller firms pull out due to costs?

A: The campaign could still proceed with just the big players, but it would reduce the £120m total and potentially limit the advertising scope. The larger firms might need to pick up more of the tab.

Q4: Is this really comparable to Thatcher’s “Tell Sid” campaign?

A: In spirit, yes – both aimed to get ordinary Brits investing in stocks. But the 1980s privatisation ads had government backing and a clearer product to sell (British Telecom shares).

Q5: When will we see the actual advertisements?

A: Campaign launch is set for April 2026, assuming the funding and agency selection process wraps up smoothly. Expect a mix of digital, TV, and social media content.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.