Got £20,000 burning a hole in your pocket? You’re facing the classic ISA investing dilemma: dump it all in your Stocks and Shares ISA at once, or drip-feed it monthly like a cautious coffee drinker.

Here’s the thing—studies consistently show lump sum ISA investing edges out pound-cost averaging by about 7% over 15 years. But before you go all-in with your ISA allowance, let’s break down both ISA investment strategies so you can pick what actually works for your situation (and stress levels).

What Is Lump Sum ISA Investing?

Think of lump sum investing like ripping off a plaster—you take your entire £20,000 ISA allowance and invest it in one go. Done. Dusted. No more decisions until next tax year.

The math backs this ISA strategy up. Alliance Witan’s research found that maxing out your annual ISA allowance at the start of each tax year generated £180,000+ gains over 15 years. Not too shabby.

The perks of lump sum ISA investing? You’re immediately fully invested, capturing every market uptick from day one. Plus, you can tick “sorted my ISA investment” off your to-do list and forget about it until April rolls around again.

The downside? If markets tank the day after you invest your ISA allowance, you’ll feel like you’ve just bought a car that immediately lost half its value. It’s psychologically brutal, even if historically temporary.

What Is Pound-Cost Averaging for ISAs?

Pound-cost averaging (or dollar-cost averaging’s British cousin) spreads your ISA investments across multiple months. Think of it as the tortoise approach—steady, measured, less likely to give you heart palpitations.

You might invest £1,667 monthly to hit your £20,000 ISA limit by year-end. When markets are high, you buy fewer shares. When they’re low, you snag more. It’s automatic market timing without the crystal ball.

The appeal of ISA cost averaging? You sleep better at night. Markets crashed in March? No worries—you’re only down on one month’s ISA contribution, not your entire pot.

The trade-off? You’re leaving money on the sidelines while markets historically trend upward. Alliance Witan’s data shows monthly ISA investors saw 9% lower returns compared to lump sum investors over the same period.

Which ISA Investment Strategy Wins?

Both ISA strategies beat keeping money in a savings account. Interactive Investor’s 25-year study found lump sum ISA investing generated 306% returns versus 297% for cost averaging. We’re talking about a 9% difference, not a 90% gap.

