British stocks are meant to be boring… right? Well, the FTSE 100 just flipped the script, smashing through 9,000 points for the first time ever while other global markets are stuck in neutral.

London’s blue-chip index peaked at 9,016.98 points Tuesday morning, pushing year-to-date gains to a spicy 10.3%. That’s not just good — it’s beating Wall Street’s S&P 500, Paris’s CAC 40, and pretty much everyone except Germany’s DAX (which got a steroid shot from their new chancellor’s spending spree).

Why London’s Suddenly the Cool Kid

Plot twist: while Trump’s tariff tantrums have other markets sweating bullets, the UK’s become the financial world’s favourite safe house.

Since Britain locked down that trade deal with Washington in May — first country to do so, by the way — London stocks have climbed nearly 5% in just two months. Meanwhile, the EU and US are still haggling over trade terms like they’re buying a used car.

“It took eight years for the FTSE to go from 7,000 to 8,000, yet only two years to break through 9,000,” notes Dan Coatsworth from AJ Bell. Translation? London’s stock market just went from zero to hero faster than you can say “Brexit who?”

Defence Stocks and Miners Are Printing Money

The FTSE’s secret sauce? It’s packed with exactly the kind of companies that thrive when the world gets messy — miners, energy firms, and defence contractors.

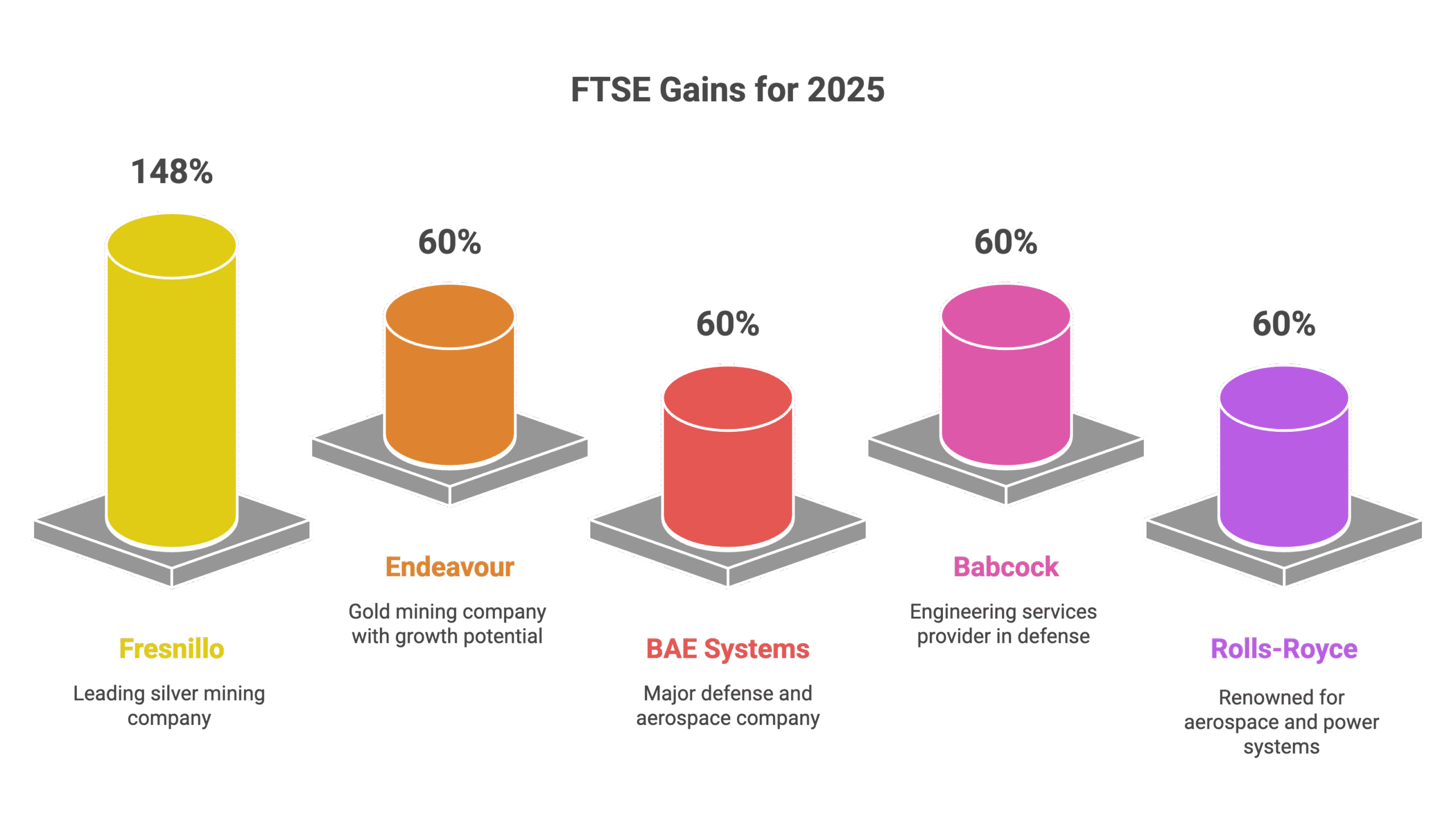

Check out these monster gains for 2025:

- Fresnillo (mining): +148%

- Endeavour (mining): +60%

- BAE Systems, Babcock, Rolls-Royce (defence): All up 60%+

With Western countries ramping up military spending and precious metals going vertical, these sectors are basically printing money. Rolls-Royce even snagged a massive government nuclear contract because apparently making jet engines wasn’t enough.

The Stability Factor Nobody’s Talking About

While Europe’s dealing with shaky coalition governments and the US is… well, being the US, Britain’s offering something radical: political predictability.

“The UK offers relative political stability compared to other parts of the world,” says John Moore from RBC Brewin Dolphin. Sure, there might be some tax hikes coming, but at least everyone knows who’s running the show for the next few years.

Bottom Line

The FTSE 100 hitting 9,000 isn’t just a number — it’s London giving the finger to everyone who wrote off UK markets. While other exchanges are playing defence against trade wars and political drama, British stocks are quietly off to the races.

Want to ride this wave? Keep an eye on defence stocks and commodity plays. They’re the ones driving this rally, and with global uncertainty not going anywhere, they might just keep the party going.

FAQ

Q1: Is the FTSE 100 outperforming US stocks?

A: Yes, the FTSE’s 10.3% gain in 2025 is beating the S&P 500. Only Germany’s DAX has performed better among major indices.

Q2: Which sectors are driving the FTSE’s gains?

A: Defence companies and miners are the big winners, with some stocks up over 100%. Banking and retail giants like Next and Tesco are also contributing.

Q3: Why is London seen as a ‘safe haven’ now?

A: The UK’s early trade deal with the US and relative political stability are attracting investors seeking shelter from tariff uncertainties elsewhere.

Q4: How long did it take to go from 8,000 to 9,000 points?

A: Just two years — compared to eight years for the jump from 7,000 to 8,000. The pace of gains has accelerated dramatically.

Q5: Should investors expect more gains?

A: With ongoing geopolitical tensions benefiting defence stocks and commodities, analysts suggest the momentum could continue, though nothing’s guaranteed.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.