Motors.co.uk has achieved its first pre-tax profit since 2019 after acquiring the collapsed Cazoo brand, marking a dramatic turnaround for the automotive marketplace. The Gumtree-owned company posted £621,000 in pre-tax profit for 2024, reversing a £9.3m loss from the previous year.

This profit milestone comes alongside explosive revenue growth, with Motors.co.uk turnover surging 147% from £20.1m to £49.9m. The transformation demonstrates how strategic acquisitions can revive failing automotive brands when executed properly.

Motors.co.uk Cazoo Acquisition: A £5m Bargain That’s Delivering Results

When Motors.co.uk acquired Cazoo for £5m in June 2024, industry observers questioned the wisdom of buying a brand that had accumulated over £260m in debts. However, the latest financial results suggest CEO Barry Judge spotted value where others saw only risk.

The Cazoo acquisition wasn’t the only driver of improved performance. Company filings reveal much of the revenue increase stemmed from dealer advertising alignment improvements that began in Q4 2023, when Motors.co.uk consolidated all dealer advertising revenue under its operating structure.

This strategic restructuring allowed Motors.co.uk to recognise the full financial impact of its dealer network across all affiliated platforms, creating a more robust revenue foundation.

Cazoo Revival Strategy: From £8bn Valuation to Sustainable Profitability

Barry Judge isn’t settling for modest recovery – his vision positions Cazoo as a serious challenger to Auto Trader’s market dominance. In recent interviews, Judge outlined plans to double Cazoo’s size over the next two years, potentially securing the number two position in the UK automotive marketplace.

The revival strategy focuses on two critical areas:

Rebuilding Market Trust: Motors.co.uk is systematically addressing the reputation damage from Cazoo’s spectacular collapse, working to restore confidence among both consumers and automotive dealers.

AI-Driven Business Model: Unlike the original cash-burning Cazoo approach, the new strategy leverages artificial intelligence to create sustainable, profitable operations from day one.

The Original Cazoo Collapse: Lessons in Automotive Marketplace Failures

Understanding Cazoo’s dramatic fall provides context for Motors.co.uk’s impressive turnaround. Founded by Alex Chesterman in 2018, Cazoo reached an $8bn valuation following its New York Stock Exchange listing, promising to revolutionise online car buying.

However, the growth-at-all-costs strategy proved unsustainable. By May 2024, mounting losses and over £260m in accumulated debts forced Cazoo into administration, making it one of the most high-profile automotive marketplace failures in recent history.

Motors.co.uk’s £5m acquisition price represents just 0.06% of Cazoo’s peak valuation, highlighting how dramatically market conditions can shift in the automotive sector.

Financial Turnaround Analysis: Key Performance Indicators

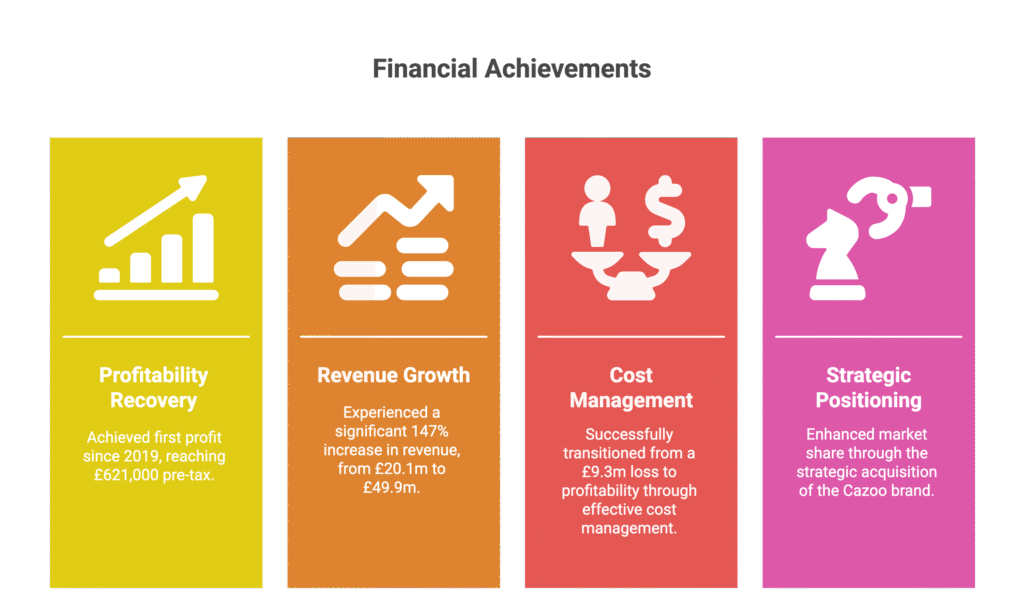

The Motors.co.uk financial results demonstrate several positive trends:

- Profitability Recovery: First profit since 2019 at £621,000 pre-tax

- Revenue Growth: 147% increase from £20.1m to £49.9m

- Cost Management: Successful transition from £9.3m loss to profitability

- Strategic Positioning: Enhanced market share through Cazoo brand acquisition

These metrics suggest Motors.co.uk has successfully integrated the Cazoo acquisition while maintaining operational discipline – a crucial balance many automotive marketplace companies struggle to achieve.

Auto Trader Competition: Can Cazoo Challenge Market Leadership?

Judge’s ambition to position Cazoo as Auto Trader’s primary competitor represents a significant challenge. Auto Trader’s FTSE 100 status and established market position create substantial barriers for newcomers in the automotive marketplace sector.

However, Motors.co.uk’s profit recovery and revenue growth provide a foundation for expansion. The company’s focus on sustainable profitability, rather than growth at any cost, may prove more effective than previous challenger strategies in the competitive automotive classifieds market.

Conclusion: Automotive Marketplace Recovery Success Story

Motors.co.uk’s transformation of Cazoo from a £260m debt-laden failure into a profitable automotive brand demonstrates the potential for strategic turnarounds in the digital marketplace sector. The £621,000 profit may seem modest, but it represents complete operational transformation within 12 months.

Whether Judge can execute his vision of challenging Auto Trader remains to be seen, but the financial fundamentals suggest Motors.co.uk has created a sustainable platform for growth. This turnaround story offers valuable insights for investors and industry observers tracking automotive marketplace dynamics.

Frequently Asked Questions

Q1: How much profit did Motors.co.uk make in 2024?

A: Motors.co.uk reported £621,000 in pre-tax profit for 2024, marking its first profitable year since 2019. This represents a dramatic turnaround from the £9.3m loss recorded in the previous financial year.

Q2: What was the Cazoo acquisition price and when did it happen?

A: Motors.co.uk acquired the Cazoo brand for £5m in June 2024, following Cazoo’s collapse into administration. This acquisition price was remarkably low compared to Cazoo’s previous $8bn peak valuation on the New York Stock Exchange.

Q3: How much did Motors.co.uk revenue increase in 2024?

A: Motors.co.uk revenue surged 147% in 2024, growing from £20.1m to £49.9m. Much of this increase resulted from dealer advertising alignment improvements and the full-year impact of the Cazoo brand integration.

Q4: Can Cazoo compete with Auto Trader under new ownership?

A: CEO Barry Judge believes Cazoo can double in size and challenge Auto Trader’s market leadership within two years. However, Auto Trader’s FTSE 100 status and established market position create significant competitive challenges for any challenger in the automotive marketplace sector.

Q5: What caused the original Cazoo business failure?

A: Cazoo collapsed due to unsustainable growth strategies that accumulated over £260m in debts by May 2024. Despite reaching an $8bn valuation, the company’s cash-burning business model proved financially unviable in challenging market conditions.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.