When Shareholders Say “Not So Fast”

Picture this: two heavyweight FTSE-listed funds announce they’re merging to create Britain’s largest infrastructure investment firm. Sounds brilliant, right? Well, not if you’re an HICL shareholder.

The proposed merger between HICL Infrastructure and The Renewables Infrastructure Group (TRIG) has been scrapped after investors made their feelings crystal clear. HICL’s board admitted it couldn’t push through the deal “without a substantial majority of support from its own investors.” Translation? The numbers just weren’t there.

Despite both boards insisting the strategic rationale was solid, sometimes conviction isn’t enough when your shareholders aren’t buying what you’re selling.

What Was the Deal Supposed to Look Like?

The merger terms offered TRIG shareholders a partial cash exit worth up to £250m—roughly 11% of TRIG’s share capital. Not a bad sweetener if you’re looking for liquidity.

If everyone took the cash option, HICL shareholders would’ve ended up with 56% of the combined entity, whilst TRIG investors held 44%. On paper, it looked balanced.

But here’s where it got messy.

The Shareholder Revolt

Analysts at Peel Hunt didn’t mince words: “We see multiple reasons for TRIG shareholders to be excited by the proposal, but fewer for HICL shareholders.”

The problem? HICL investors faced a “material shift in strategy and portfolio” without the same liquidity opportunity TRIG shareholders enjoyed. Essentially, they were being asked to take on more risk without comparable upside.

When the deal collapsed, the market’s reaction said it all. TRIG shares dropped 3.8% to 71p, whilst HICL shares jumped 4.2% to 118p. Investors were relieved the merger was off.

What Do These Companies Actually Own?

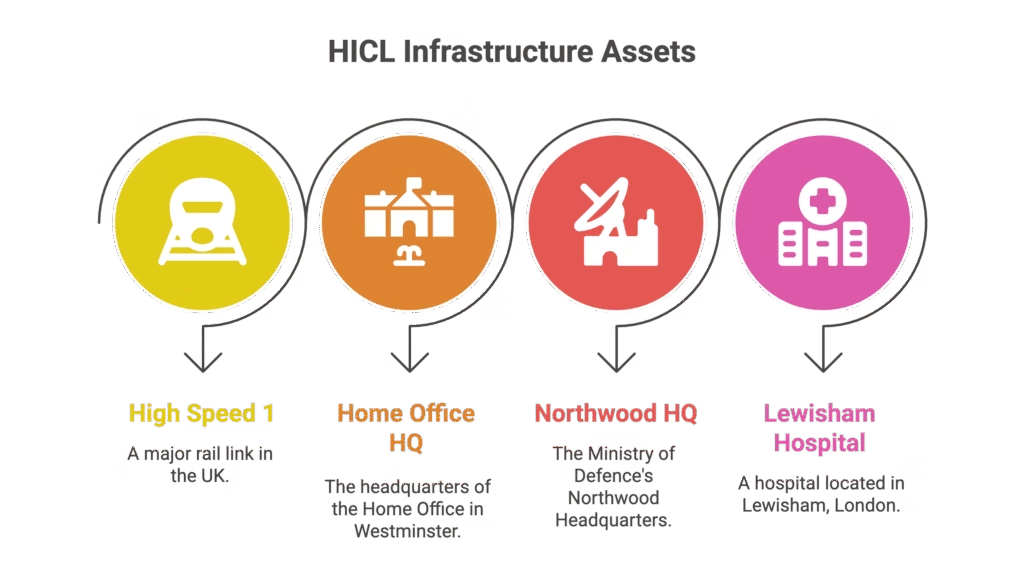

HICL Infrastructure has been around since 2006 and cut its teeth on the UK’s Private Finance Initiative (PFI) projects. We’re talking serious national assets here:

- High Speed 1 rail link

- Westminster’s Home Office headquarters

- The Ministry of Defence’s Northwood HQ

- Lewisham Hospital

It’s the kind of portfolio that screams stability and government backing.

TRIG, launched in 2013, went down a different route entirely. It specialises in renewable energy infrastructure—wind farms, solar projects—spread across the UK, Germany, France, and Spain. Think green energy rather than grey concrete.

Why This Merger Made Sense (In Theory)

Combining traditional infrastructure with renewable energy assets could’ve created a diversified powerhouse. Climate-conscious investors get exposure to green energy, whilst risk-averse types benefit from stable government-backed assets.

Both boards genuinely believed in the deal’s merits. But belief doesn’t override basic maths: if your own shareholders aren’t convinced, you’re fighting a losing battle.

The announcement on 17 November sparked immediate pushback, and by early December, the deal was dead in the water.

What Happens Next?

Both companies will carry on independently, managing their respective portfolios. HICL continues overseeing its government and healthcare infrastructure, whilst TRIG focuses on expanding its renewable energy operations.

For investors, it’s a reminder that even well-intentioned deals need to stack up for all parties involved. Strategic rationale is important, but so is ensuring every shareholder group sees genuine value.

The UK infrastructure investment space remains fragmented for now—but don’t be surprised if dealmakers return with better-balanced proposals down the line.

Key Takeaways

The collapse of the HICL-TRIG merger shows that even blockbuster deals can unravel when shareholder interests aren’t aligned. Whilst both boards believed in the strategic vision, HICL investors simply didn’t see enough upside to justify the shift in portfolio strategy. For now, both funds will continue operating independently—and investors seem perfectly happy with that outcome.

Want to stay updated on UK infrastructure and renewable energy investments? Keep an eye on both HICL and TRIG as they navigate their next moves independently.

FAQ

Q1: What was the HICL and TRIG merger about?

A: HICL Infrastructure and The Renewables Infrastructure Group planned to merge and create the UK’s largest infrastructure investment firm. The deal would’ve combined traditional government-backed assets with renewable energy projects, but it was abandoned after HICL shareholders pushed back on the terms.

Q2: Why did HICL shareholders reject the merger?

A: HICL investors faced a significant shift in portfolio strategy without the same liquidity benefits offered to TRIG shareholders. Analysts noted that TRIG investors had clear incentives (including a £250m partial cash exit option), whilst HICL shareholders were taking on more risk without comparable upside.

Q3: What assets does HICL own?

A: HICL’s portfolio includes major UK infrastructure projects like the High Speed 1 rail link, the Home Office headquarters in Westminster, the Ministry of Defence’s Northwood facility, and Lewisham Hospital. Most of these assets originated from the UK’s Private Finance Initiative (PFI) programme.

Q4: What does TRIG invest in?

A: TRIG specialises in renewable energy infrastructure, primarily wind and solar projects. Its portfolio spans the UK, Germany, France, and Spain, giving investors exposure to the growing green energy sector across Europe.

Q5: Will HICL and TRIG attempt another merger?

A: Both boards stated they remain convinced of the strategic rationale for combining the two companies. However, any future deal would need significantly better alignment of shareholder interests to succeed where this attempt failed.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.