The OECD’s latest forecast shows higher taxes and Trump tariffs will squeeze UK growth to just 1% in 2026 – while inflation hits 3.5%, second highest in the G7.

Here’s what’s coming and why it matters for your wallet.

OECD Growth Forecast: UK Economy Stuck in First Gear

The OECD kept its UK growth prediction for 2026 at a modest 1% growth – unchanged from its previous forecast. The culprit? Britain’s “tighter fiscal stance”.

There’s a silver lining though: 2025 growth got a tiny bump from 1.3% to 1.4%. But let’s be honest – that’s still crawling speed compared to what we need.

The real kicker? The Office for Budget Responsibility predicted 1.9% growth for 2026 back in March. Expect that number to get slashed when the Budget drops.

UK Tax Policy and Economic Headwinds

Right on cue, September’s PMI data showed the UK’s private sector hitting a four-month low. Chris Williamson from S&P Global Market Intelligence stated:

“September brought a litany of worrying news including weakening growth, slumping overseas trade, worsening business confidence and further steep job losses.”

We’re talking about 50,000 job losses signalled over three months. The UK economy’s not just slowing – it’s practically stalling.

Reeves Responds: “More to Do”

Chancellor Rachel Reeves put on a brave face, calling the figures proof that “the British economy is stronger than forecast.” She pointed to the UK being the fastest-growing G7 economy in H1 2025.

But even she admitted: “There is more to do to build an economy that works for working people.”

Fair point. Especially when you consider that some of that H1 growth came from companies panic-buying imports before Trump’s tariffs kicked in.

Inflation: The Unwelcome Houseguest

Inflation is expected to reach 3.5% in 2025, making the UK the second-worst performer among the world’s seven largest economies (only the US will be higher). This is worse than experts predicted just a few months ago.

The problem doesn’t go away quickly either. Even in 2026, inflation is projected to stay at 2.7% – still well above the Bank of England’s ideal target of 2%.

What makes this especially concerning is “core inflation” – the price increases for everything except food and energy. The UK’s core inflation of 3.7% is a full point higher than the average for the world’s 20 largest economies. That’s worse than the US, Spain, and most other major countries.

Bottom line: Everything you buy will keep getting more expensive, meaning your money won’t stretch as far as it used to.

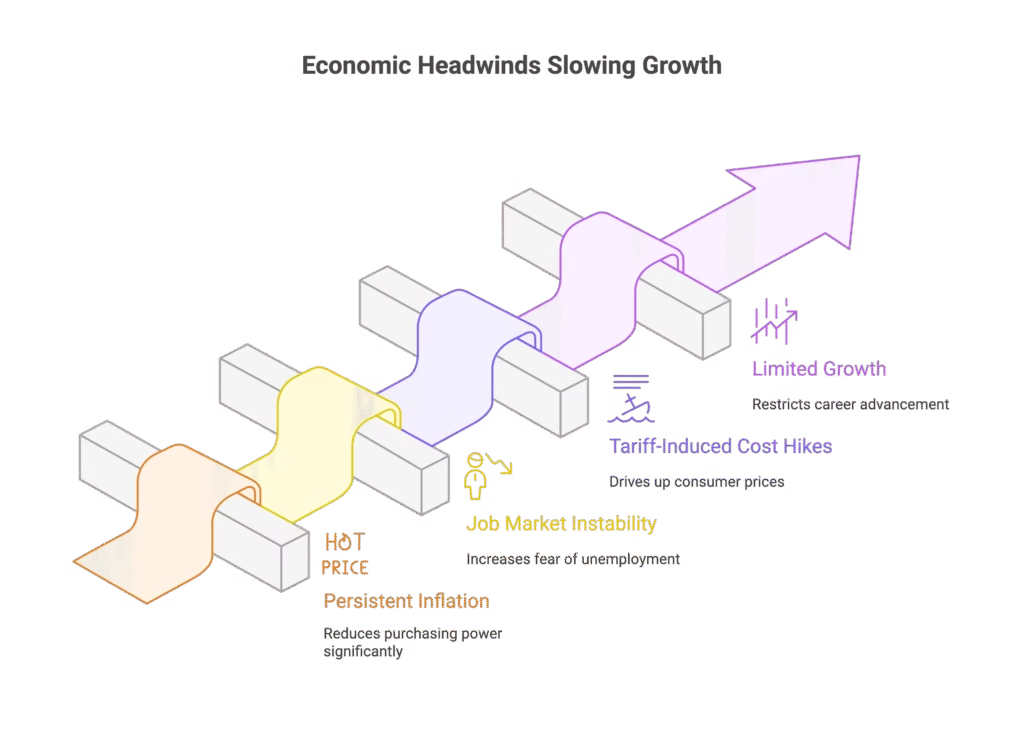

What’s Driving This Perfect Storm?

Three factors are colliding:

Trump’s tariffs – Adding costs across global supply chains, with UK businesses caught in the crossfire

Higher UK taxes – The government’s fiscal tightening is squeezing growth just when we need momentum

Global slowdown – The OECD’s global GDP forecast for 2026 dropped to 2.9%, down from 3.2% in 2025

The OECD’s advice? Governments need to “strengthen economic growth” while central banks stay “vigilant” on inflation. Easier said than done when you’re walking that tightrope.

What This Means for You

If you’re planning major purchases, investments, or career moves, factor in:

- Stubborn inflation eating into wages and savings

- Job market uncertainty with redundancies rising

- Higher costs from tariffs working through supply chains

- Slower growth limiting opportunities for raises and promotions

The Bank of England might shift toward a more dovish stance (rate cuts), but don’t expect dramatic relief anytime soon.

The Bottom Line

The UK’s economic forecast isn’t catastrophic – but it’s not pretty either. Sluggish growth, persistent inflation, and external headwinds from tariffs create a challenging environment through 2026.

For businesses and households alike, the message is clear: batten down the hatches and prepare for a bumpy ride.

Want to stay ahead of UK economic changes? Subscribe to our newsletter for weekly insights on growth, inflation, and policy shifts that affect your finances.

FAQ: UK Economy & OECD Forecast

Q1: Why is UK inflation higher than other G7 countries?

A: The UK faces a combination of Trump’s tariffs adding to import costs, domestic fiscal tightening, and structural inflation pressures. Core inflation at 3.7% is significantly above the G20 average, reflecting these compounded challenges.

Q2: Will the Bank of England cut interest rates?

A: With growth stalling and job losses mounting, pressure is building for a more dovish stance. However, inflation remaining above the 2% target complicates rate cut decisions through 2026.

Q3: How accurate are OECD forecasts?

A: OECD forecasts are closely watched by economists and governments as reliable indicators, though they’re updated quarterly as conditions change. They’ve already revised UK inflation up by 0.4 percentage points from their last report.

Q4: What were Trump’s tariffs’ impact on UK growth?

A: Trump’s tariffs caused UK businesses to front-load imports in H1 2025, temporarily boosting growth. Now that effect is reversing, contributing to the slowdown and adding to inflation pressures going forward.

Q5: Should I be worried about job security?

A: The PMI data signals around 50,000 job losses over three months, with business confidence declining. While not a crisis, it’s worth being cautious about job security and building emergency savings.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.