McLaren Racing’s valuation has skyrocketed to £3bn ($5bn) following a complete buyout of minority shareholders by Gulf investors, making it the fourth most valuable Formula 1 team behind Ferrari, Mercedes, and Red Bull Racing.

The Bahrain sovereign wealth fund Mumtalakat and UAE-based CYVN Holdings are acquiring the remaining 30% minority stake from MSP Sports Capital and other investors, giving Middle Eastern entities complete control of the iconic papaya-coloured F1 team. This Formula 1 team valuation represents a staggering 10x return for MSP Sports Capital since their 2020 investment.

McLaren Racing Stake Sale: Record-Breaking F1 Team Valuation

MSP Sports Capital, which invested £185 million in December 2020 when McLaren Racing was valued at just £560 million, is now exiting with the biggest sports team return ever for an institutional fund. The McLaren F1 team valuation surge reflects the sport’s explosive commercial growth under Liberty Media ownership.

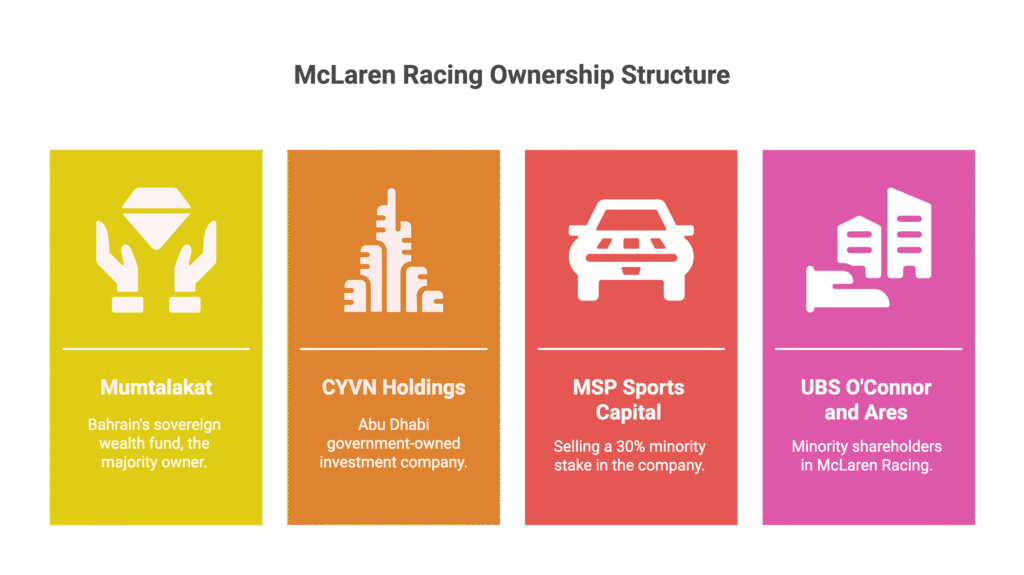

Key stakeholders in the McLaren Racing buyout include:

- Bahrain’s Mumtalakat sovereign wealth fund (majority owner)

- CYVN Holdings (Abu Dhabi government-owned)

- MSP Sports Capital (selling 30% minority stake)

- UBS O’Connor and Ares Investment Management (minority shareholders)

This McLaren Racing stake sale comes as Formula 1 team valuations have reached record levels, with all 10 teams now worth over $1 billion.

Why McLaren F1 Team is Worth £3bn: Championship Success Drives Valuation

On-track performance fuels financial success. McLaren won their first Constructors’ Championship in 2024 since 1998 and are leading both championships in 2025 with 12 wins in 15 races. This Formula 1 championship success directly impacts team valuation through increased prize money, sponsorship opportunities, and global visibility.

Mastercard title sponsorship deal worth $100m annually. McLaren announced Mastercard as their naming partner starting in 2026, ending over a decade without a title sponsorship agreement. The deal showcases how F1 team valuations benefit from premium brand partnerships.

Multi-series racing portfolio expands revenue streams. McLaren Racing operates successful IndyCar and upcoming WEC sportscar teams, with Arrow McLaren finishing 2nd in IndyCar Championship just four years after acquisition. This diversification supports the £3bn McLaren Racing valuation.

