Here’s a stat that’ll make Bitcoin investors sit up straight: businesses are hoarding Bitcoin nearly four times faster than miners can produce it. With companies buying 1,755 Bitcoin daily whilst miners only generate 450 new coins, we’re heading towards a potential supply shock that could reshape cryptocurrency markets in 2025.

According to River’s latest institutional data, this dramatic imbalance between Bitcoin supply and demand has analysts predicting significant price appreciation ahead. When demand outstrips supply by 7:1, basic economics suggests one outcome: higher prices.

Bitcoin Supply Shock Indicators: The Numbers Don’t Lie

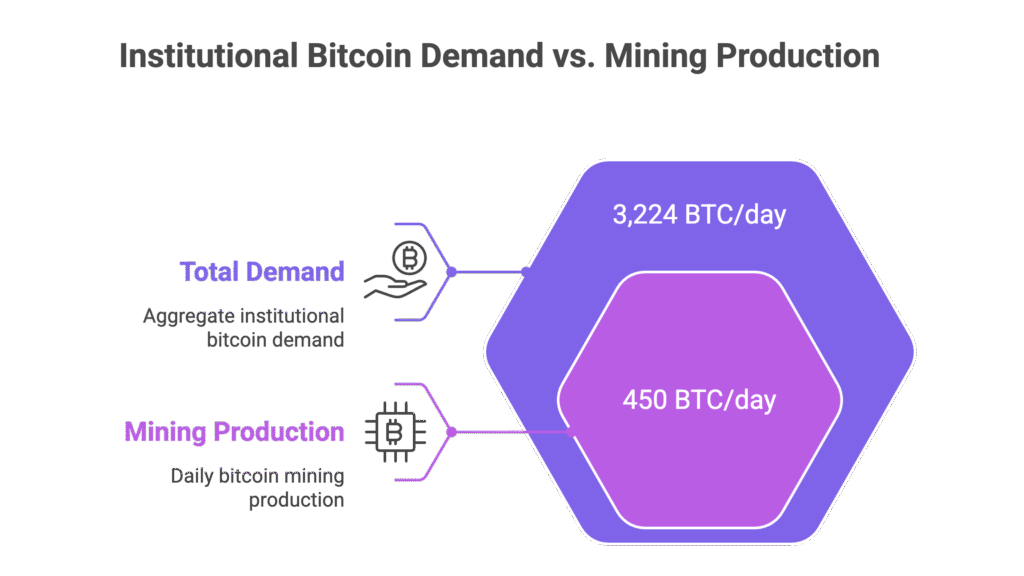

The current Bitcoin buying frenzy breaks down as follows:

- Corporate Bitcoin treasury companies: 1,755 BTC/day

- Bitcoin ETFs and investment funds: 1,430 BTC/day

- Government Bitcoin purchases: 39 BTC/day

- Total institutional Bitcoin demand: 3,224 BTC/day

- Daily Bitcoin mining production: 450 BTC/day

This creates a demand-to-supply ratio that hasn’t been seen since Bitcoin’s early days, with exchange reserves now sitting at five-year lows representing less than 11% of total circulating supply.

MicroStrategy Bitcoin Holdings: Leading the Corporate Charge

Leading this corporate Bitcoin accumulation strategy is MicroStrategy (now rebranded as Strategy), holding 632,457 Bitcoin – making it the world’s largest corporate Bitcoin holder. That’s roughly £63 billion worth at current Bitcoin prices, with no other company coming remotely close.

Bitcoin treasury companies collectively acquired 159,107 Bitcoin in Q2 2025 alone, bringing total corporate Bitcoin holdings to approximately 1.3 million coins. Some analysts suggest MicroStrategy is “synthetically” creating its own Bitcoin halving through relentless accumulation.

The company’s aggressive Bitcoin strategy has transformed it from an enterprise software firm into what’s essentially become a Bitcoin investment vehicle. Strategy’s most recent purchase involved 21,021 Bitcoin worth $2.46 billion, demonstrating continued commitment despite Bitcoin trading near all-time highs.

Bitcoin Exchange Reserves: A Critical Supply Metric

One of the strongest Bitcoin supply shock indicators is the steady decline of Bitcoin held on centralised exchanges, now at its lowest point in over five years. Exchange reserves continue dwindling as Bitcoin moves into institutional custody and corporate treasuries.

This trend isn’t just about retail investors moving Bitcoin to cold storage. A substantial portion of recent exchange outflows represents institutional reshuffling – from exchange hot wallets into ETF custodian wallets and corporate treasury holdings.

