Wondering how to spot financial scams before they empty your bank account? You’re not alone. Here’s a sobering fact: criminals stole over £1bn through financial fraud in 2024, with scam cases hitting 3.3 million — a 12% jump from 2023.

But here’s the silver lining: banks prevented £1.5bn in fraudulent transactions, proving that spotting financial scams early really works. Ready to protect yourself? Let’s dive into the most common financial scams and exactly how to avoid them.

Most Common Financial Scams in 2025: What to Watch For

Investment Fraud Scams: The Biggest Money Trap

Investment fraud topped the charts for financial damage in 2024, with victims losing £144m — a staggering 34% increase. These sophisticated scams have evolved far beyond traditional pyramid schemes.

Modern investment scammers create professional-looking fake platforms, promise guaranteed high returns, and use deepfake technology featuring trusted financial experts to promote fraudulent WhatsApp investment groups.

Purchase Fraud: The Online Shopping Nightmare

Purchase scams remain the most frequent type of financial fraud. Victims pay for goods or services upfront but never receive them, making this a persistent threat for online shoppers.

Social Media Financial Scams: Where Most Fraud Begins

Here’s the alarming reality: 70% of financial scams now start on social media platforms. Fraudsters use luxury lifestyle content to attract victims, then direct them to fake investment opportunities through private messaging.

How to Spot Financial Scams: Red Flags That Matter

Watch for these warning signs:

Pressure tactics: “Limited time offer!” or “Act now!” Real investments don’t come with ticking clocks.

Unsolicited contact: Random calls, texts, emails, or door-knocks about financial opportunities should trigger immediate suspicion.

Dodgy contact details: If they won’t provide proper contact information or you can’t verify them through official channels, walk away.

Unrealistic promises: Returns that sound too good to be true usually are. If someone’s guaranteeing 50% returns with “zero risk,” they’re either lying or defying economic reality.

The golden rule? Legitimate investment opportunities don’t vanish the moment you hang up to verify details.

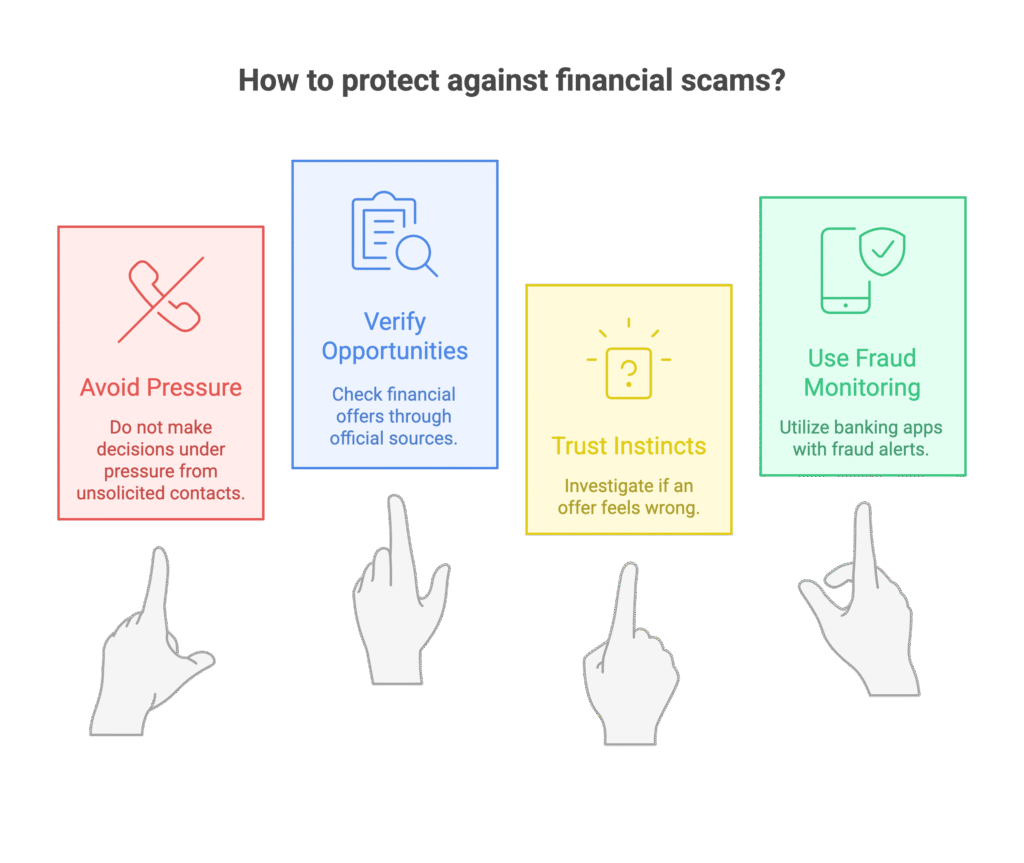

How to Protect Yourself From Financial Scams

Prevention is your best defence against financial fraud:

- Never make investment decisions under pressure from unsolicited contacts

- Always verify financial opportunities through independent, official sources

- Trust your instincts — if something feels wrong about a financial offer, investigate further

- Use banking apps with fraud monitoring that alert you to suspicious account activity

As financial expert Sarah Coles from Hargreaves Lansdown advises: “If in doubt, it’s always better to err on the side of caution and assume something is a scam.”

