The September 2025 FTSE 100 reshuffle is set to shake up London’s premier stock index, with Greek industrial powerhouse Metlen Energy and Metals likely to secure a coveted FTSE 100 spot. Meanwhile, struggling UK housebuilder Taylor Wimpey faces potential FTSE 100 relegation after a devastating 20% share price decline.

This quarterly FTSE index review highlights contrasting corporate fortunes – Metlen’s £5.8bn market cap growth versus Taylor Wimpey’s £800m value destruction. The upcoming FTSE 100 changes reflect broader UK stock market trends affecting international listings and domestic sectors.

Key takeaway: September’s FTSE reshuffle could mark a significant shift in index composition, impacting millions of tracker fund investments.

Why Metlen Energy Qualifies for FTSE 100 Inclusion

Metlen Energy’s FTSE 100 prospects look increasingly strong following its strategic London Stock Exchange primary listing switch from Athens. The industrial conglomerate’s £5.8bn market capitalisation and £46.32 share price position it well above FTSE 100 minimum requirements.

Richard Hunter, head of markets at interactive investor, describes Metlen’s valuation as “significant” for UK market attractiveness. The LSE’s September rule changes allowing non-Sterling denominated securities into FTSE indices creates a clear pathway for Metlen’s index inclusion.

Market impact: Metlen’s entry would represent one of the largest Greek companies ever to join the FTSE 100, potentially attracting more international listings to London.

Taylor Wimpey’s Rough Year

While Metlen’s climbing, Taylor Wimpey’s been sliding down a pretty steep hill. The homebuilder’s stock has tanked nearly 20% this year, wiping over £800m off its market value.

What’s crushing homebuilders? The usual suspects:

- Stubbornly high interest rates (thanks, Bank of England’s “gradual” approach)

- Cost of living pressures squeezing buyers

- Build cost inflation eating margins

- That painful planning permission process

Hunter points to “high build cost inflation, a lengthy planning permission process, and pressure on operating margins” as key headwinds. Not exactly a recipe for FTSE 100 success.

Burberry FTSE 100 Prospects: Luxury Brand’s Recovery Rally

Burberry shares have staged an impressive recovery, surging 92% over 12 months and 33% in 2025 alone. However, despite this strong performance, the luxury fashion house remains unlikely to secure immediate FTSE 100 promotion.

“Despite coming up strongly on the rails,” Hunter suggests an immediate promotion is “less likely… barring a last-minute rally” before September’s review.

CEO Joshua Schulman has significant incentive to drive Burberry back into the FTSE 100. He’s eligible for a performance bonus worth 300% of his £1.2m base salary if the company achieves maximum targets, including potential index re-entry.

FTSE 100 Index Review Timeline and Market Implications

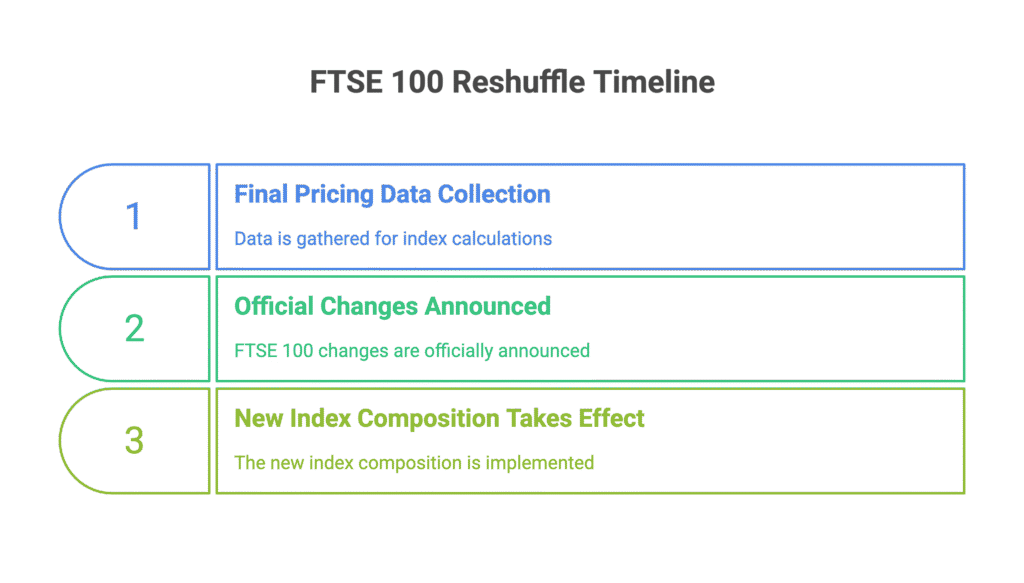

Critical FTSE 100 reshuffle dates:

- 2 September 2025: Final pricing data collected for index calculations

- 3 September 2025: Official FTSE 100 changes announced

- 22 September 2025: New index composition takes effect

Investment implications: Approximately £2 trillion in assets track FTSE 100 performance, meaning index changes trigger automatic buying and selling across pension funds, ETFs, and institutional portfolios.

This September’s FTSE reshuffle exemplifies London’s evolving market dynamics – international companies like Metlen choosing UK listings whilst traditional sectors face structural challenges. Index tracker fund holders should expect portfolio adjustments and potential short-term volatility around implementation dates.

FAQ

Q1: Why is Metlen allowed in the FTSE 100 if it’s Greek?

A: The London Stock Exchange changed rules in September to allow non-Sterling securities into FTSE UK indices. Metlen switched its primary listing to London, making it eligible.

Q2: What happens to investors who own Taylor Wimpey if it gets kicked out?

A: Nothing dramatic – you still own the shares. But FTSE 100 tracker funds will have to sell, potentially creating downward pressure on the stock price.

Q3: How often does the FTSE 100 get reshuffled?

A: Quarterly reviews happen four times a year. Companies are added or removed based on market capitalisation and other eligibility criteria.

Q4: Could Burberry still make it into the FTSE 100?

A: Possible but unlikely without a major rally. Despite strong performance, timing and market cap positioning suggest it’ll need to wait for the next review cycle.

Q5: Do FTSE 100 changes really matter for regular investors?

A: Yes, if you own index funds or ETFs tracking the FTSE 100. These funds must buy new constituents and sell departing ones, which can impact individual stock prices.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.