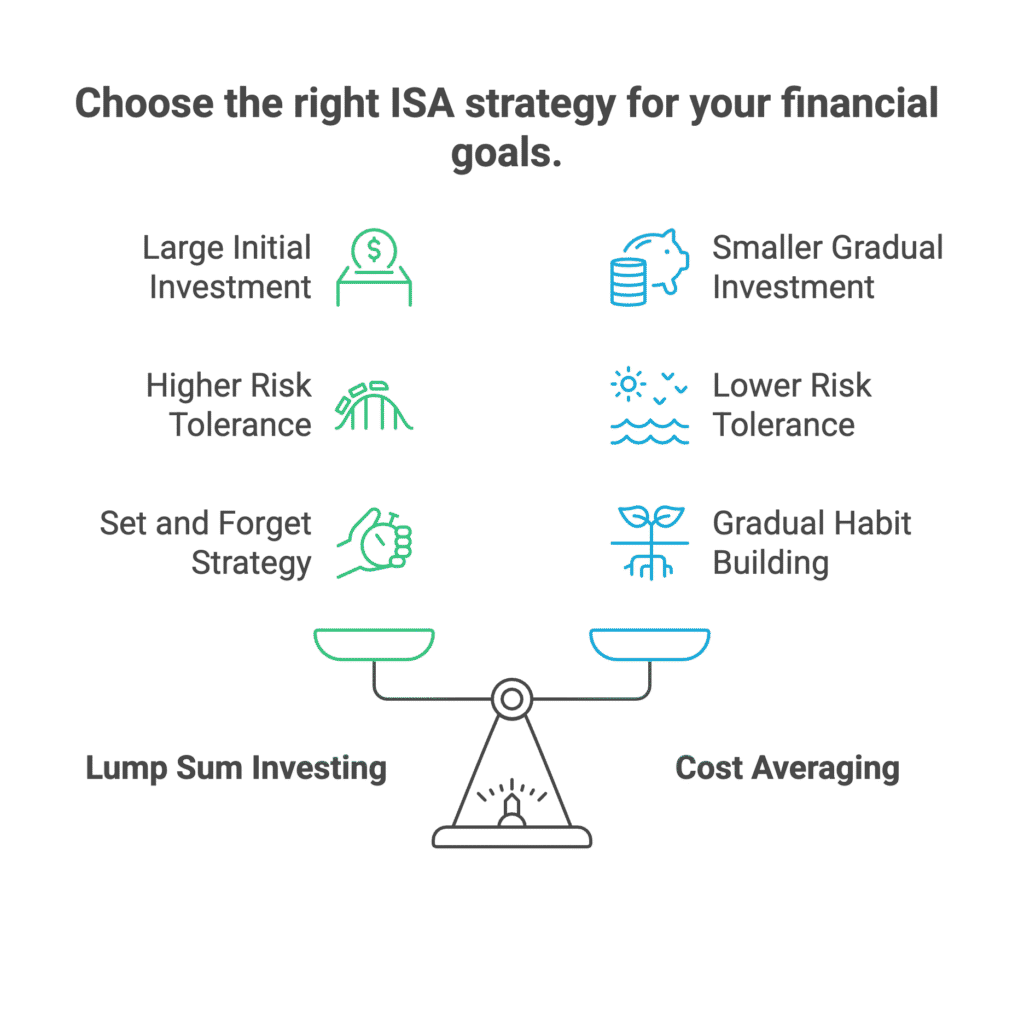

Choose lump sum ISA investing if you:

- Have a bonus, inheritance, or windfall sitting around

- Can stomach short-term volatility for potentially higher long-term ISA returns

- Want to “set and forget” your annual ISA strategy

Choose ISA cost averaging if you:

- Don’t have £20,000 lying around (join the club)

- Prefer sleeping soundly over squeezing out extra percentage points

- Want to build ISA investing habits gradually

Mark Atkinson from Alliance Witan puts it perfectly: “Each investor is unique… most importantly, it’s about playing the long-game and sticking with your strategy even in times of market volatility.”

The Bottom Line on ISA Strategies

Don’t let perfect be the enemy of good. Whether you go all-in with lump sum ISA investing or drip-feed monthly with pound-cost averaging, you’re already winning by investing in your Stocks and Shares ISA rather than letting inflation eat your cash savings.

Can’t decide between ISA investment strategies? Start with what feels comfortable. You can always adjust your ISA approach next tax year—that’s the beauty of ISAs.

Ready to optimise your ISA strategy? Review your current financial situation and pick the approach that you’ll actually stick with long-term for maximum ISA returns.

FAQ

Q1: Is lump sum ISA investing always better than cost averaging?

A: Not always—it depends on timing and your risk tolerance. While studies show lump sum investing typically generates 7-9% higher ISA returns over 15+ years, pound-cost averaging can reduce volatility stress and works better for investors who don’t have large sums available for their ISA allowance upfront.

Q2: What if I invest a lump sum in my ISA and markets crash immediately?

A: It stings short-term, but historically markets recover and trend upward over 10+ year periods. If you can’t handle that volatility, ISA cost averaging might suit your temperament better—even if ISA returns are slightly lower.

Q3: Can I combine both ISA investment strategies?

A: Absolutely. You might invest a lump sum from a bonus, then set up monthly ISA contributions for regular savings. Many investors use hybrid ISA approaches based on their cash flow and comfort levels.

Q4: When should I invest my annual ISA allowance each year?

A: Research suggests investing your £20,000 ISA allowance at the start of the tax year (April) captures more growth potential, but the most important factor is consistency—regular ISA investing beats timing the market perfectly.

Q5: How much difference does the ISA strategy really make?

A: Over 15 years, we’re talking about roughly 7-9% difference in total ISA returns. While meaningful, both ISA strategies significantly outperform cash savings—so pick the approach you’ll stick with rather than obsessing over optimisation.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.