Think back to when crypto was just for tech nerds and Reddit traders. Well, those days are done. Wall Street’s biggest brains at Bernstein just dropped a headline-maker: we’re in for a “long and exhausting” crypto bull market. And this time? It’s not your typical pump-and-dump fiasco.

Here’s why institutional investors are betting big on digital assets — and why this rally is different to anything we’ve witnessed before.

This Isn’t Your 2017 Crypto Rally

Forget everything you think you know about past crypto cycles. Bernstein analysts just revealed their “conviction in blockchain and digital assets has never been higher.” Bold words from a firm that doesn’t throw around superlatives lightly.

What’s changed? Three game-changers:

Regulatory clarity is finally here. The SEC launched a Crypto Task Force. The EU rolled out MiCA regulations. Even Congress is pushing major crypto bills through. No more regulatory hit and hope.

Institutions aren’t just dipping toes — they’re diving in. Bitcoin ETFs are pulling serious money. Major firms are building dedicated crypto desks. This isn’t retail FOMO; it’s calculated institutional allocation.

Governments want in on the action. Countries are exploring Bitcoin reserves. Central banks are testing digital currencies. When nations start HODLing, you know something’s shifted.

The Real Story: Building a New Financial System

The spicy bit. Bernstein isn’t just bullish on Bitcoin — they’re calling this the foundation of an “internet-native financial system.”

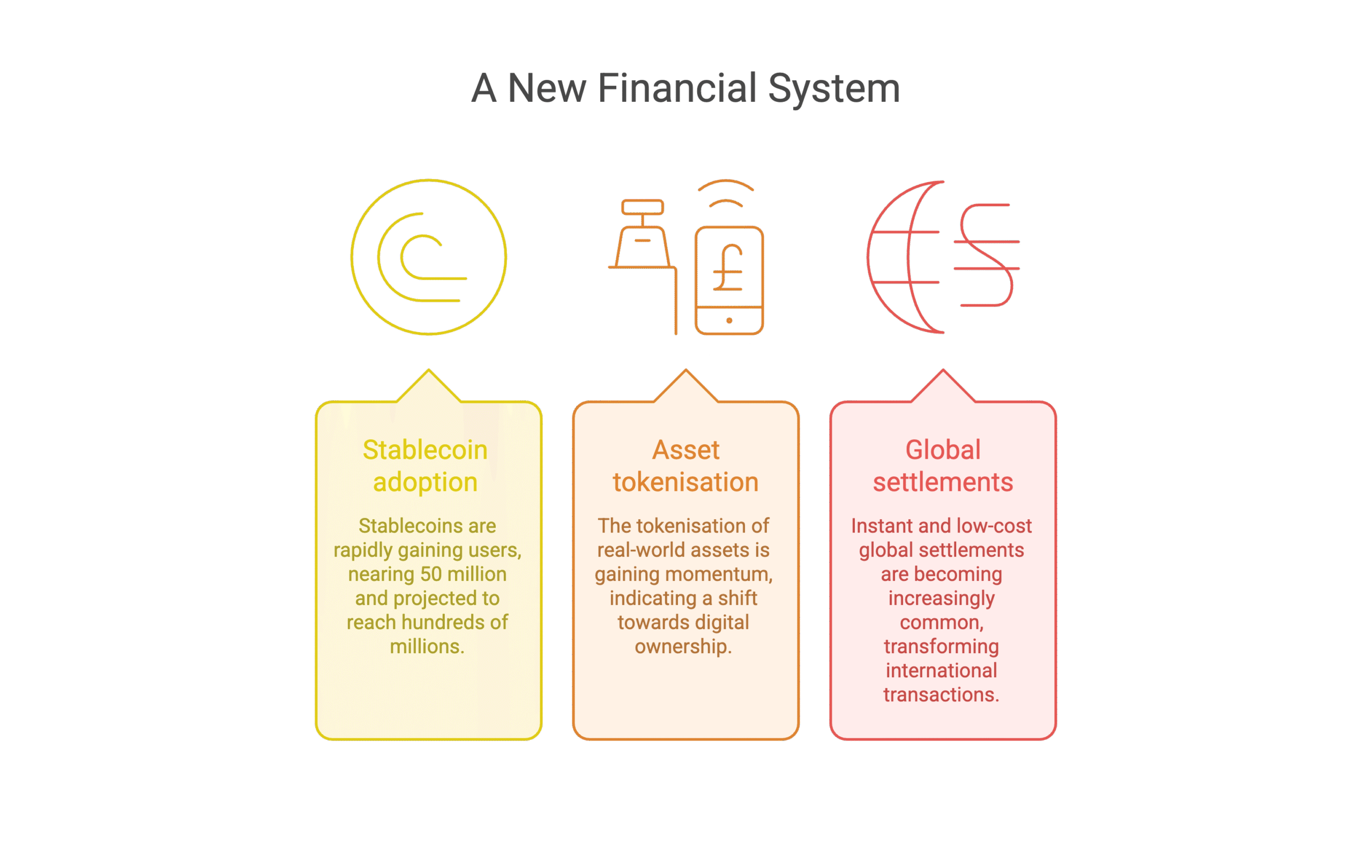

Think bigger than just sending money. We’re talking:

- Stablecoins approaching 50 million users (headed for hundreds of millions)

- Tokenisation of real-world assets gaining steam

- Instant, low-cost global settlements becoming the norm

“We are in the build-out and installation phase,” the analysts noted. Translation? We’re watching the financial equivalent of the early internet being built.

Why This Bull Market Feels Different

Past rallies rode on Bitcoin halving hype and retail speculation. This time? The momentum comes from structural shifts that aren’t going away.

Public blockchains like Ethereum and Solana are becoming legitimate infrastructure. Banking, payments, and commerce are integrating crypto tools. It’s less “when moon?” and more “how do we build on this?”

Bernstein called it “a rather long and exhausting crypto bull market.” They’re not predicting a quick spike — they’re forecasting a marathon of growth.

The Bottom Line

Wall Street’s smartest money managers aren’t just tolerating crypto anymore — they’re embracing it as the future of finance. With regulatory frameworks solidifying, institutions piling in, and real-world use cases multiplying, this bull market has legs.

Ready to dive deeper into crypto’s institutional revolution? Start tracking stablecoin adoption metrics and tokenisation projects. The next phase of finance is being built right now.

FAQ

Q1: How is this crypto bull market different from previous ones?

A: Unlike past cycles driven mainly by Bitcoin halvings and retail speculation, this rally is powered by institutional adoption, regulatory clarity, and government involvement. It’s a structural shift, not just another price pump.

Q2: What role are stablecoins playing in this bull market?

A: Stablecoins are the gateway drug of crypto adoption, with nearly 50 million wallet users already. Bernstein sees them as the first blockchain application to hit critical mass, paving the way for mainstream financial integration.

Q3: Why are analysts calling it a “long and exhausting” bull market?

A: This isn’t a quick spike — it’s a sustained build-out phase of new financial infrastructure. Think years of steady growth and development rather than months of explosive gains.

Q4: What’s driving institutional confidence in crypto now?

A: Clear regulations (like the EU’s MiCA), dedicated oversight (SEC’s Crypto Task Force), and proven use cases in payments and asset tokenization. The Wild West days are ending, making room for serious money.

Q5: What should investors watch for next?

A: Keep an eye on tokenization projects, stablecoin adoption rates, and integration with traditional banking systems. These are the building blocks of the “internet-native financial system” Bernstein predicts.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.