Introduction

Rachel Reeves just delivered the UK’s biggest tax grab in decades, and your wallet’s about to feel it. The Chancellor raised £26bn through a cocktail of frozen thresholds, new property levies, and a cash ISA slash that’ll push nearly 2 million more Brits into higher tax brackets. Forget the manifesto promises about not hiking taxes on “working people”, this Budget takes the UK’s tax burden to an all-time high. From pension shake-ups to dividend hikes, here’s exactly how Reeves’ announcements will hit your personal finances.

Income Tax Freezes: The £8.3bn Stealth Tax

Reeves extended income tax thresholds until 2031, three years longer than planned. Sounds boring? It’s anything but.

This “fiscal drag” will pull 920,000 more people into the 40% tax bracket as wages rise but thresholds don’t. Another 780,000 will start paying income tax for the first time. If you’re earning around £100,000 with young kids, losing 30 hours of free childcare makes this even more painful.

Economists are calling it a manifesto break. The government’s calling it “fiscal responsibility.” Either way, it’s £8.3bn out of taxpayers’ pockets.

Property Taxes: Landlords and Mansion Owners Take the Hit

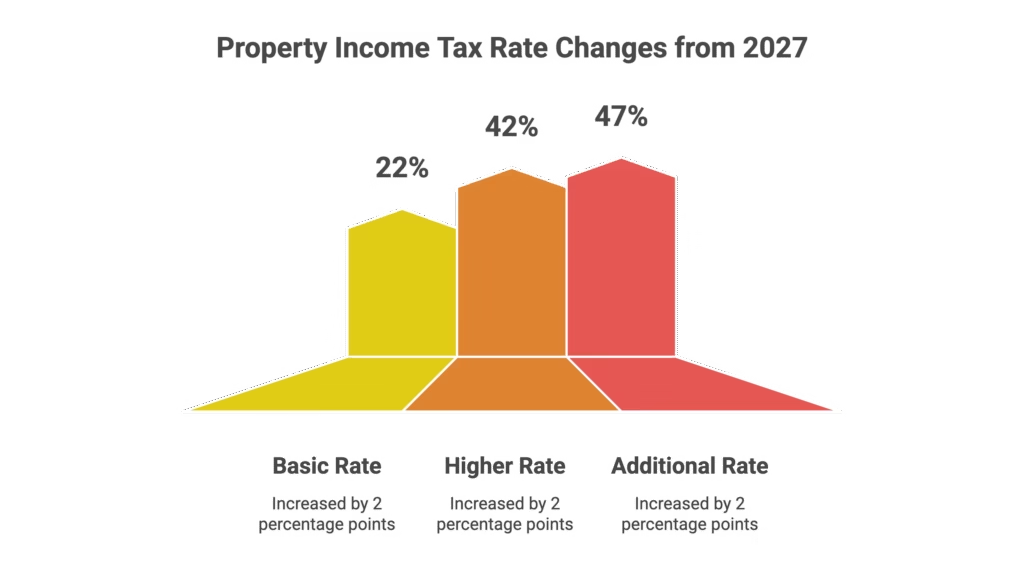

Property Income Tax Hike

From April 2027, landlords earning over £25,000 annually will see property income taxed at higher rates:

- Basic rate: 22% (up 2 percentage points)

- Higher rate: 42% (up 2 percentage points)

- Additional rate: 47% (up 2 percentage points)

This’ll raise £0.5bn yearly from 2028 onwards. Not huge for the Treasury, but a proper sting for buy-to-let investors.

The “Mansion Tax” Arrives

Owners of properties worth over £2m will pay a new council tax surcharge across four price bands. The surcharge starts at £2,500 annually for properties valued between £2m and £2.5m, rising to £7,500 for properties above £5m.

Expected to raise £0.4bn in 2029-30, with cash flowing straight to central government rather than councils.

Inheritance Tax and Capital Gains: Mostly Spared

After last year’s pension pot shake-up, estate planning got a breather this time round.

The inheritance tax threshold stays frozen at £325,000 until 2031—one year longer than expected. As property and asset values climb, more estates will creep into the taxable zone.

Capital gains tax rates remain unchanged after last year’s hikes, and the £3,000 annual exemption stays put. One notable change: CGT relief on business sales into Employee Ownership Trusts drops from 100% to 50%, which could sting retiring business owners.

Pensions: The Salary Sacrifice Shake-Up

The 25% tax-free lump sum survived the rumour mill—pensioners can breathe easy. But employees and employers? Not so much.

What’s Changing with Salary Sacrifice?

Salary sacrifice lets employees swap salary for benefits like pension contributions or childcare vouchers, reducing taxable income. It’s been a lifeline for those hovering near the £100,000 threshold.

From April 2029, salary sacrifice will be capped at £2,000 per employee annually. Any pension contributions above that will face standard National Insurance rates:

- 8% on salaries under £50,270

- 2% on income above £50,270

Reeves argues this levels the playing field for minimum-wage workers. Higher earners will see their tax-efficient pension strategies gutted.