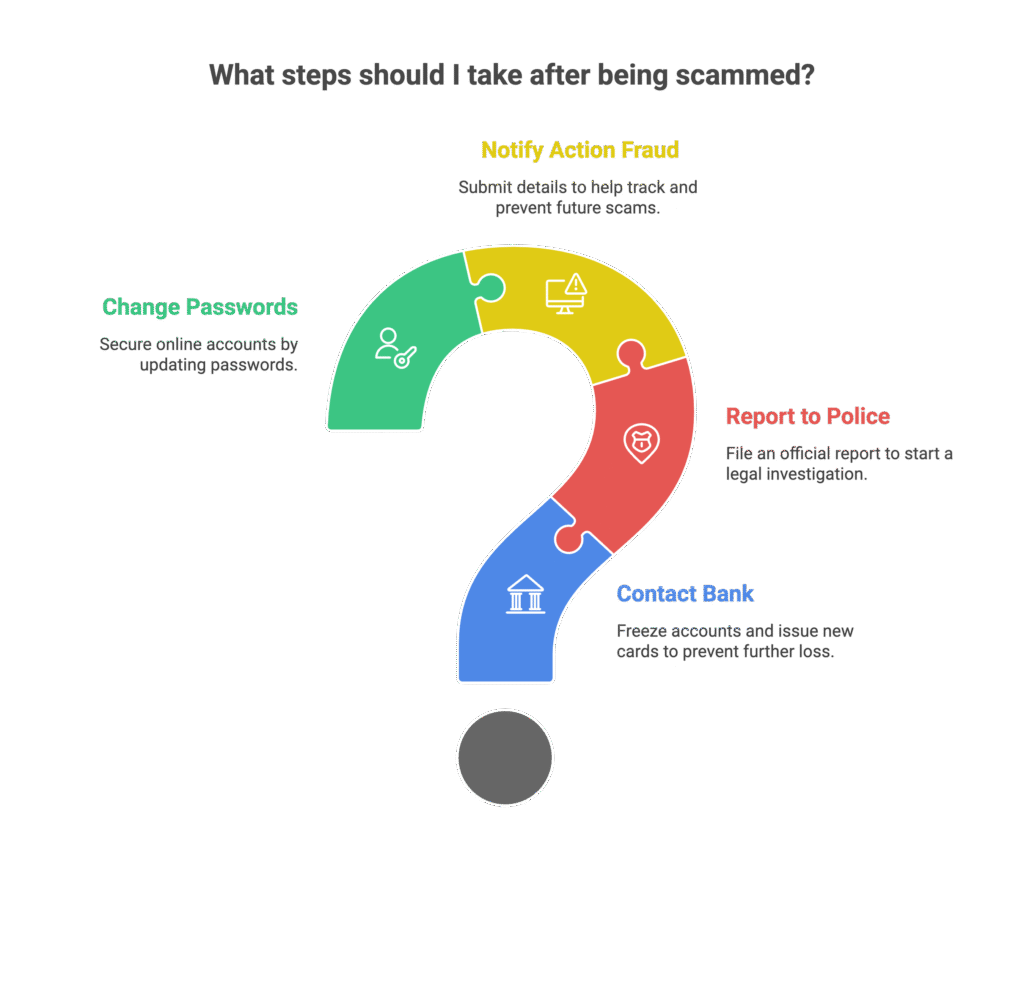

What to Do After Being Scammed

If you’ve been hit by a financial scam, time is critical:

- Contact your bank first — They can freeze compromised accounts and issue replacement cards

- Report to police — Call 101 to file an official report

- Notify Action Fraud — Submit details through their reporting system

- Change all passwords — Especially if you shared login credentials with scammers

Quick action significantly improves your chances of recovering funds and preventing further losses.

FAQ

Q1: What are the most common financial scams in 2025?

A: Purchase scams lead in frequency, while investment fraud causes the largest financial losses. Social media platforms now generate 70% of all financial scam cases.

Q2: How can I verify if an investment opportunity is a scam?

A: Check the Financial Conduct Authority (FCA) register, verify contact details independently, and never invest based on social media advertisements or unsolicited communications. Legitimate opportunities don’t require immediate decisions.

Q3: Can banks prevent financial scams effectively?

A: Banks prevented £1.5bn in unauthorised fraud in 2024, but they cannot stop authorised payments to scammers. Prevention through scam awareness remains your primary protection.

Q4: What should I do if I receive suspicious investment calls?

A: End the call immediately and verify any claims through official channels. Note down details they provide, then check the FCA register and search for independent reviews before considering any offers.

Q5: Are deepfake videos really used in financial scams?

A: Yes, scammers increasingly use deepfake technology featuring well-known financial experts to promote fraudulent investment schemes. Always verify investment advice through official company channels, not social media content.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.