Picture this: you’ve got £50K in Bitcoin but need cash for a house deposit. Instead of selling your crypto (and triggering taxes), you simply borrow against it. That’s the future Bitwise CEO Hunter Horsley says is arriving within 6-12 months.

Crypto credit markets are positioned for explosive growth, with the potential to unlock trillions in capital that’s currently sitting idle. The lending boom could transform how we think about money, investing, and accessing liquidity without liquidising assets.

The $64 Trillion Opportunity

Horsley dropped some numbers on X that’ll make your head spin. There’s nearly $4 trillion in crypto assets currently locked up, waiting to be borrowed against. Add in $60 trillion in U.S. public equities that could be tokenized, and you’ve got a massive untapped lending market.

“When people can borrow against this crypto, rather than sell, they will,” Horsley explained. Makes sense – why liquidise appreciating assets when you could just use them as collateral?

Why Small Investors Win Big

Here’s the game-changer: tokenised lending opens credit markets to everyone. Right now, if you own $7,000 worth of Apple stock, you can’t do much except sell or hold. But once that stock gets tokenised on-chain? Suddenly you can borrow against it for the first time.

Your portfolio becomes your personal ATM, accessible 24/7.

The Risks Worth Watching

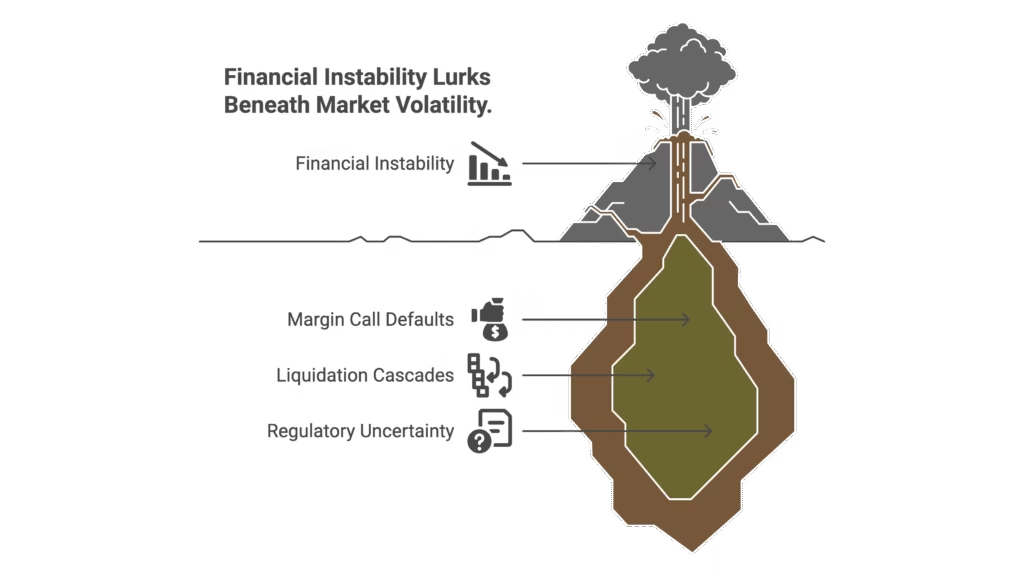

Naturally, crypto lending isn’t risk-free. We’ve seen what happens when leverage meets volatility (Terra Luna, FTX, anyone?).

Key Concerns Include:

- Over-leveraging in volatile markets

- Liquidation cascades during crashes

- Regulatory uncertainty around tokenised assets

But proponents argue that proper risk management could make these systems more robust than traditional credit markets.

What This Means for Your Money

If Horsley’s right, we’re looking at a fundamental shift in capital markets. Instead of choosing between holding assets and accessing liquidity, you get both. This could be huge for retail investors wanting cash flow while staying invested, institutions seeking new yield opportunities, and global markets needing more efficient capital allocation.

The credit revolution isn’t just coming – it’s already building momentum. Smart money is paying attention.

FAQ: Crypto Credit Markets Explained

Q1: How soon could mainstream crypto lending actually happen?

A: According to Horsley, significant growth could start in 6-12 months. The infrastructure is already being built by major DeFi platforms and traditional finance players entering the space.

Q2: What’s the difference between crypto lending and traditional bank loans?

A: Crypto lending is typically over-collateralised and happens on-chain without credit checks. Traditional loans rely on credit scores and are usually under-collateralised.

Q3: Is borrowing against crypto actually safe?

A: It depends on the platform, collateral ratios, and market conditions. The risk of liquidation is real if your collateral drops in value.

Q4: Could tokenised stock lending replace traditional margin accounts?

A: Potentially, yes. Tokenised assets could offer 24/7 access, lower fees, and more flexible terms than traditional brokers.

Q5: What happens if the crypto market crashes while I have loans out?

A: You could face liquidation if your collateral falls below required ratios. Most platforms have safeguards, but crashes can trigger rapid liquidations.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.