The UK’s GDP Problem Is Worse Than Your Phone Signal On The Train

Here’s a fun fact to brighten your morning commute: Britain’s GDP per capita is about £37,000. America’s? A whopping £60,000. That’s right — the average American is practically earning enough for a deposit on a London parking space while we’re still counting rusty pennies.

But wait, it gets better (and by better, I mean worse). If we’d kept growing at our pre-2008 pace, we’d be sitting pretty at around £50,000 per person today. Instead, the average British worker is earning roughly the same as they did when Gordon Brown was Prime Minister. Eugh. Adjusted for inflation, that’s… well, let’s just say your 2008 self wouldn’t be impressed.

So why does this matter to your wallet? Because when a country’s economy flatlines for 17 years, everything from your morning coffee to your faith in democracy starts to crumble. And trust me, we’re all feeling it.

The Great British Economic Illusion: Acting Rich on a Budget

We’re Not Even Leading the European Pack

Let’s talk numbers that actually matter. Britain’s GDP per capita puts us squarely in the middle of European rankings — not exactly the economic powerhouse we pretend to be at international summits. We’re like that friend who insists on splitting the bill evenly after ordering water and a side salad. You know who you are.

The harsh reality? We’re experiencing what economists politely call “economic decline” and what the rest of us call “why does everything feel broken?” From pothole-riddled roads to the NHS waiting lists, our public services are screaming the truth our politicians won’t admit: we’re a poor country wearing a rich country’s hand-me-downs.

Labour’s Long Game (But We Need Points Now)

Credit where it’s due, as painful as it is — Labour seems to have noticed the fat elephant in the room. Their focus on infrastructure investment and long-term development sounds great on paper. They’ve even made “kickstarting economic growth” one of their five missions, which is like making “getting fit” your New Year’s resolution — admirable, but we’ll see.

The problem? Their short-term policies are basically kneecapping their own ambitions. With tax burdens hitting breaking point and growth-killing policies multiplying faster than Brexit promises, that economic kickstart feels more like a gentle nudge.

The Numbers That Should Keep You Up at Night

One Percent Growth: The New British Dream

The Resolution Foundation just dropped a reality bomb: typical real income is set to grow by a pathetic, measly 1% over the next five years. By 2030, your income will be essentially unchanged from 2019/20. That’s not growth — that’s treading water in a pool that’s slowly draining.

What’s driving this slow-motion car crash?

- Council tax bills climbing faster than house prices (impressive, really)

- Frozen tax thresholds secretly picking your pocket

- A productivity crisis that makes a sloth look ambitious

What Britain Actually Needs (It’s a Lot)