ISAs and Dividends: Cash Gets Crunched, Stocks Get Squeezed

Cash ISA Allowance Slashed

The cash ISA tax-free limit drops from £20,000 to £12,000 from April 2027. The Chancellor’s trying to nudge Brits out of savings accounts and into investments.

Pensioners dodge the cut and keep the full £20,000 allowance, letting them move capital back into lower-risk cash holdings during retirement.

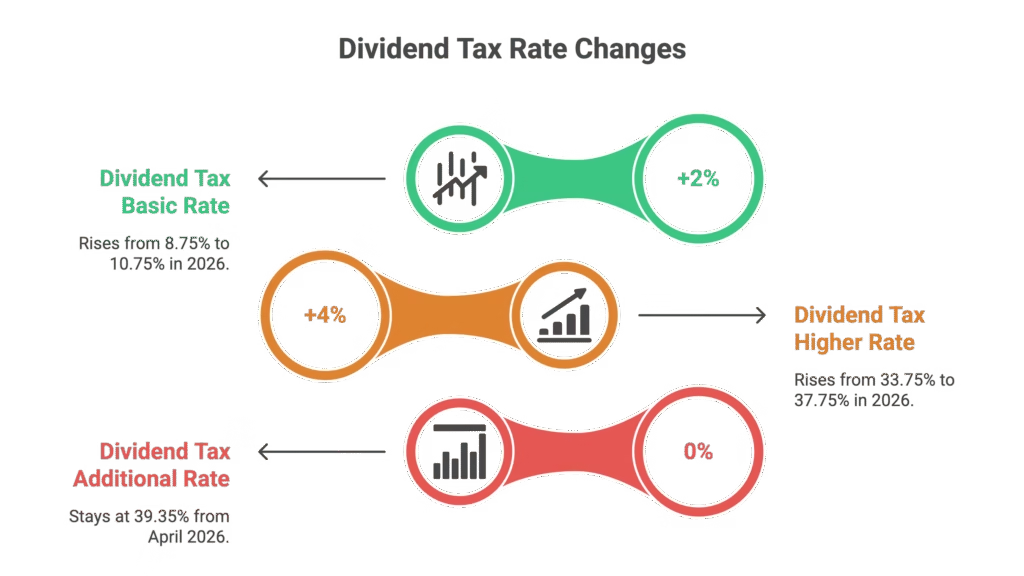

Dividend Tax Hike

From April 2026, dividend tax rises by 2 percentage points:

- Basic rate: 10.75% (up from 8.75%)

- Higher rate: 37.75% (up from 33.75%)

- Additional rate: stays at 39.35%

This hits investors holding shares outside tax-free wrappers. Consider shifting funds into pensions (dividends grow tax-free, but you can’t access them until 55) or stocks and shares ISAs (shield up to £20,000 from income tax and the dividend allowance).

The Good News: Stamp Duty Holiday for New Listings

Finally, a tax cut. The 0.5% stamp duty on new London Stock Exchange listings has been scrapped for three years.

It’s a small win for investors and a shot in the arm for the City. Every little helps when you’re dodging tax hikes elsewhere.

Lifetime ISA: Consultation Ahead

The Lifetime ISA keeps its £4,000 annual limit, but change is brewing. The Treasury will consult on a new, simpler ISA product for first-time buyers in early 2026.

Once launched, it’ll replace the LISA. No confirmation yet on lifting the controversial £450,000 property price cap, but speculation suggests the government might budge. London buyers, watch this space.

Conclusion

Reeves’ Budget is a tax grab dressed up as fiscal responsibility. Between frozen thresholds, property levies, and ISA cuts, nearly 2 million more people will pay higher taxes. The pension salary sacrifice cap and dividend hikes add insult to injury. But the stamp duty holiday offers a sliver of relief, and potential LISA changes could help first-time buyers. Consider moving investments into tax-efficient wrappers before the deadlines kick in.

FAQ

Q1: Will I pay more income tax after this Budget?

A: If your income rises above £50,270 by 2031, you’ll likely enter the 40% bracket thanks to frozen thresholds. Around 920,000 more people will face higher tax bills, even without a formal rate increase.

Q2: How does the cash ISA cut affect me?

A: From April 2027, you can only save £12,000 tax-free in a cash ISA instead of £20,000. Pensioners keep the full allowance. The move pushes savers towards stocks and shares.

Q3: What happens to my salary sacrifice pension contributions?

A: From April 2029, only the first £2,000 of salary sacrifice per year stays tax-efficient. Contributions above that face National Insurance at 8% (up to £50,270) or 2% (above £50,270).

Q4: Should I move my investments before the dividend tax hike?

A: Consider it. Dividends in pensions grow tax-free, and stocks and shares ISAs shield up to £20,000 from income tax. The hike hits in April 2026, so you’ve got time to reorganise.

Q5: Will the Lifetime ISA £450,000 cap increase?

A: Not confirmed yet. The government’s consulting on a new first-time buyer ISA in early 2026, which may replace the LISA. Speculation hints at a higher property cap, but nothing’s official.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.