Bitcoin ETF Impact: Institutional Demand Accelerating

BlackRock’s iShares Bitcoin Trust (IBIT) averaged £344 million in daily net inflows during late May 2025, culminating in £5.1 billion of monthly inflows – its largest ever. U.S. spot Bitcoin ETFs absorbed 2.4 times the annual mining supply in 2024, fundamentally altering Bitcoin market dynamics.

When institutions purchase through spot Bitcoin ETFs, the underlying Bitcoin gets moved into custodial cold storage, effectively removing these coins from liquid market supply. This creates additional upward pressure on Bitcoin prices whilst simultaneously reducing available supply for retail investors.

Bitcoin Price Predictions: Supply Shock Implications

Industry experts are increasingly bullish, with Michael Saylor predicting a “supply shock” following Bitcoin’s recent halving, whilst Marshall Beard of Gemini Exchange projects Bitcoin could reach $150,000 by year-end.

More ambitious forecasts include Cathie Wood of Ark Invest predicting Bitcoin could reach $1 million within five years, driven by its finite supply and increasing institutional adoption as a global store of value.

The mathematical reality supports these optimistic projections. With Bitcoin’s hard cap of 21 million coins and 93% already mined, combined with institutional hoarding and declining exchange reserves, supply scarcity is becoming increasingly acute.

What This Bitcoin Supply Crunch Means for Investors

If corporations and institutions continue accumulating Bitcoin whilst exchange reserves shrink, we’re approaching a legitimate supply shock scenario. Some market analysts predict this supply shortage would be decidedly bullish for Bitcoin, tightening sell-side liquidity and amplifying upward price pressure during periods of rising demand.

The question isn’t whether this trend continues – institutional Bitcoin adoption shows no signs of slowing. Rather, it’s how dramatically Bitcoin prices will react when supply scarcity truly bites and retail investors compete for increasingly limited available coins.

For Bitcoin investors, this supply shock narrative represents both opportunity and urgency. Those wanting exposure to Bitcoin may find themselves competing with deep-pocketed institutions for an increasingly scarce digital asset.

Frequently Asked Questions

Q1: What exactly is a Bitcoin supply shock?

A: A Bitcoin supply shock occurs when available BTC for purchase on exchanges becomes significantly limited whilst demand remains steady or accelerates, often leading to sharp price increases due to basic supply and demand principles. Unlike fiat currencies, Bitcoin has a fixed supply cap of 21 million coins.

Q2: How does MicroStrategy’s buying strategy avoid pumping Bitcoin prices immediately?

A: MicroStrategy spreads purchases through over-the-counter (OTC) transactions that occur off public exchanges. Their treasury officer explains that with Bitcoin trading over $50 billion daily volume, buying $1 billion over several days doesn’t immediately impact spot market prices.

Q3: Are Bitcoin exchange reserves really at critical levels?

A: Yes, Bitcoin held on centralised exchanges has declined to five-year lows, representing less than 11% of total circulating supply. About 70% of Bitcoin supply hasn’t moved in at least a year, indicating most holders are taking long-term positions.

Q4: Could this Bitcoin supply shortage be sustainable long-term?

A: Some analysis suggests potential selling pressure from long-term holders during bull runs could provide natural market rebalancing, with approximately 1.4 million BTC potentially transferring from long-term to short-term hands during 2025’s bull run.

Q5: Which other companies are following MicroStrategy’s Bitcoin treasury strategy?

A: Over 70 public companies worldwide have now adopted Bitcoin treasury standards, though none approach MicroStrategy’s scale. Marathon Digital holds the second-largest corporate Bitcoin position at 40,435 coins, whilst Tesla holds 9,720 Bitcoin.

DISCLAIMER

Effective Date: 15th July 2025

The information provided on this website is for informational and educational purposes only and reflects the personal opinions of the author(s). It is not intended as financial, investment, tax, or legal advice.

We are not certified financial advisers. None of the content on this website constitutes a recommendation to buy, sell, or hold any financial product, asset, or service. You should not rely on any information provided here to make financial decisions.

We strongly recommend that you:

- Conduct your own research and due diligence

- Consult with a qualified financial adviser or professional before making any investment or financial decisions

While we strive to ensure that all information is accurate and up to date, we make no guarantees about the completeness, reliability, or suitability of any content on this site.

By using this website, you acknowledge and agree that we are not responsible for any financial loss, damage, or decisions made based on the content presented.