Two in five young adults aren’t contributing to their pension pots right now. Why? They’re too busy surviving today to worry about tomorrow. With house prices hitting £271,079 (up from £265,375 last year) and rent eating half their paycheque, Gen Z and Millennials face an impossible choice: pay for life now or save for life later.

The kicker—nearly 40% feel anxious about retirement, but only 23% believe they’re saving enough. It’s a financial catch-22 that’s setting up an entire generation for retirement poverty.

The Cost of Living Is Crushing Retirement Dreams

Young people aren’t avoiding pensions because they’re reckless. They’re making tough financial trade-offs every month. According to new research from fintech Chest, pressing priorities are winning out over pension contributions:

- Housing costs are through the roof

- Wedding expenses keep climbing

- Basic living costs leave little room for long-term savings

“Despite being anxious about our financial future, battling the high cost of living means that we have nothing spare to put into a pension,” says Ali Adam, co-founder of Chest.

Think about it—when you’re choosing between rent and retirement, rent wins every time.

Trust Issues: Why Young People Don’t Buy What Pensions Are Selling

Gen Z and Millennials don’t just lack money—they lack trust. There’s a “recession of trust towards pension companies,” especially among younger consumers.

The problem? Pension communication is stuck in the past. It’s complex, jargon-heavy, and feels completely disconnected from young people’s reality.

“Pension communication fails to engage younger generations,” explains Jason Murphy, Chest’s co-founder. “They feel financially illiterate, but advice is seen as inaccessible due to cost.”

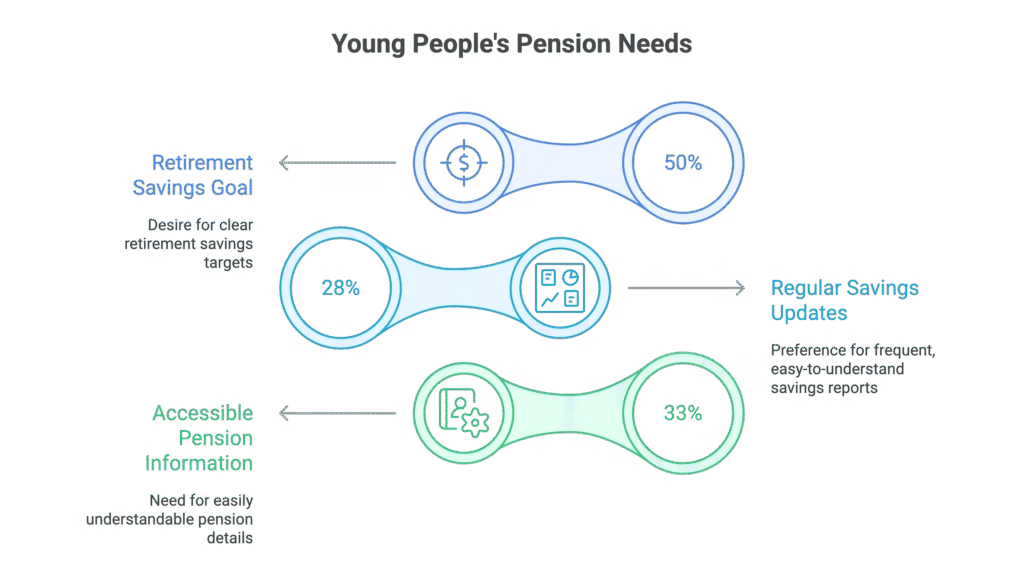

What Young People Actually Want From Pension Providers

The survey revealed some eye-opening insights about what would actually help:

- 50% want to know exactly how much they need for comfortable retirement

- 28% want regular, digestible savings updates

- 33% need more accessible pension information

Instead of getting proper guidance, one in three young people are turning to social media influencers for financial advice. Yes, really. They’re getting retirement planning tips from TikTok because traditional providers aren’t speaking their language.

The Bottom Line: A Generation at Risk

This isn’t just about individual choices—it’s about systemic failure. When an entire generation can’t afford to save for retirement while simultaneously not trusting the system designed to help them, we’ve got a problem.

The solution? Pension providers need to wake up, simplify their messaging, and meet young people where they are. Because right now, millions of future retirees are being left behind.

FAQ

Q1: How much should I be saving for retirement in my 20s and 30s?

A: Financial experts recommend 10-15% of your income for retirement. Even small amounts matter—starting with £50-100 monthly builds significant wealth over time.

Q2: Can I still have a comfortable retirement if I start saving late?

A: Yes, but you’ll need to save more aggressively. Starting in your 30s instead of 20s means saving 15-20% of income rather than 10-15%.

Q3: Are workplace pensions enough for retirement?

A: Most workplace pensions won’t provide enough for comfortable retirement. The minimum auto-enrollment is just 8% total, which typically falls short.

Q4: Should I prioritise paying off debt or saving for retirement?

A: Focus on high-interest debt first, but don’t ignore pensions—especially with employer matching. That’s free money you shouldn’t leave behind.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.