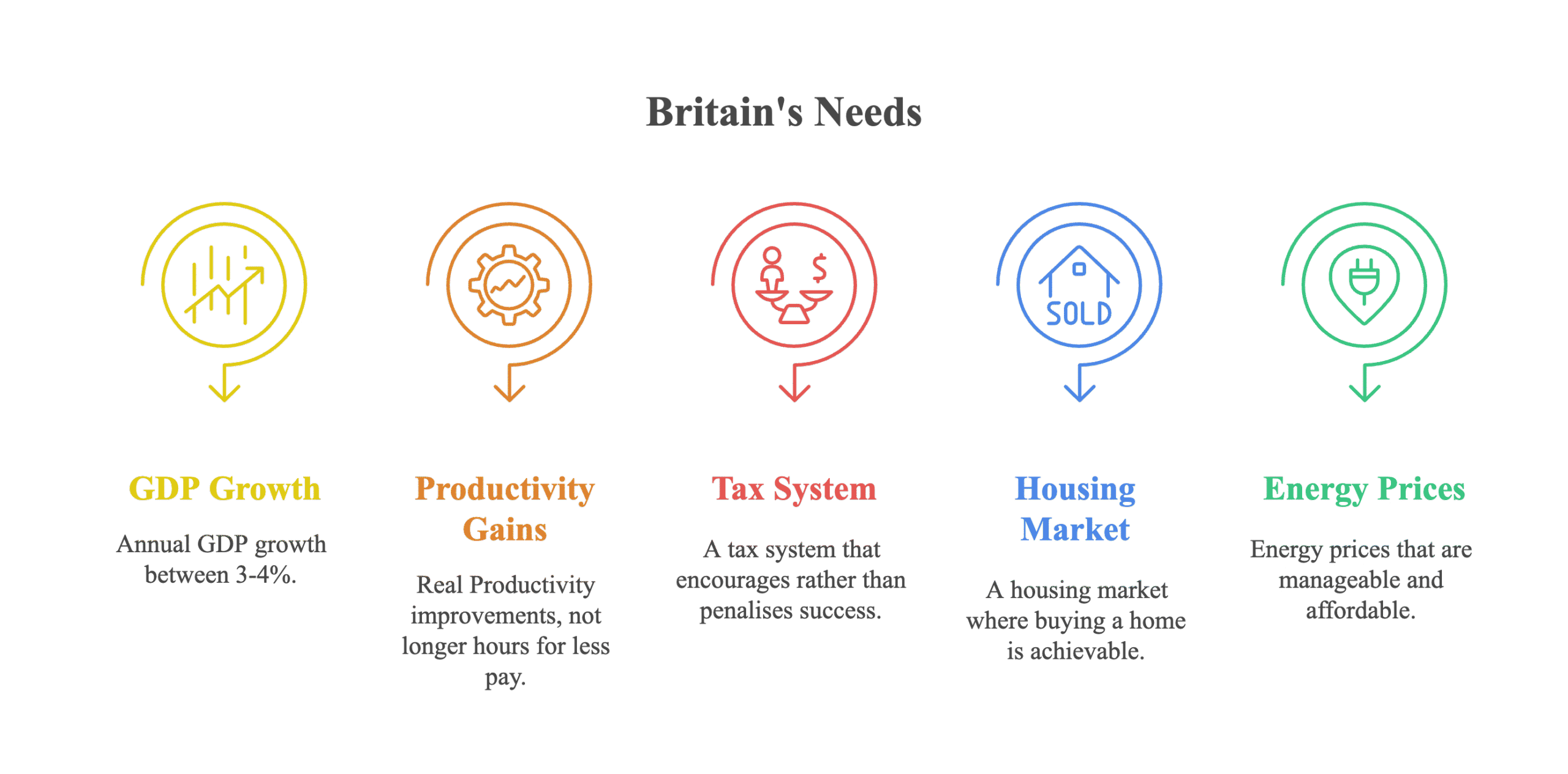

Kemi Badenoch’s warning that “the country is living beyond its means” is like telling someone already drowning, they should probably learn to swim. Not immediately helpful. What we actually need is:

- GDP growth of 3-4% annually (currently we’d celebrate 1% like it’s a sunny bank holiday)

- Genuine productivity gains (not just working longer for less)

- A tax system that doesn’t punish success

- A housing market that doesn’t require selling organs

- Energy prices that don’t trigger existential crises

This isn’t a five-year plan — it’s the work of decades. But here’s the thing: as with all good ideas, we needed to start yesterday.

The Bottom Line: Time to Face Economic Reality

Westminster can debate welfare reform and defence spending till every cow in the country has come home, but until we address the fundamental issue — that Britain is cosplaying as a wealthy nation while running on economic fumes — we’re just rearranging deck chairs on the Titanic.

The average British worker deserves more than wage stagnation dressed up as stability. We need policies that actually grow the pie, not just argue about how to slice it thinner. Because right now? We’re not just falling behind — we’re forgetting what moving forward even looks like.

Ready to dig deeper into Britain’s economic challenges? Soon you’ll be able to subscribe to our newsletter for weekly insights that’ll make you the smartest person at the pub quiz (economically speaking, anyway).

FAQ: Your Burning Questions About Britain’s Economic Reality

Q1: Is Britain really poorer than other European countries?

In terms of GDP per capita, yes — we’re middle of the pack in Europe and significantly behind the US. While we’re not exactly Greece circa 2010, we’re definitely not the economic powerhouse many assume. Think of us as the economic equivalent of a mid-table Premier League team claiming to be title contenders.

Q2: Why hasn’t the average wage increased since 2008?

The 2008 financial crisis knocked Britain’s economy off course, and we’ve never fully recovered our growth trajectory. Add Brexit uncertainty, COVID-19, and policy missteps, and you’ve got a perfect storm of wage stagnation. It’s like we hit pause on prosperity and forgot to press play again.

Q3: What would 3-4% GDP growth actually mean for regular people?

It would mean real wage increases, better public services, and actual economic opportunity. Think new jobs that pay well, infrastructure that works, and maybe — just maybe — affording both rent and avocado toast. Currently, we’re lucky to see 1% growth, which barely keeps pace with population increases.

Q4: Can Labour’s infrastructure investment plan actually fix this?

Long-term infrastructure investment is essential, but it’s like planting trees — you won’t see shade for years. The real question is whether short-term political pressures will derail these plans before they bear fruit. History suggests British politicians aren’t great at thinking beyond the next election cycle.

Q5: How does Britain’s economic situation compare to the post-war period?

Post-war Britain saw genuine reconstruction and growth despite starting from rubble. Today, we have better technology and resources but seem paralysed by political gridlock and short-term thinking. It’s ironic — we rebuilt after the Blitz but can’t seem to fix productivity in peacetime.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.