BP’s shareholders weren’t exactly throwing confetti for outgoing chair Helge Lund—nearly a quarter voted against his re-election in April. Now the oil giant has found its replacement, and he’s got quite the track record.

Albert Manifold, who just wrapped up a stellar decade running building materials group CRH, will take BP’s helm in October. During his CRH tenure, the company’s share price soared nearly 400%. Not too shabby for a resume builder.

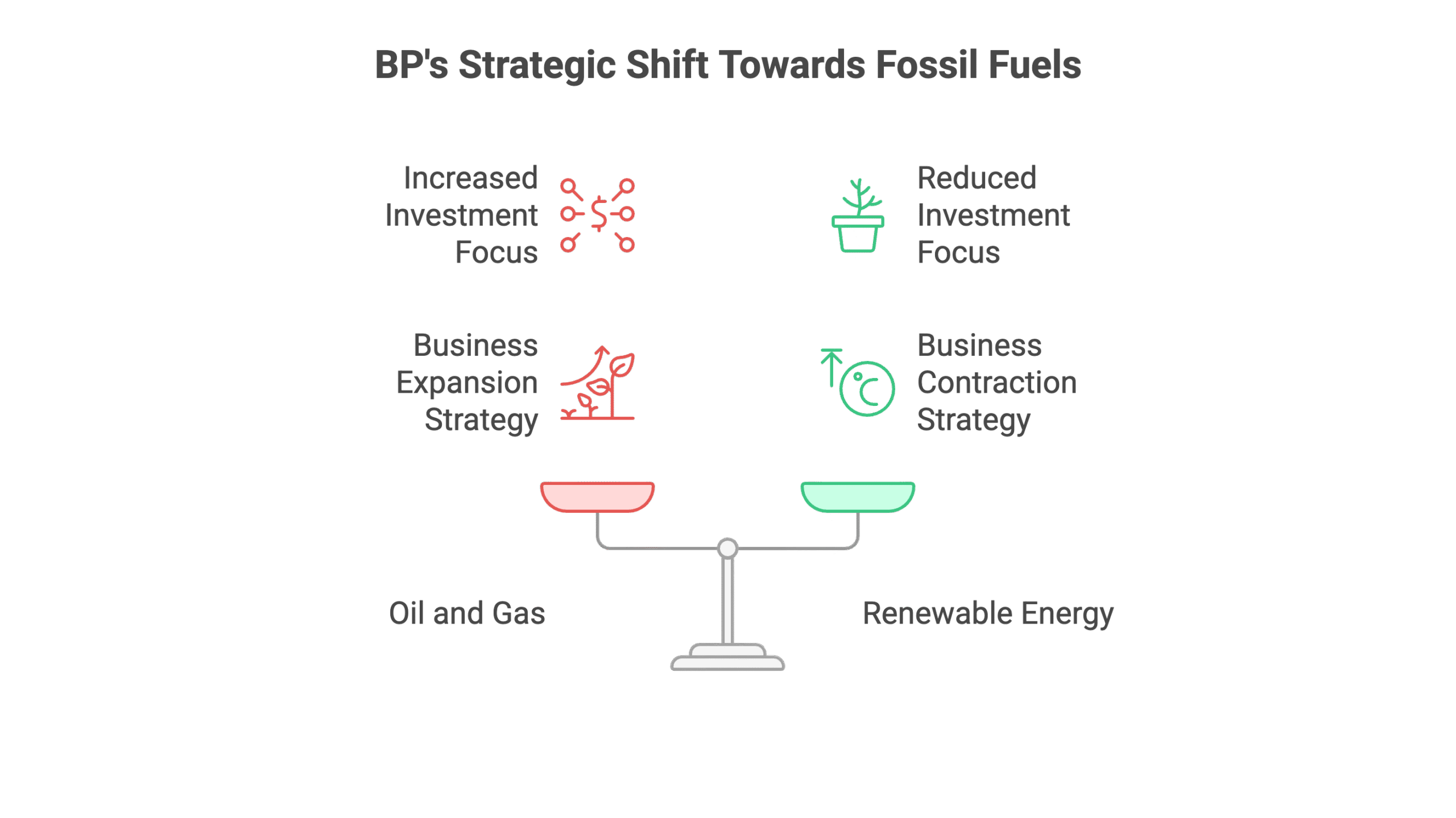

This appointment comes as BP executes a dramatic U-turn on its green energy strategy, pivoting back to oil and gas after investor pressure mounted over underwhelming stock performance.

Who Is Albert Manifold?

Manifold isn’t your typical corporate chair appointment. The former CRH chief executive transformed his company into a global powerhouse, delivering what BP calls “superior growth, cash generation and returns.”

He currently sits on the board of LyondellBasell, a New York-listed chemicals producer, giving him additional energy sector experience. BP praised his “strong track record of strategic leadership and operational delivery with a focus on cost efficiency, disciplined capital allocation and cash flow generation.”

Translation? He knows how to make money and keep shareholders happy—exactly what BP needs right now.

BP’s Strategic Turnaround Explained

BP announced in February it would slash renewable energy investment and double down on oil and gas instead. The numbers tell the story:

- Oil and gas project funding will jump 20% to £7.9bn annually

- The company just agreed to sell its US onshore wind business

- Renewable energy takes a backseat to fossil fuel profits

This strategic pivot represents a complete reversal from BP’s previous green energy ambitions. When your shareholders are revolting and your stock’s tanking, sometimes you’ve got to dance with who brought you.

What This Means for BP’s Future

Dame Amanda Blanc, who led the chairman search, believes Manifold’s “relentless focus on performance” makes him perfect for BP’s current challenges. His CRH success story suggests he can navigate complex industrial transformations.

Manifold seems ready for the challenge, stating he’s “honoured to be appointed chair of one of the world’s great energy companies” and looking forward to driving “compelling and sustainable shareholder value creation.”

The appointment signals BP’s commitment to financial performance over environmental optics—at least for now.

The Bottom Line

BP’s new chairman brings proven expertise in shareholder value creation at exactly the moment the company needs it most. With Manifold’s track record and BP’s renewed focus on profitable oil and gas operations, investors might finally have reason to smile.

Whether this strategy pays off long-term remains to be seen, but one thing’s certain: BP isn’t betting its future on wind farms anymore.

FAQ

Q1: Why did BP replace its chairman?

A: Helge Lund faced significant shareholder opposition, with nearly 25% voting against his re-election in April. This reflected broader investor frustration with BP’s underperforming share price and strategic direction.

Q2: What’s Albert Manifold’s background?

A: Manifold led building materials group CRH for ten years, delivering a nearly 400% share price increase. He’s currently a non-executive director at chemicals producer LyondellBasell and has extensive experience in strategic transformation.

Q3: How is BP changing its strategy?

A: BP is pivoting away from renewable energy investments back to oil and gas. The company plans to increase oil and gas funding by 20% to £7.9bn annually while selling off green energy assets like its US wind business.

Q4: When does Manifold take over as chairman?

A: Manifold will officially become BP chairman in October 2025, following a one-month period as chair-elect to ensure a smooth transition.

Q5: What do investors think about this appointment?

A: While it’s early, Manifold’s proven track record of shareholder value creation at CRH suggests investors may view this appointment favorably, especially given BP’s recent strategic refocus on profitable operations.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.