F1 Team Valuations: McLaren Ranks Fourth Among Most Valuable Teams

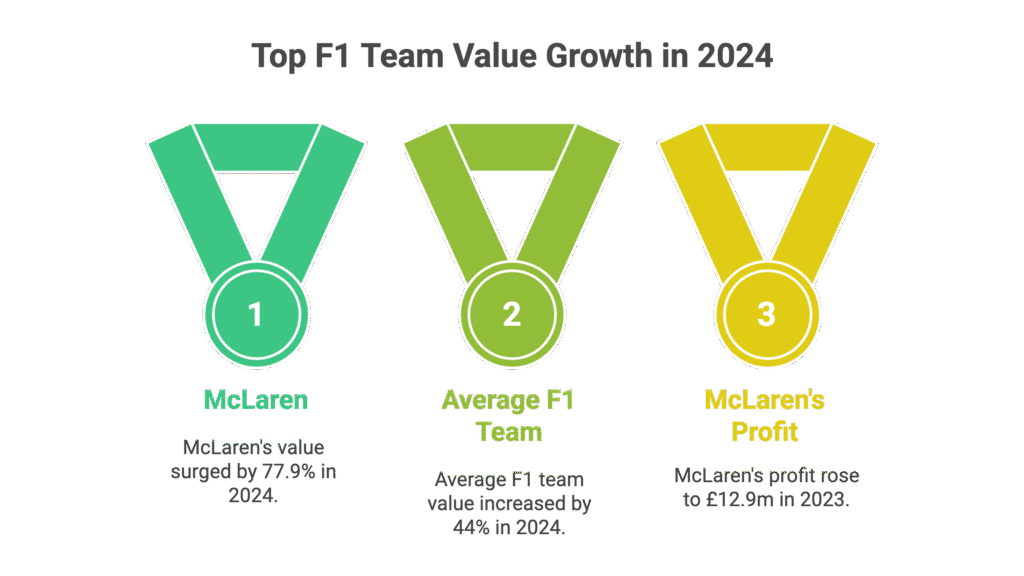

McLaren’s £3bn valuation places them fourth globally behind Ferrari ($4.78bn), Mercedes ($3.94bn), and Red Bull Racing ($3.5bn). The Formula 1 team valuations landscape has transformed dramatically:

- Average F1 team value: $2.31 billion in 2024, up 44% from 2023

- McLaren’s value increase: 77.9% growth from 2023 to 2024

- Revenue performance: McLaren posted £12.9m profit in 2023, reversing £57.8m loss from prior year

Liberty Media generated $3.22 billion from F1 in 2023, with 38% shared among teams totalling $1.22 billion, demonstrating the commercial engine driving these McLaren Racing valuations.

What McLaren F1 Valuation Means for Formula 1’s Financial Future

This McLaren Racing stake sale to Gulf investors reflects F1’s shift toward sovereign wealth fund ownership. With deep capital reserves and long-term investment horizons, these Middle Eastern entities can sustain competitive spending while building global motorsport brands.

McLaren’s cross-series presence across Formula 1, IndyCar, and WEC positions the team for growth beyond traditional F1 boundaries. The £3bn valuation signals confidence in motorsport’s expanding commercial opportunities worldwide.

For F1 fans and investors alike, McLaren’s record-breaking team valuation proves championship success and smart commercial partnerships create extraordinary shareholder returns in modern Formula 1.

Frequently Asked Questions About McLaren F1 Team Valuation

Q1: What is McLaren F1 team worth in 2025?

McLaren Racing is valued at £3bn ($5bn) following the Gulf investors’ buyout of minority shareholders. This makes McLaren the fourth most valuable Formula 1 team globally behind Ferrari, Mercedes, and Red Bull Racing.

Q2: Who owns McLaren F1 team after the stake sale?

A: Bahrain’s Mumtalakat sovereign wealth fund remains the majority shareholder, with UAE-based CYVN Holdings holding the remainder. The buyout gives Gulf entities 100% control after purchasing minority stakes from MSP Sports Capital and other investors.

Q3: How much did MSP Sports Capital make from McLaren investment?

A: MSP Sports Capital achieved a 10x return on their £185 million investment from December 2020, representing the biggest sports team exit ever for an institutional fund. Their investment valued McLaren at £560 million in 2020.

Q4: Why are Formula 1 team valuations so high in 2024?

A: F1’s global popularity surge, Netflix’s Drive to Survive success, and Liberty Media’s commercial innovations have driven average team valuations to $2.31 billion. Championship success, premium sponsorships, and expanded media rights fuel these record valuations.

Q5: What makes McLaren Racing more valuable than other F1 teams?

A: McLaren’s multi-series presence across F1, IndyCar, and WEC, combined with their 2024 Constructors’ Championship and 55 F1 sponsors including Mastercard’s $100m title deal, creates multiple revenue streams supporting their £3bn valuation.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.